Revised February 13, 2023

Below are slides the authors prepared about tax credit opportunities and development challenges for battery storage.

Tax benefits available after passage of the IRA: What is storage?

"Energy Storage Technology" eligible for ITC is:

- Property (other than property primarily used in the transportation of goods or individuals and not for the production of electricity) which receives, stores, and delivers energy for conversion to electricity (or, in the case of hydrogen, which stores energy), and has a nameplate capacity of not less than five kilowatt hours, and

- Thermal energy storage property, which means property comprising a system which (I) is directly connected to a heating, ventilation, or air conditioning system, (II) removes heat from, or adds heat to, a storage medium for subsequent use, and (III) provides energy for the heating or cooling of the interior of a residential or commercial building. The term "thermal energy storage property" does not include (I) a swimming pool, (II) combined heat and power system property, or (III) a building or its structural components.

- Must be placed in service on or after January 1, 2023.

Tax benefits available after the passage of the IRA: Pump storage?

Not clear from the face of the statute if pump storage qualifies, but Ways & Means Committee Chair Neal added a statement in the Congressional Record that pump storage is intended to qualify:

- Pumped-storage hydroelectric facilities are sometimes called water batteries. Electricity is used to pump water from a lower to an upper reservoir. When needed, this water is then released and run through turbines to convert the stored energy back into electricity. The definition of energy storage technologies includes ''property . . . which receives, stores, and delivers energy for conversion to electricity'' under new section 48(c)(6)(A)(i). Thus, it is the Committee's intent such property not only include the two reservoirs as well as the pipe and pump to move the water uphill, but also the turbines and step-up transformer to convert the stored energy back into electricity.

- Such congressional statements are not law, but the IRS is unlikely to issue guidance that contradicts the chair of Ways & Means.

Tax benefits after passage of the IRA: Credit rates

Credit rate is 30 percent for:

- Projects that start construction no more than 60 days after wage and apprenticeship guidance is issued

- Projects that start construction more than 60 days after wage and apprenticeship guidance is issued, but meet those rules

- Credit rate is only six percent for projects that start construction 60 days after guidance and do not meet the wage and apprenticeship requirements.

Bonus credits

- Domestic Content (starting in 2023): 10 percent bonus

- Must include 100 percent domestic iron and steel and 40 percent domestic content for manufactured products (increases after 2024)

- Energy Communities (starting in 2023): 10 percent bonus

- An area which has (or at any time after December 31, 1999, had) (i) (a) significant employment (> 0.17 percent) related to the extraction, processing, transport, or storage of coal, oil, or natural gas (as determined by the Secretary) or (b) 25 percent or greater local tax revenue from the foregoing activities, and (ii) higher unemployment than the national average for the "previous year"; or

- A census tract in which (I) after December 31, 1999, a coal mine has closed, or after December 31, 2009, a coal-fired electric generating unit has been retired, or (II) which is directly adjoining to any census tract described in subclause (I).

- Brownfield sites (as identified in CERCLA);

- Environmental justice credit (LMI) does not apply to storage, only wind and solar projects < 5MW of capacity.

IRA provides unprecedented discretion and novelty for treasury guidance

- "There is a ton of discretion, an almost unprecedented amount of discretion on some of these provisions, on really big consequential decisions. ... This is generational legislation." Tom West, Treas. Dep. Ass't Sec'y for Business Tax, quoted in Chandra Wallace, Energy Credit Guidance is top Priority at Treas., 177 Tax Notes Fed. 628 (Oct. 24, 2022).

- "There's so much nontax novelty and complexity here. [The IRA is] a brave new world for us." Tom West, quoted in Chandra Wallace, Tax Drafters Brace for Climate Bill Technical Corrections, 177 Tax Notes Fed. 629 (Oct. 24, 2022).

- "In addition, the energy provisions in the Inflation Reduction Act will require development of new expertise at Treasury in order to get the implementation right." Aruna Kalyanam, Treasury Deputy Assistant Secretary for Tax and Budget, paraphrased in Chandra Wallace, Tax Drafters Brace for Climate Bill Technical Corrections, 177 Tax Notes Fed. 629 (Oct. 24, 2022).

Tax benefits available after IRA: Interconnection costs

ITC on interconnection costs for storage projects if 5MW (a/c) or less:

- Eligible interconnection costs include utility-owned property paid for by the taxpayer and network upgrades paid for by the taxpayer

- The taxpayer must "incur" the interconnection cost, which usually is paid by the sponsor before the tax equity investor invests

- Can a lessor in a sale-leaseback claim ITC on interconnection costs (i.e., how is that tax attribute transferred to a lessor when the interconnection is owned by the utility)

- One way to look at this question is whether the interconnection costs are capitalized into the interconnection agreement, which would make them not transferable to a lessor, or into the project itself

- Same question applies to a partnership that acquires a project for fair market value at mechanical completion if the interconnection costs were already paid

Tax benefits are available after passage of the IRA: MACRS, normalization and placed in service

- Trade associations seeking clarification that stand-alone storage projects qualify for five-year MACRS if placed in service in 2023 or 2024.

- The IRA is clear that projects placed in service after 2024 qualify for five-year MACRS.

- Normalization: Utility can opt-out of normalization on storage.

- Placed in service: Energy storage technology is not an electric generating facility, so the five-factor test does not necessarily apply when determining whether energy storage technology is placed in service. Five-factor test for energy generation:

1. All required licenses and permits have been approved.

2. Legal ownership and control of the facility has passed to the taxpayer.

3. The generating unit has been synchronized to the power grid for its function of generating electricity to produce income.

4. The critical tests for the various components have been completed.

5. Daily or regular operation of the facility has commenced.

New options for monetizing energy storage ITC: Transferability

- Transferability (selling tax credits to third parties)

- Only one sale allowed, no brokers acting as buyers to re-sell.

- Can be sold after the close of the tax year but before the buyer files its tax return.

- Must be sold for cash.

- Must be sold to an unrelated party.

- No taxable income to seller; no deduction for buyer.

- Sale election is made at the "partnership" level, not the partner level.

- TBD at what price credits will trade.

- Need guidance on application of passive activity loss rules and the at-risk rules to individual buyers.

- Need guidance on whether the buyer or seller suffers recapture from a transfer/casualty.

- Need guidance ability to combine with a lease pass-through election.

- Sellers that can provide stronger guaranties are likely to get a higher price.

New options for monetizing energy storage ITC: Direct pay

Direct Pay

- Limited to tax-exempt owners (but not manufacturers' tax credits, 45V, or 45Q)

- Applicability for storage projects

- IRS pays 100 cents on the dollar

Key commercial risk

Commercial risks

- How to forecast/underwrite ancillary services revenue?

- How many storage projects have a primary source of revenue of time-of-day arbitrage?

- Difficult to obtain a fully wrapped EPC, so you run the risks associated with split-scope contracting where multiple contractors can blame each other for problems, causing cost and schedule issues.

Development of storage projects: Structure

Lump Sum Turn Key vs. Multi-Contracting Split Scope

- Lump Sum comes at a price. Sole source contracting still having price pressure to implement and deliver a fully wrapped project, making split scope contracting price and schedule attractive notwithstanding the risks associated.

- Split Scope introduces risk not only around cost and schedule though, issues also can arise around design, integration and commissioning.

- The type of project (PPA vs Merchant) can limit optionality: The cliff of PPA LDs can bring risk into focus.

What is the project expected to do? Consider agreements closely to ensure you are buying what you need.

- Do Performance Tests and Performance Guarantees reflect that?

- Is the Use Case reflected in the testing and guarantees?

Development of storage projects

- Supply Chain continues to cause issues.

- Strong demand outstripping supply creating difficult environment to contract.

- Force Majeure and Change in Law: Open ended change rights can cause difficulties for project.

- Address extended delay: Extended delay in delivery and commissioning and flow on effects should be considered—it's not just a theoretical lawyer issue.

- Deemed events: Deemed events can have flow on effects in world of extended delay.

- Performance Testing and Performance Guarantees: Testing and requirements should meet use case.

- Technology risk: Integration of AC Block, DC Block and EMS can have issues.

- O&Ms and LTSAs: Consider OEM versus third party.

- EMS: Can this be wrapped into scope? Testing and verification of performance critical.

Key tax points to be addressed in documentation

Tax risks

- ITC eligible basis

- Placed in service

- Bonus Credits

- Beginning of Construction/Wage and Apprentice:

- Guidance expected by the end of 2022 according to statement by the Deputy Assistant Treasury Secretary for Tax Policy: Projects that "begin construction" 60 days after the guidance is published must satisfy wage and apprentice. We expect "begin construction" to be defined similarly to how it has been, but Treasury could surprise us.

What are the tax challenges of co-located energy storage projects?

ITC/PTC

- Developers are asking whether they can claim PTCs on solar projects and an ITC on the paired battery. While the IRA is not clear on its face on this point, it appears that it was the intention of Congress to allow both an ITC on a battery and a PTC on a solar facility when co-located. Ways and Means Committee Chair Neal stated in a floor statement that "the Committee intends that a credit is allowed for energy storage technology under section 48 regardless of whether it is part of a facility for which a credit under section 45 is or has been allowed."

- Point of sale for PTC projects. If a taxpayer can claim the ITC on the battery and the PTC on the co-located electric generating facility, where does the sale to an unrelated party occur for purposes of calculating the PTC?

What are the tax challenges of adding battery storage to renewable generation?

Augmentation

Section 48(a)(6)(B): Modifications of certain property

In the case of any property which either:

- Was placed in service before the date of enactment of this section [1] and would be described in subparagraph (A)(i), except that such property has a capacity of less than five kilowatt hours and is modified in a manner that such property (after such modification) has a nameplate capacity of not less than five kilowatt hours, or

- Is described in subparagraph (A)(i) and is modified in a manner that such property (after such modification) has an increase in nameplate capacity of not less than five kilowatt hours,

such property shall be treated as described in subparagraph (A)(i) except that the basis of any existing property prior to such modification shall not be taken into account for purposes of this section. In the case of any property to which this subparagraph applies, subparagraph (D) shall be applied by substituting "modification" for "construction".

- Existing solar/wind facilities

- Applicability of dual-use rules for new and existing storage

What are other tax challenges?

- Useful life is of a storage project given the major overhauls that are needed.

- ITC eligibility of the major overhaul that is required periodically.

- Additional guidance is needed from the IRS in a number of areas.

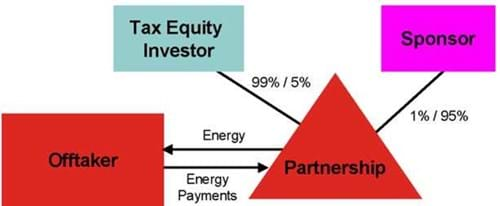

Structuring options for financing energy storage projects: Partnership flip

Traditional Tax Equity: Partnership flip

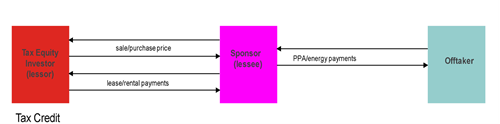

Structuring options for financing energy storage: Sale-leaseback

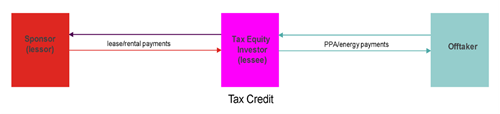

Structuring options for financing energy storage: Pass-through lease

There are other structuring variations of the lease pass-through.

Tax credits for US battery manufacturers: § 45x

- Section 45X provides tax credits to US manufacturers of batteries.

- US$45 per KWh of capacity, which consists of (i) US$35 per KWh of battery capacity for battery cells and (ii) US$10 per KWh of capacity for battery modules.

- If the battery does not use cells and has a capacity of at least seven KWh then it qualifies for US$45 per KWh.

- 10 percent of the cost to produce "electrode active materials" also qualifies for a Section 45X tax credit.

Tax credit for critical minerals produced in the US

- 10 percent of the cost of producing or purifying "critical minerals" in the US qualifies for a Section 45X tax credit.

- The critical minerals do not have to be mined in the US, but they do have to be extracted or processed in a country with which the US has a fair trade agreement.

- Also qualifies if the critical minerals are recycled in the US.

- 25 critical minerals listed in Section 45X(c)(6).

- 25 "other minerals" that the cost of purifying to 99 percent purity is eligible for the 10 percent tax credit are listed in Section 45X(c)(7).

Manufacturing tax credits: Direct pay and transferability

- Section 45X credits for manufacturers are eligible for direct pay, even if the factory is not owned by a tax-exempt.

- Section 45X credits are also eligible for transferability.

- Direct pay is preferable as it results in a payment of 100 cents on the dollar, while the buyer under transferability will want to pay less than 100 cents on the dollar to incentivize it to transact.

- It remains to be seen if direct pay is a slower process to actually receive cash than transferability.