Environmental Update - April 2013

By Sue Cowell

Two state-level climate change cap-and-trade programs in the United States appear to be finding solid footing.

On the west coast, a cap-and-trade program in California is off to a slow, but solid start. On the east coast, there were more bidders than available carbon dioxide (CO2) allowances for the first time in the last seven auctions of such allowances in the Regional Greenhouse Gas Initiative, or RGGI, a joint effort among nine states in New England and the midAtlantic to limit greenhouse gas emissions.

The California cap-and-trade program kicked off the first auction of greenhouse gas allowances in November 2012 and held its second auction in February 2013. The program caps the amount of CO2 and other greenhouse gases that are allowed to be released each year by certain covered entities. The program initially covers only the power and manufacturing sectors, but will expand to reach other emitters of greenhouse gases. Covered entities need to surrender one allowance for each ton of greenhouse gas emitted.

The first auction held in November 2012 saw all of the offered 2013 vintage year allowances sell at a settlement price of $10.09 per ton, but only about 14% of the available 2015 vintage allowances were sold. All 12,924,822 of the 2013 vintage year allowances were sold in February’s auction, this time at a settlement price of $13.62 per ton along with just over 46% of 9,560,000 2016 vintage year allowances.

The California Air Resource Board, known as CARB, cancelled a scheduled reserve auction in March 2013 because no covered entity expressed interest by submitting a bid or bid guarantee. The reserve auction was to offer allowances for sale from a cost containment reserve — a group of allowances withheld by the state for later release if needed to prevent a price spike — something that the market signaled was not needed. CARB intends to offer these allowances for sale during the next reserve auction on June 27, 2013. CARB recently announced that a total of 14,522,048 2013 vintage year allowances and 9,560,000 2016 vintage year allowances will be offered at the upcoming May 16, 2013 auction.

Meanwhile, on the east coast, RGGI serves as a multi-state program to reduce CO2 emissions from power plants in Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island and Vermont. Under RGGI, the nine states use a regional cap-and-trade system to limit CO2 emissions. Each ton of CO2 emissions is worth one allowance. Regulated entities must submit an allowance for each ton of CO2 emitted.

Results for the 19th auction of CO2 allowances were announced in March. All of the offered 37,835,405 CO2 allowances were sold at a clearing price of $2.80 a ton. The auction was oversubscribed with a ratio of 2.2 bids to each allowance. This is the first time in the prior seven auctions for demand to exceed the supply and is probably a result of proposed changes to the rules for the program that were announced in February. Each state’s trading is based on a model rule that was developed in 2008. The changes to the model rule announced in February include a reduction in the overall cap from 165 to 91 million tons of CO2 in 2014, a 45% reduction. There were no proposed changes to the 2.5% year reduction in the cap from 2015 through 2020.

Methane Hydrate

Japan announced what appears to be a significant step toward the next natural gas boom.

The Japanese Ministry of Economy, Trade and Industry announced the start of a trial extraction of gas from a methane hydrate deposit off of Japan’s coast. Last April, researchers from the US Department of Energy, ConocoPhillips and Japan Oil Gas & Metals National Corporation demonstrated a field method to unlock natural gas from methane hydrate.

Methane hydrate exists in Alaska and offshore in continental shelf lands all over the world. According to the US Bureau of Ocean Energy Management, the mean in-place gas hydrate resource volume for the lower 48 states within the limits of the 200 nautical-mile US exclusive economic zone is 1,453 trillion cubic meters or 51,338 trillion cubic feet. However, this does not mean that this amount of methane hydrate is technically or even economically recoverable. Surveys of the methane hydrate resources associated with Alaska are underway. For comparison, in 2011 the US Energy Information Administration reported an estimated 862 trillion cubic feet of recoverable shale reserves in the United States.

Methane hydrate is a three-dimensional lattice ice structure loaded with trapped methane. Some call it fire ice since methane is the primary component of natural gas. According to the US Department of Energy, one cubic meter of methane hydrate can release 164 cubic meters of natural gas.

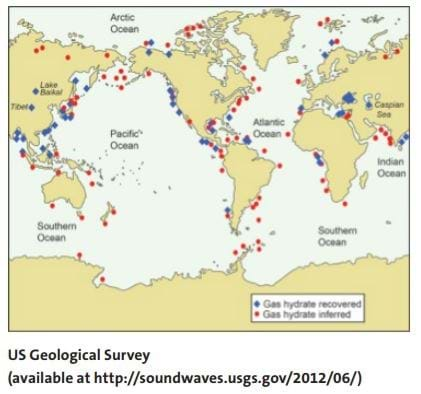

Methane hydrate exists all over the world as shown by the US Geological Survey map on the previous page, and, for some countries, could be a game changer. However, there is considerable concern about potential environmental impacts associated with the extraction process, including the release of methane to the atmosphere. Methane is a greenhouse gas and is estimated to be more than 20 times more powerful as CO2 as a greenhouse gas.

Wastewater Discharge Guidelines

Lenders and investors in power plants that make steam as an intermediate step to generate electricity should watch for release of wastewater effluent guidelines for the industry by the US Environmental Protection Agency in April. Some fear the new guidelines will require significant spending on retrofits. The guidelines will address mercury, zinc and selenium, among other pollutants.

The EPA is required to issue proposed rules by April 19, 2013 and to issue final rules by May 22, 2014 under a consent decree to which it and private litigants agreed in Defenders of Wildlife v. EPA, No. 10-cv-01915 (D.D.C.). It has been more than 30 years since these regulations were updated, a time period during which air emissions limits for many other pollutants have been ratcheted down. Instead of being released into the air, these pollutants can end up being discharged in wastewater effluent. Industry is concerned that new pollution limits may require significant new spending to retrofit existing power plants to comply with the new limits.