Below are bullet points outlining tax credit opportunities for clean energy technology companies. Topics covered include the production tax credit (PTC), the investment tax credit (ITC), tax credits for carbon capture, tax credits for clean commercial vehicles and tax credits for manufacturers of components of clean energy projects. Credit “adders,” “transferability” and “direct pay” are also addressed.

ITC and PTC Rates

ITC credit rate is 30% and the PTC rate is $27.50/MWh for:

- Projects that start construction before January 30, 2023.

- Projects that satisfy the wage and apprenticeship rules – see Exhibit 1; or.

- Projects that are less than 1 MW (a/c).

- ITC and PTC levels can be increased by domestic content and energy community bonuses, see Exhibit 2.

Production Tax Credit

- Eligible Renewable/Other Technologies: Geothermal Electric, Solar Thermal Electric, Solar Photovoltaics, Wind (All), Biomass, Hydroelectric, Municipal Solid Waste, Landfill Gas, Tidal, Wave, Ocean Thermal, Wind (Small), Hydroelectric (Small), and Offshore Wind.

Investment Tax Credit

- Eligible Renewable/Other Technologies: Solar Water Heat, Solar Space Heat, Geothermal Electric, Solar Thermal Electric, Solar Thermal Process Heat, Solar Photovoltaics, Wind (All), Geothermal Heat Pumps, Municipal Solid Waste, Combined Heat & Power, Fuel Cells using Non-Renewable Fuels, Tidal, Wind (Small), Geothermal Direct-Use, Fuel Cells using Renewable Fuels, Microturbines, Offshore Wind Biogas, Microgrid Controllers, and Interconnection Property.

Manufacturing Tax Credits, Section 45X

The IRA introduced new Section 45X advanced manufacturing credit and Section 48C credit for qualifying advanced energy projects.

Advanced Manufacturing Production Credit – Section 45X

- Provides a production tax credit (PTC) for the production and sale to unrelated persons of certain solar, wind, inverter, battery, or mineral components. The credit only applies to components produced in the U.S. or its territories.

- Timing: the credit applies to components produced and sold after December 31, 2022. It begins phasing out in 2030 and is not available for components sold after 2032.

- Credit Amount: varies based on the eligible component produced and sold and is calculated on a per component basis (no requirement to pay prevailing wages or employ apprentices). – see Exhibit 3 for the list of eligible components.

- The section 45X credit is not available for components produced in a factory that benefited from the section 48C credit.

- It is eligible for direct pay (even if the factory is not owned by a tax-exempt) and transferability – see Exhibits 4 and 5.

Manufacturing Tax Credits, Section 48C

Advanced Energy Production Credit – Section 48C

- A tax credit for certain manufacturing activities, such as:

- Factories that make components for electric vehicles, hybrid vehicles, fuel cell vehicles and other wind, solar, fuel cells, and storage.

- Timing: starts January 1, 2023, with no specific end date.

- Credit Amount: 30%, but if construction of the factory begins after January 29, 2023, then prevailing wages must be paid, and apprentices hired.

- Denial of double benefit: the credit is not allowed for any qualified investment for which a credit is allowed under section 48 (energy credit), 48A (advanced coal credit), 48B (gasification credit), 48E (clean energy credit), 45Q (carbon capture), or 45V (clean hydrogen).

- Allocation from IRS required: Project owner must apply for and receive an allocation from the IRS.

- It is eligible for transferability - see Exhibits 4 and 5.

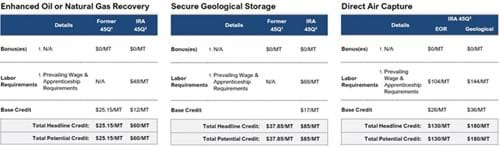

Credit for Carbon Oxide Sequestration - Section 45Q

- IRA expands and extends 45Q credit.

- The 2022 changes to 45Q provide up to $85 per metric ton (“MT”) of CO2 permanently stored and $60 per MT of CO2 used for enhanced oil recovery or other industrial uses of CO2 (provided emissions reductions can be clearly demonstrated.) - See the table below.

- The credit amount significantly increases for direct air capture projects to $180 per MT of CO2 permanently stored and $130 per MT for used CO2 – See the table below.

- The IRA reduces the capacity requirements for eligible projects: 18,750 MT per year for power plants (provided at least 75% of the CO2 is captured), 12,000 MT per year for other facilities, and 1,000 MT per year for DAC facilities.

- Projects must “begin construction” before January 1, 2033 – see discussion included in Exhibit 1.

This table was prepared by Marathon Capital.

Clean Fuel Production Tax Credit Section 45Z

- A PTC that applies only to the production of clean fuels that are used for transportation.

- Qualified Facility: must be used for the production of transportation fuels, provided none of the following credits are available in the year in which the Section 45Z credit is claimed:

- Section 45V Clean Hydrogen Production

- Section 48 Clean Hydrogen Investment

- Section 45Q Carbon Capture

- Transportation fuel: any fuel that is produced in the U.S. by a registered producer, is suitable for use as fuel in a highway vehicle or aircraft, has an emissions rate not greater than 50 kg of C02e per mmBTU, and is not derived from co processing certain glycerides, fatty acids, or fatty acid esters with a non biomass feedstock.

- Timing: Credit is available in respect of fuel produced after December 31, 2024 and sold through December 31, 2027.

- Wage and Apprenticeship Requirement: Base rate multiplied by five when wage and apprenticeship requirements are met.

- Credit Amount: 20 cents per gallon of any transportation fuel produced at a qualified facility and sold to an unrelated taxpayer. For use by such person:

- In the production of a fuel mixture, or

- in a trade or business, or

- who sells such fuel at retail to another person and places that fuel in the other person’s fuel tank.

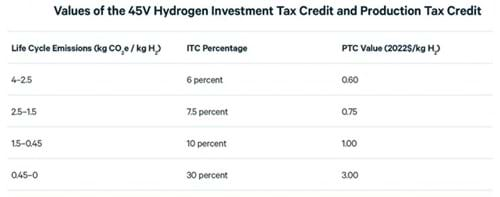

Clean Hydrogen Production - Section 45V

- Section 45V, gives projects that begin construction before 2033 a tax credit for 10 years after they’re placed in service, getting 60 cents for every kilogram of clean hydrogen produced.

- The hydrogen must be produced through a process resulting in lifetime greenhouse gas emissions rate of no more than $3.00 a kg of hydrogen, with a lower amount if it is less clean. The lifetime greenhouse gas emissions are determined by the GREET model which comes from the U.S. Department of Energy (“DOE”) lab.

- As an alternative to the Clean Hydrogen Production Credit, taxpayers may elect the Section 48 ITC with respect to clean hydrogen production facilities, receiving an ITC of up to 30% depending on the carbon intensity of the production process.

- Timing: Credit is available for qualified clean hydrogen produced after December 31, 2022. The construction of a facility must begin before 2033.

- Denial of double benefit: A facility cannot take both the 45V and carbon capture and sequestration tax credits. However, can simultaneously take the 45V tax credit and other tax credits for clean energy generation, e.g., powering the hydrogen plant with wind or solar and claiming the ITC or PTC on the wind or solar.

- Credit Amount: depends on the life cycle greenhouse gas emissions associated with the hydrogen production and whether or not the hydrogen producer complies with the prevailing wage and apprenticeship requirements in the bill. See below.

Qualified Commercial Clean Vehicles Section 45W

- The tax credit generally applies to a variety of commercial vehicles, as well as mobile machinery.

- Eligible Property: Qualified commercial clean vehicles, including mobile machinery that are “clean” vehicles as defined in Section 30D or fuel cell vehicles as defined in Section 30B. In addition, the vehicle must be:

- Acquired for use or lease by the taxpayer and not for resale,

- of a character subject to the allowance for depreciation (unless not subject to a lease and placed in service by a tax-exempt entity), and

- of a character for which no credit under the Section 30D Clean Vehicle Credit has been allowed.

- Timing: begins January 1, 2025 and is subject to the phase-out as described below.

- Credit Amount is the lesser of:

- 15% of the basis in the vehicle (increased to 30% if the vehicle is neither gas nor diesel powered), or

- The increased price of the clean vehicle relative to a comparable vehicle. (A “comparable vehicle” is any vehicle of comparable size and use to the eligible clean vehicle and that is powered solely by a gasoline or diesel engine; comparable vehicles need not necessarily be of the same model or even of the same manufacturer).

- The credit amount is subject to a hard cap of:

- $7,500 for vehicles with a GVWR of less than 14,000 pounds, or

- $40,000 for all other eligible vehicles.

- Eligible for Direct Pay, but not Transferability.

Clean Electricity Production Credit Section 45Y (replacing 45 (PTC) after 2024)

- IRA adds new Section 45Y, the Clean Energy Production Tax Credit.

- It applies to any qualified facility that is used for the generation of electricity, which is placed in service after 2024, and has an anticipated greenhouse gas emissions rate of no more than zero.

- Qualified facilities also include any additions of capacity that are placed in service on or after January 1, 2025. Sections 45Y is intended to be technology neutral and replace the PTC for facilities placed in service on or after January 1, 2025.

- Credit Amount: Full PTC ($27.50/MWh) – increased by the inflation adjustments between now and 2025, and then annually.

- Timing: begins January 1, 2025 and ends in 2035.

- Phase-out: The credit amount is phased out based on when the facility begins construction after the “applicable year.”

- The applicable year is the later of (i) the calendar year in which the annual greenhouse gas emissions from the production of electricity in the United States are reduced by 75% from 2022 levels, or (ii) 2032 (such year, the “Applicable Year”).

- Wage and Apprenticeship Requirements: similar to those set forth in Section 45, see Exhibit 1.

- Adders: Subject to 10% energy communities and 10% domestic content adders, see Exhibit 2.

- Depreciation: eligible property for the credit will be 5-year MACRS property.

Clean Electricity Investment Credit Section 48E (replacing 48 (ITC) after 2024)

- IRA adds new Section 48E, Clean Electricity Investment Credit as a continuation of Section 48 (ITC) in 2025.

- It applies for investments in qualifying zero-emissions electricity generation facilities or storage technologies for facilities placed in service after December 31, 2024.

- Applies to any qualified facility and energy storage technology. Sections 48E is intended to be technology neutral and replace the ITC for properties placed in service on or after January 1, 2025.

- Credit Amount: up to full ITC - 30%, mirrors the current Section 48 (ITC).

- Timing: begins January 1, 2025 and ends in 2035.

- Wage and Apprenticeship Requirements: similar to those set forth Section 48, see Exhibit 1.

- Adders: Subject to 10% energy communities and 10% domestic content adders, see Exhibit 2.

- Depreciation: eligible property for the credit will be 5-year MACRS property.

Exhibit 1 – Wage and Apprenticeship Requirements

Wage and Apprenticeship (W&A) Requirements

- W&A requirements must be satisfied for a facility to receive the full amount of tax credits (not be subject to an 80% haircut). E.g., a full 30% section 48 ITC would be reduced to 6% if an eligible facility subject to the W&A requirements does not satisfy such requirements.

- Guidance: On November 30th, IRS issued wage and apprentice guidance with a list of requirements. Projects must be under construction by January 28, 2023, to be exempt from these new requirements.

- Construction begins:

- Physical Work Test - construction has begun when work of a “significant nature” is performed, and

- Five Percent Safe Harbor - construction has begun when a taxpayer has paid or incurred 5% of the total cost of a facility.

- Also, a project needs to satisfy the “continuity requirement” pertaining to continuous construction or continuous efforts after a facility starts construction, but also with the existing taxpayer-friendly, placed-in-service-date-dependent, continuity safe harbors.

- Completion time: generally, 4 years; offshore wind projects and projects on federal and Indian land - 10 years; carbon capture projects – 6 years; and renewable power projects with construction start date between 2016 and 2020 - 6 years. The continuity requirement does not apply if the project meets the continuity safe harbor (e.g., 4-years for most projects).

- Prevailing wage requirements: (1) laborers and mechanics employed in the construction, alteration, or repair of facilities have been paid the appropriate prevailing wages and (2) the taxpayer has maintained and preserved sufficient records substantiating such information.

- Apprenticeship requirements: needs to satisfy (1) the labor hour requirements set forth under the IRA, subject to any federal or state apprentice ratios required thereunder; (2) the apprentice participation requirements under the IRA; and (3) needs to comply with certain recordkeeping requirements substantiating such information.

Exhibit 2 - Credit Adders

Bonus Credits

- Domestic Content (starting in 2023) – 10% bonus

- Must include 100% domestic iron and steel and 40% domestic content for manufactured products (increases after 2024).

- Energy Communities (starting in 2023) – 10% bonus

- Brownfield sites (as identified in CERCLA);

- An area which has (or at any time after December 31, 1999, had) (i) (a) significant employment (>.17%) related to the extraction, processing, transport, or storage of coal, oil, or natural gas (as determined by the Secretary) or (b) 25% or greater local tax revenue from the foregoing activities, and (ii) higher unemployment than the national average for the “previous year”; or

- A census tract in which (I) after December 31, 1999, a coal mine has closed, or after December 31, 2009, a coal-fired electric generating unit has been retired, or (II) which is directly adjoining to any census tract described in subclause (I).

- The domestic content adder is only 2% (rather than 10%), and the energy community adder is only 2% (rather than 10%) if i) construction of the facility begins after the January 28, 2023, (ii) the prevailing wage and apprenticeship requirements are not satisfied and (iii) the facility has a capacity of more than 1 MW.

- Environmental justice credit (LMI) only applies to wind and solar projects <5 MW of capacity and must apply to the IRS for an allocation that is granted. IRS must publish rules on the environmental justice credit by February 12, 2023 to meet deadline set by Congress.

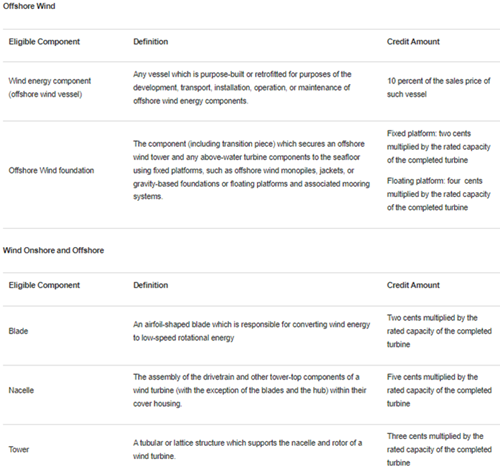

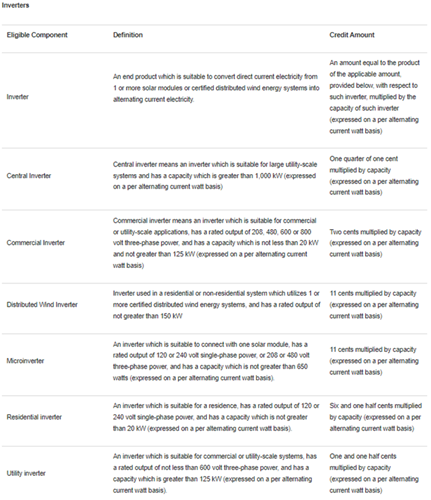

Exhibit 3 – Section 45x Eligible Components

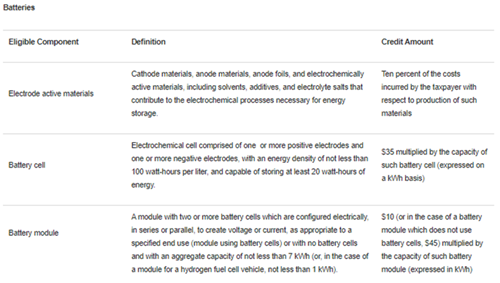

- Eligible components under section 45X include photovoltaic cells and wafers, solar grade polysilicon, polymeric backsheets, solar modules, wind energy components, torque tubes, structural fasteners, electrode active materials, battery cells, battery modules, and certain critical minerals.

- Subject to certain additional calculations, the amount of the total credit is the sum of the amounts corresponding to each eligible component reproduced in the table below.

- The tables below indicate the eligible component, the definition of such component, and its corresponding credit amount:

Exhibit 3 – Section 45x Eligible Components (Continued)

Exhibit 3 – Section 45x Eligible Components (Continued)

Exhibit 3 – Section 45x Eligible Components (Continued)

Exhibit 4: “Transferability” of Tax Credits

Transferability - selling tax credits to third parties.

- Major banks are trying to offer 80 cents per $1.00 of tax credit, but we continue to think they will trade in the low 90s cents.

- Corporations without tax equity expertise may pay more than banks with tax equity desks that could view transferability as cannibalizing their tax equity business.

- Only one sale allowed, no brokers acting as buyers to re-sell.

- Can be sold after the close of the tax year but before the buyer files its tax return.

- Must be sold for cash.

- Must be sold to an unrelated party.

- No taxable income to seller; no deduction for buyer.

- Sale election is made at the “partnership” level, not the partner level.

- Need guidance on application of passive activity loss rules and the at-risk rules to individual buyers.

- Need guidance on whether the buyer or seller suffers recapture from a transfer/casualty.

- Need guidance ability to combine with a lease pass-through election.

- Sellers that can provide stronger guaranties are likely to get a higher price.

Exhibit 5: Direct Pay for Tax Credits

Direct Pay

- Available for all owners claiming the 45X manufacturers’ tax credits, hydrogen tax credits (45V), or carbon capture tax credits (45Q).

- For wind, solar, storage and other types of energy generation projects, direct pay is only available if the project is owned by tax-exempt entity (e.g., a solar project owned by a school district).

- IRS pays 100 cents on the dollar.