If some of the text of the chart is difficult to read, here’s a link to a PDF of the chart

Overview

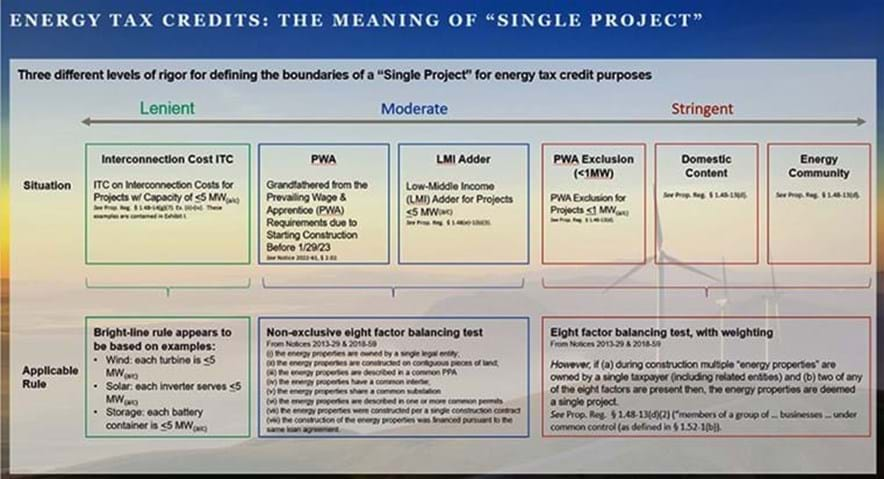

Whether a renewable energy project qualifies for tax credits depends on how “project” is defined. More precisely, the meaning of “single project” for energy tax credit purposes varies across contexts and can lead to disparate outcomes.

The “single project” question bears upon eligibility for tax credits in several respects. The first is size: projects with a capacity of under one megawatt measured in alternating current (MW(AC)) are excepted from prevailing wage and apprenticeship (PWA) requirements. Further, projects located in or serving residents of certain low and middle income (LMI) communities can apply to be awarded a 10-20 percent bonus investment tax credit (ITC), so long as such project is under 5 MW(AC). Finally, solar and wind projects that claim the ITC and are under 5 MW(AC) are eligible for ITC on their interconnection costs. The question in this context is when will the IRS aggregate several projects together to cause them to exceed these thresholds?

The second consideration is geography: projects using a specified minimum percentage domestically manufactured products are eligible for the 10 percent domestic content adder; however, do, for instance, a solar and storage project that are in the same area need to be aggregated as a single “project” when testing whether there is sufficient domestic content?

A third consideration is timing: can work in one area be attributed to another area for purposes of having started construction on a "project" either (a) to be grandfathered from the PWA requirement (i.e., did construction start before January 29, 2023) or (b) locking in an annual unemployment rate for purposes of the 10 percent energy community adder?

Policy

To understand how there can be three different levels of rigor for the definition of project for six different energy tax credit purposes, one must understand the policy goals of each of the six different tax credit purposes.

ITC on Interconnection Costs

After the Inflation Reduction Act of 2022, the tax allows for ITC to be claimed on interconnection costs but only if the project has a capacity of five MW (a/c) or less. Treasury adopted an extremely lenient definition in the proposed regulations that based on reading between the lines of the examples included in the proposed regulations, provided in Appendix I, can apparently be managed by limiting turbine size to 5 MW (a/c), ensuring that no solar inverter serves modules with more than 5 MW (a/c) of capacity and ensuring that no battery container has batteries with more than five megawatts of capacity.

Reportedly, the Department of Energy (DOE) was the driving force behind the lenient definition of project for purposes of the five-megawatt limitation and viewed ITC on interconnection costs as a means to subsidize improvements to the grid. The question is whether Congress intended the meaning adopted in the proposed regulations. If a project consisting of 200 wind turbines that each have a capacity of four megawatts can qualify for ITC on its interconnection costs, why did Congress impose any capacity limitation on the ITC-eligibility for interconnection costs? Nonetheless, the proposed regulations read as they do and until the final regulations are published may be relied upon.

Grandfathering from PWA

Renewable energy tax credits are one-fifth of what they would otherwise be (e.g., 6 percent v. 30 percent), if the project does not either comply for PWA or qualify to be excluded for it. The deadline to be grandfathered from the PWA requirements was that a project had to start construction before January 29, 2023. The ITC regulations were not published until November 2023, so it would have been at best impractical for the proposed ITC regulations to change the standard for purposes of the lapsed deadline.

In Notice 2022-61, the Treasury and IRS opted to adopt the definition of single project that had applied to energy tax credit start of construction deadlines since 2013.

LMI Adder

The LMI adder is a 10 or 20 percent increase in the ITC for projects that are located in a LMI area or economically benefit LMI households. The LMI adder must be applied for. The DOE processes the applications and makes recommendations to the IRS. The IRS awards the allocation.

The LMI adder program has an annual limit that the IRS cannot award allocations of additional ITC in excess 1.8 gigawatts of projects. The program is over-subscribed. Regardless of how “project” was defined, the 1.8 gigawatt statutory limit would apply, so there was no opportunity to provide a larger subsidy for wind and solar. Thus, Treasury played it down the middle and used the historical eight factor balancing test.

PWA Exclusion

For project that have a capacity of one-megawatt or less, the project can benefit for the 5x multiplier (e.g., 30 percent ITC, rather than six percent) without having pay the construction workers “prevailing wages” as determined by the Department of Labor and apprentices do not have to be hired. Prevailing wages are comparable to union wages; however, actual union workers do not have to be hired, but once a project must pay union wages, most opt to hire union workers. Labor unions benefit from prevailing wages having to be paid and apprentices from the unions’ training programs having to be hired. Given how organized labor voted in the 2020 election, it is not surprising that the stringent definition was applied to determine if a project satisfied the exclusion.

Domestic Content

The domestic content adder is a 10 percent greater tax credit. For instance, the ITC (assuming PWA compliance) would be 40 percent, rather than 30 percent. Or the production (PTC) tax credit (assuming PWA compliance), would be 110 percent of, currently, $28 a megawatt hour for ten years or $30.80 a megawatt hour.

The intersection of the definition of a single project and the domestic rules are somewhat subtle. If for instance a solar project and a storage project are close together, is the minimum percentage of domestic manufactured products applied separately to the solar project and the storage project. Let’s say the storage project is using batteries made in the United States and would qualify on its own and the solar project is using imported solar modules. Can the storage project qualify for the adder on a stand-alone basis or must the two projects be considered on a combined basis in which case neither may qualify.

Although, climate change is important to the Administration, so is rebuilding the nation’s manufacturing capacity. Therefore, Treasury opted to (i) try to spur more domestic manufacturing by not allowing projects with certain commonalities to be measured for domestic content separately or (ii) at least limit how many projects qualified for the domestic content adder and the resulting larger tax credit.

Energy Community Adder

Most projects that satisfy the energy community adder do so due to being in a statistical area that (i) in any year after 2009 had at least .17 percent fossil fuel unemployment and (ii) in “the previous year” had an unemployment rate not less than the national average. The “previous year” for projects that begin construction in 2023 or later is either (i) the year before the year the project began construction under the energy tax credit definition or (ii) the year before the year the tax credit accrues (i.e., the placed in service year for ITC or for the PTC each of the ten years of the PTC period).

The only way to have certainty about satisfying the unemployment requirement is to begin construction in a year that follows a year in which unemployment rate in the statistical area was not less than the national average. Therefore, for projects that are (i) sited in statistical areas meeting the fossil fuel employment requirement and that (ii) in the prior year had an unemployment rate not less than the national average, there is a push to begin construction before the Department of Labor publishes annual unemployment statistics for the subsequent year. The proposed regulations adoption of a stringent definition of “project” for purposes of the adders can make it easier for a project to be deemed to have begun construction to lock in satisfaction of the unemployment requirement for the energy community adder. For instance, if there is a solar plus wind project (with the same tax credit to be claimed with respect to both technologies) and the solar and the wind elements are owned by a single taxpayer (including related entities) during construction and two of the eight single projects factors are present (e.g., ownership by a single limited liability company and the two elements are on contiguous land), then beginning construction on the solar (e.g., installation of significant racking) would count as beginning construction on the wind element too as the two elements would be characterized as a single project. The sentence “Note, for this purpose, the eight factor test is reduced to seven factors as ownership by a single taxpayer is one of the gating questions that triggers the test, so the regulations exclude common ownership from the traditional eight factors. See Prop. Reg. § 1.48-13(d)(1)(i) – (vii).”

It seems unlikely that Treasury was trying to make it easier for projects to qualify for the energy community adder. Rather, Treasury preferred a broad definition of single project for PWA and domestic content purposes due to the policy considerations discussed above and there was not a sufficient policy motivation to adopt a different definition for energy community purposes. Therefore, Treasury’s conservative approach to domestic content and PWA had the knock-on effect of making it easier for projects to satisfy the unemployment prong of the energy community adder.

Conclusion

Treasury has created a complicated maze for taxpayers to navigate in determining whether they own a single project for various energy tax credit purposes. The best guide through that maze is to keep in mind Treasury’s policy objectives with respect the tax credit purpose in question.

Appendix I

(Single Project for 5 MW(a/c) Limit on Interconnection Cost ITC-Eligibility)

- 1.48-14(g)(7). Ex. (ii)-(iv):

(ii) Example 2. Application of Five-Megawatt Limitation to an interconnection agreement for a single energy property.—X develops three solar energy properties located in close proximity. The three solar energy properties are not considered an energy project pursuant to the definition in §1.48-13(d). Each of the solar energy properties is a unit of energy property and has a maximum net output of 4 MW (as measured in alternating current). Electricity that is suitable for use or transmission (and is not further conditioned) from the three solar energy properties feeds into a single gen-tie line and a common intertie. X is party to a separate interconnection agreement with the utility for each solar energy property and each interconnection agreement allows for a maximum output of 4 MW (as measured in alternating current). X may include the costs it paid or incurred for qualified interconnection property for each solar energy property when calculating its section 48 credit for each of the three solar energy properties, subject to the terms of each interconnection agreement, because each of the solar energy properties has a maximum net output of not greater than 5 MW.

(iii) Example 3. Application of Five-Megawatt Limitation to a single interconnection agreement for multiple energy properties.—The facts are the same as Example 2, except that X is party to one interconnection agreement with the utility with respect to the three solar energy properties and the interconnection agreement allows for a maximum output of 12 MW (as measured in alternating current). With respect to each of the three solar energy properties, X may include the costs it paid or incurred for qualified interconnection property for each solar energy property when calculating its section 48 credit for each of the three solar energy properties, subject to the terms of the interconnection agreement, because each of the solar energy properties has a maximum net output of not greater than 5 MW.

(iv) Example 4. Application of Five-Megawatt Limitation to an Energy Project.—The facts are the same as Example 3, except that the three solar energy properties are also subject to a common power purchase agreement and as a result, are considered an energy project (as defined in §1.48-13(d)). With respect to each of the three solar energy properties, X may include the costs it paid or incurred for qualified interconnection property when calculating its section 48 credit for each of the three solar energy properties, subject to the terms of the interconnection agreement, because each of the solar energy properties has a maximum net output of no greater than 5 MW.