An Expanding US P3 Market

By Doug Fried and Jake Falk

A consensus is emerging in Congress that something must be done about crumbling US infrastructure, but consensus remains elusive about how to pay for it. Public-private partnerships may end up being part of the solution.

This report provides an overview of the current US P3 market, including information about the pipeline of projects in procurement, deal structures, market participants and public sector programs.

It analyzes the trends and developments that are shaping the US P3 market, how the market has matured in recent years and where it may be heading in the future.

Chadbourne initially surveyed private involvement in US roads on a P3 basis in 2004. While few deals had been done at that time, a market for US P3s was emerging in the transportation sector. Industry participants were encouraged by the Chicago Skyway and Indiana toll road P3s in 2005 and 2006, respectively, and were hopeful that a wave of US P3s was on the horizon. However, political concerns and the financial downturn put off or delayed some US projects, including some very high-profile P3s that the industry had been pursuing. Nevertheless, the US P3 market has continued to grow over the last 10 years.

During this time, P3 structures have matured, and P3 opportunities have diversified and increased. States have been procuring more greenfield P3s and using availability payment structures for some projects. Certain states are developing more predictable procurement processes, and the pipeline of projects in procurement has generally become more reliable. Global concession companies continue to set up US offices. P3s are spreading to new states and cities and to new sectors, including transit, social and water. A number of P3s are currently in procurement, and more P3s are expected to be developed for procurement in the future.

Growing US Pipeline

A number of new P3s are in procurement or being planned. More than twice as many P3s could reach financial close in 2015 than in 2014. Many are in the transportation sector.

P3s currently in procurement, a number of which may reach financial close in 2015, include the Long Beach Civic Center in California, the UC Merced Campus project in California, the Escambia County waste processing project in Florida, the Illiana corridor in Illinois (which was recently put on hold by the new governor), the Illiana corridor in Indiana, the Indianapolis court house, the University of Kansas campus project, the Purple Line light rail P3 in Montgomery county, Maryland, a waste-to-energy project in Prince Georges county, Maryland, the LaGuardia Airport terminal building in New York, a rapid bridge replacement project in Pennsylvania, a CNG fueling stations project in Pennsylvania, the Port of Ponce P3 in Puerto Rico, the Portsmouth Bypass in Ohio, State Highway 288 in Texas and the Houston justice complex.

Several factors are contributing to the growing use of P3s in the United States.

P3s can reduce project costs, including construction and long-term O&M costs, accelerate project delivery, allocate risks from the public to the private sector and encourage innovation in all phases of the project life-cycle.

Traditional federal grant funding available to states for transportation infrastructure is falling short, and the federal government is increasingly encouraging private investment in infrastructure with new and expanded infrastructure financing programs.

Significant amounts of private capital are available for investment in US P3s.

Infrastructure investment needs are clear in many cases based on the condition, age and performance of US infrastructure facilities and networks.

Sustainable, long-term sources of revenue are being approved at the state and local level, such as sales taxes that can be used to support project financings.

Public officials are becoming more familiar with P3s and are establishing P3 offices, including, for example, in Virginia, Ohio, Pennsylvania and Puerto Rico.

Early P3 projects are completing construction and opening for operation, including, for example, the Capital Beltway and I-95 HOT lanes in Virginia, the Long Beach court house in California and the I-595 managed lanes and Port of Miami tunnel in Florida.

The P3 delivery model is spreading to new states and also to new sectors, including transit, airports, social, water and, most recently, waste-processing infrastructure.

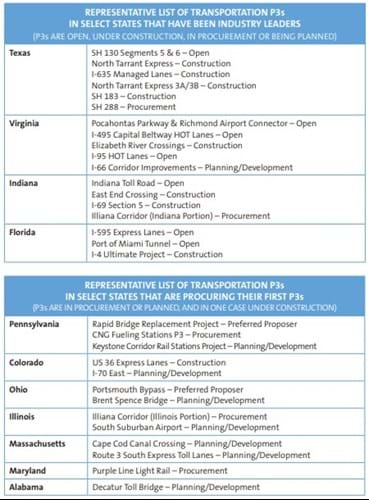

A number of states that have closed P3s over the last 10 years are leveraging their experience and developing more P3s. Some examples of P3s that these states have closed, are procuring or are planning are in the chart below.

A growing number of states have turned recently to P3s for the first time. Some examples of P3s that these states are procuring or are planning are in the second chart on the following page.

In some cases, the states identified in the chart are procuring their first P3s, but cities or local agencies within these states have already closed a number of P3s. Examples are states like Illinois where P3s have been procured by the City of Chicago and Colorado where P3s have been procured by local agencies.

Highway, bridge and tunnel projects continue to predominate in the US P3 market, but other infrastructure sectors are seeing more P3s.

Transit: The first major transit P3 in the US, the Eagle light rail P3 in Denver, Colorado, is in full construction and is expected to open in 2016. The Purple Line light rail P3 in Maryland is now in procurement. In addition to light rail, possible transit P3s could include high-speed rail, commuter rail, bus rapid transit, streetcar and intermodal station projects, including, for example, the proposed Keystone corridor rail stations project in Pennsylvania.

Social: The Long Beach court house P3 in California opened in 2013, and there are currently five major social P3s in procurement in the United States: the Long Beach Civic Center (preferred proposer), the Indianapolis court house (preferred proposer), the Houston justice complex (shortlisted proponents), the UC Merced campus project (shortlist issued) and the University of Kansas campus project (request for qualifications).

Water: A handful of major water P3s have reached financial close in recent years, including projects in Rialto, California and Bayonne, New Jersey, and P3s are being considered for a water treatment facility in Miami-Dade county, Florida and other projects. Congress recently created a pilot P3 program and a new “WIFIA” loan program to support water P3s that is based on the Transportation Infrastructure Finance and Innovation Act (TIFIA) loan program.

Airport: The Luis Munoz Marin airport P3 in Puerto Rico reached financial close in 2012. The central terminal building project at LaGuardia airport in New York is being procured as a P3, the Denver airport great hall project is being procured as a P3, and Illinois is considering a P3 for development of the new South Suburban airport.

Other: A handful of parking P3s closed in recent years, including Ohio State University’s parking P3 and Chicago’s parking meters P3, although no parking projects are currently in procurement. There have also been P3s for port facilities, including some active procurements. These and other infrastructure sectors, including waste-to-energy (there are currently two projects in early stages of procurement), may see more P3 activity in the years ahead as the P3 delivery model becomes more familiar and spreads to new parts of the country with their own infrastructure needs.

There are also various US P3s in planning or development stages that should support continued growth of the market in the years ahead. This list includes the following possible P3s for which requests for qualifications may be issued in the first part of 2015: the 1-70 East corridor project in Colorado, the Decatur toll bridge project in Alabama, the SR 156 West corridor project in California and the 1-66 corridor improvements project in Virginia. Additional P3s for which there may be RFQs in 2015 include, among others, the Cape Cod canal crossing and Route 3 South managed lanes P3s in Massachusetts and the Keystone corridor rail stations P3 in Pennsylvania.

Of note, the November 2014 elections brought new leadership to some of the states that have been actively pursuing P3s, which could potentially alter the landscape for P3 activity in 2015 and 2016. The impact of the elections will not be fully known until the new leaders begin making decisions about infrastructure projects during 2015.

Evolving P3 Structures

Deal structures for US P3s have matured and diversified over the last decade. The US P3 market has evolved from an initial focus on long-term leases of existing facilities and is now increasingly focused on new projects.

There also seems to be a shift toward more availability payments and shorter concession periods.

Greenfield P3s: Since 2008, there have been more “greenfield” P3s for development of new projects than “brownfield” P3s, or leases of existing facilities. This shift coincided with the failure of two high-profile brownfield P3s (the proposed Pennsylvania Turnpike and Chicago Midway airport P3s), but also reflects the growing familiarity of states with the P3 approach for developing and delivering new infrastructure.

Availability Payments: Florida helped pioneer the use of availability payments for greenfield P3s with the Port of Miami tunnel and 1-595 managed lanes P3s that each closed in 2009. Indiana and California have also used availability payments. Many of the states procuring their first P3s are using availability payments, such as Pennsylvania, Ohio, Illinois and Maryland.

Toll Roads & Managed Lanes: Since 2008, many of the toll-backed P3 projects in the United States have been for development of new managed lanes, with certain exceptions, such as the brownfield P3 for PR 22 in Puerto Rico and the Elizabeth River crossings P3 in Virginia. The managed lanes projects often include high-occupancy toll lanes, dynamic pricing to manage congestion, mass transit and other strategies to provide drivers increased reliability and choice. The limited number of real toll road projects reflects, in part, federal regulations that restrict tolling on interstate highways, which the Obama Administration proposed loosening earlier in 2014.

Bundling P3s: Pennsylvania is packaging the replacement of several hundred bridges into one major P3 for its rapid bridge replacement project, and it reached commercial close with a consortium of Plenary, Walsh and Granite on January 9, 2015. This P3 could pave the way for additional bundling projects that come with their own set of risks and unique procurement issues that have to be structured appropriately.

Market Participants

The diversity of companies participating in US P3s continues to increase as a growing number of US and global companies are being named as preferred proponents for US P3s. For example, Plenary (US 36 express lanes in Colorado) and Isolux (1-69 section 5 in Indiana) reached financial close on their first major US transportation P3s in 2014, and Walsh, Vinci and Bilfinger Berger (East End crossing in Indiana and Kentucky) did the same in 2013.

Developers and Equity Funds: A snapshot of six major US highway and transit P3s that were in the request-for-proposal stage in the summer of 2014 shows the growing diversity of bidders for these P3s. The six projects are the Illiana corridor in Illinois, the Illiana corridor in Indiana, Maryland’s Purple Line, Pennsylvania’s rapid bridge replacement project (the Plenary Walsh Keystone Partners team consisting of the Plenary Group, the Walsh Group, Granite Construction Company and HDR Engineering reached commercial close for this project on January 9, 2015), Ohio’s Portsmouth bypass (the Portsmouth Gateway Group consisting of ACS Infrastructure Development, Inc., Infrared Capital Partners Limited, Star America Fund GP and Dragados, USA, Inc. reached commercial close for this project on December 5, 2014) and SH-288 in Texas.

More companies are participating in the US P3 market, including major engineering and construction companies, local and regional design and construction firms and companies focused on other types of infrastructure. However, the six P3s in this snapshot are representative of recent US highway and transit P3s and provide a good sense of the growing interest in this segment of the market.

Sixteen major US and global developers participated or are participating on bid teams for these six P3s (including ACS/Dragados, Alstom, Cintra/Ferrovial, Edgemoor, Fluor, Granite, Isolux, Kiewit, Lane, OHL, Parsons, Plenary, Shikun & Binui, Skanska, Vinci, Walsh).

Six equity funds participated or are participating on bid teams for these six P3s (Fengate, InfraRed, John Laing, Macquarie, Meridiam, Star America).

One US developer (Walsh) participated or is participating on bid teams for five of the six P3s and another (Fluor) participated or is participating on bid teams for three of the P3s.

Two foreign developers (ACS and Cintra) participated or are participating on bid teams for four of the six P3s, and another (Plenary) participated or is participating on bid teams for three of the P3s.

Two of the equity funds (Meridiam and InfraRed) were or are on bid teams for four of the P3s, and the other equity funds were or are on bid teams for two of the P3s.

A number of the foreign developers and equity funds included in this snapshot have set up offices in the US to facilitate their involvement in these and other P3s, including some that opened US offices in the last 12 to 24 months.

Lenders: Project sponsors in the United States obtain financing to close P3s through tax-exempt private activity bonds, bank loans and federal loan programs, in addition to equity and public contributions. Other sources of financing might also be available for US P3s, such as taxable bonds and institutional debt, but have not typically been used thus far to close P3s. While banks participated in most of the early P3s in the United States, they have not been involved in many of the P3s, particularly the greenfield P3s, that reached financial close after the market downturn in 2008. This may be changing. For example, banks are providing senior debt for Florida’s $2.3 billion I-4 ultimate project that reached financial close on September 5, 2014.

The primary federal credit assistance programs used for P3s are tax-exempt bonds and the TIFIA loan program, which remains critical to the financing of some transportation P3s. Tax-exempt bonds and TIFIA are discussed below.

Pension Funds & Institutional Investors: The US P3 market has seen only a relatively limited amount of direct equity investment by pension funds and other institutional investors thus far, despite the apparent alignment of their investment objectives with infrastructure’s long-range returns. While the Dallas Police and Fire Pension System invested in two P3s in Texas alongside Cintra and Meridiam, and TIAA-CREF acquired an interest in the I-595 managed lanes P3 in Florida during construction, these types of investments are currently not that common for US P3s.

State Activity

Thirty-three states and Puerto Rico have legislation allowing P3s for highway and bridge projects, according to the National Council of State Legislatures.

Some of this legislation is broad, allowing P3s for a variety of projects across multiple sectors without further approvals, while other legislation is more limited, and may require additional legislative approval of P3s or limit the number or type of P3s that state agencies may undertake.

Many of the states that are delivering P3s are developing more predictable procurement processes that work. States that are procuring their first P3s are learning from states that preceded them. (One of the Obama administration’s P3 goals is to share best practices among states.)

More states have been considering P3s in recent years than previously, although not all of the states with enabling legislation are currently pursuing P3s. States that are considering or procuring their first P3s include Alabama, Illinois, Maryland, Massachusetts, Ohio and Pennsylvania.

An emerging hallmark for success is the creation of state-level P3 offices or dedicated personnel that can coordinate public P3 requirements and keep projects on track. States that have created P3 offices or dedicated personnel in recent years to implement P3 programs include Virginia, Ohio, Pennsylvania, Indiana and Puerto Rico.

Some states accept unsolicited proposals for P3s, but the majority of the P3s that have advanced through the procurement process have been solicited.

A few procurements have been cancelled after state agencies shortlisted bidders. Most recently, Nevada elected to deliver the I-15 expansion (Project Neon) as a design-build project rather than a P3 after shortlisting three teams.

Federal Financing Support

Federal programs have played a significant role in financing US transportation P3s. Of the 17 most recent major highway and transit P3s to reach financial close in the United States identified below, 14 used a direct loan from the TIFIA program, 11 used tax-exempt private activity bonds authorized by the US Department of Transportation, and nine used both a TIFIA loan and tax-exempt bonds.

The 17 most recent major US highway and transit P3s include the I-4 Ultimate project in Florida, I-69 in Indiana, US 36 express lanes in Colorado, Goethals bridge in New York and New Jersey, North Tarrant express 3A and 3B in Texas, East End crossing in Indiana and Kentucky, I-95 HOT lanes in Virginia, Presidio Parkway in California, Elizabeth River crossings in Virginia, PR 22 in Puerto Rico, Eagle light rail P3 in Colorado, I-635 managed lanes in Texas, North Tarrant express in Texas, Port of Miami tunnel in Florida, I -595 managed lanes in Florida, SH 130 segments 5 and 6 in Texas, and Capital Beltway HOT lanes in Virginia.

TIFIA: provides low-cost, flexible loans for eligible transportation projects, which include both P3s and publicly-financed projects. In 2012, Congress substantially increased the amount of money TIFIA can lend from approximately $1 billion a year to approximately $7.5 billion in 2013 and $10 billion in 2014. Also in 2012, Congress increased the portion of a project’s total costs that a TIFIA loan can cover from 33% to 49%, but the government has continued limiting loans to 33%.

More publicly-financed projects are advancing under the expanded TIFIA program than P3s. Of the 44 letters of interest, submitted for TIFIA assistance since the program’s lending capacity was increased in 2012, 33 have been for publicly-financed projects and 11 have been for P3s. The large number of publicly-financed projects is not likely to crowd out P3s as long as Congress continues to provide sufficient budget authority for TIFIA to make loans to all of the projects that are requesting assistance.

Private Activity Bonds: Private activity bonds are tax-exempt debt instruments issued by public agencies on behalf of private developers. Authority to use the bonds is granted by the US Department of Transportation for eligible highway and transit projects. Congress established a national limit of $15 billion on the use of such bonds when it created the program in 2005. As of November 12, 2014, $10.2 billion of the $15 billion cap had been allocated to eligible projects, and $4.8 billion of bonds had been issued. As the amount of allocations begins to approach the $15 billion cap, Congress would have to authorize a higher limit for the program to remain viable. Tax-exempt bonds are also available for certain water, waste and other types of infrastructure projects that may be financed through P3s.

TIFIA and private activity bonds have featured so prominently in US highway and transit P3s because they help reduce financing costs. TIFIA has also been particularly helpful for toll road P3s because TIFIA’s flexible repayment provisions can better match projected cash flows.

WIFIA: The federal government recently created a Water Infrastructure Finance and Innovation Act program called “WIFIA” that is modeled on TIFIA. The program allows each of the US Environmental Protection Agency and the US Army Corps of Engineers to make flexible, low-interest loans for water projects, including P3s. Various types of water and wastewater projects are eligible.

National Infrastructure Bank: Since 2007, many proposals have been offered in Congress for a new national infrastructure bank, but none has passed. The failure of these proposals is attributable, in part, to the difficulty of passing substantial new spending measures during an economic downturn and to a polarized Congress. The failure may also be due to the success of sector-specific programs like TIFIA that provide many of the benefits that an infrastructure bank would provide at a low cost to the taxpayer.

Traditional Public Funding

Federal Transportation Funding: Public officials are turning to P3s for transportation, in part, because traditional federal highway and transit spending is falling short. Federal transportation spending has relied on revenue from motor fuel taxes since 1956. These revenues have supported a federal Highway Trust Fund that provides grants to state and local governments to pay for highway and transit projects with currently-available funds rather than borrowing. However, Americans are consuming less fuel, and federal motor fuel tax rates have not been raised since 1993, leaving the Highway Trust Fund short of funds.

According to a June 2014 report from the Congressional Budget Office,

The federal government spends more than $50 billion per year on surface transportation programs... [but in] the past 10 years, outlays from the Highway Trust Fund have exceeded revenues by more than $52 billion, and outlays will exceed revenues by an estimated $167 billion over the 2015–2024 period [at current spending and tax rates].

Since 2008, the federal government has addressed these shortfalls by making transfers from the US Treasury general fund to the Highway Trust Fund. The 2012, the federal highway and transit bill known as “MAP-21” did not provide any significant new revenues for transportation programs to address the shortfalls. Congress had until September 30, 2014 to reauthorize MAP-21 before the programs expired, but pushed off the deadline to May 31, 2015, largely because it could not solve the funding problem. President Obama proposed a $302 billion reauthorization of MAP-21, but this is more spending than the Highway Trust Fund can support.

The federal shortfalls over the last several years have helped push federal policymakers to consider new approaches for funding and delivering infrastructure, including P3s. Both Congress and the Obama administration have launched initiatives to explore the possibility of expanding P3s.

House P3 Panel: The House Transportation and Infrastructure Committee created a special panel in January 2014 to focus on P3s across various types of infrastructure. The panel produced a report on September 17, 2014, and the panel’s work may lead Congress to encourage broader use of private-sector investment and P3s when Congress considers new infrastructure legislation.

Build America Initiative: In July 2014, the Obama administration launched a “Build America Investment Initiative” to encourage broader public and private sector collaboration and expand opportunities for P3s. The initiative includes a new Build America center at the US Department of Transportation to serve as a “one-stop shop for cities and states seeking to use innovative financing and partnerships with the private sector to support transportation infrastructure.” The administration also created an inter-agency working group to focus on P3s with more than a dozen agencies and offices participating. The group will review ideas and make recommendations to promote broader use of P3s for US infrastructure.

State and Local Funding: With federal grant programs for transportation facing shortfalls, state and local governments have been creating new, dedicated sources of revenue for transportation infrastructure. Some of these sources of revenue are being leveraged to support infrastructure investment using innovative financing approaches, including P3s. Using new sources of revenue and innovative financing approaches allows cities and states to advance major projects in the near-term without waiting for new federal funding.

Some of the most significant local efforts to raise revenue are referenda that allow local voters to approve new sales and use taxes and dedicate the revenue to specific projects. One of the most substantial voter-approved sales taxes in recent years was the half-cent “Measure R” sales tax approved by voters in Los Angeles in 2008. Measure R revenues will be used to fund a number of transportation projects to be delivered by the Los Angeles county Metropolitan Transportation Authority, including possible P3s. Local sales taxes also fund the Denver Regional Transportation District’s projects, including the Eagle light rail P3.

Some states have also recently been supplementing state motor fuel excise taxes with other long-term taxes that can be dedicated to transportation. These include increased motor fuel taxes, dedicated sales taxes and increased fuel taxes at the wholesale level.

Tolling and Pricing: One significant reform that the federal government could make to help states raise revenue for transportation projects would be to relax the current restrictions on tolling interstate highways. By creating a dedicated source of revenue that can be used by private entities to pay debt service and receive a return on equity or to allow states to make availability payments, tolling would facilitate more P3s. Some states have expressed interest in tolling interstates in recent years to make critical improvements and replace aging and, in some cases, inadequate infrastructure. In 2014, the US Department of Transportation proposed that Congress provide more flexibility for states and cities to charge tolls on interstates. This proposal was in the draft highway and transit bill that President Obama sent Congress to replace MAP-21.

Opportunities

The US P3 market is growing and will continue to do so due to shortfalls in federal grant funds, the need to invest in aging and inadequate infrastructure, availability of private capital and public sector efforts to improve the financing and delivery of projects. The growth is also aided by the growing familiarity of public officials with P3s, the completion of early P3s and the effectiveness of the P3 delivery model.

There are currently several P3s in procurement or being planned. Some of the upcoming opportunities for the private sector to invest in US P3s include the following potential P3s currently in procurement or expected to move there:

1-70 East corridor project (CO) — An approximately 11-mile, $1.5 billion project to add capacity and managed lanes on I-70 East from downtown Denver toward Denver International airport. A request for qualifications is expected in early 2015.

CNG fueling stations P3 project for transit (PA) — An approximately $50 to $100 million project to install CNG fueling stations at up to 37 transit facilities across Pennsylvania. The shortlisted bidders were announced on January 16, 2015.

Decatur toll bridge (AL) — An approximately $250 million toll bridge P3 proposed for northern Alabama connecting Morgan and Limestone counties over the Tennessee River in Decatur. A request for qualifications is possible in 2015.

I-66 corridor improvements (VA) — An approximately 28-mile managed-lanes project on I-66 from Haymarket in Prince William county west of Washington to the Capital Beltway. A request for qualifications is expected for this P3 in early 2015.

Port of Ponce (PR) — A port operations P3 at the Port of Ponce in Puerto Rico with opportunities for additional improvements. A request for proposals was issued for this P3 in October 2014 describing the shortlisting and bidding process.

Prince George’s county waste processing and alternative energy facility (MD) — A P3 to construct a new waste processing and conversion facility for Prince George’s county. A request for qualifications was issued in October 2014.

South Miami Heights water treatment plant (FL) — A P3 to construct a new water treatment facility for Miami-Dade county. A draft request for qualifications was issued, and a final RFQ is expected in 2015.

SR-156 West corridor (CA) — An approximately $268 million project to construct a new highway parallel to Highway 156 in Monterey county. A pre-development agreement could be awarded in 2015 following an RFQ-RFP process.

University of Kansas Central District development project (KS) — A P3 for the planning, design, construction, financing and potentially operations and maintenance of the Central District development project. Responses to the request for qualifications were received on January 15, 2015.

Emerald Coast/Escambia county waste processing facility (FL) — A P3 for the design, permitting, financing, construction and long-term operation of a waste processing facility. The short-listed bidders were announced on January 7, 2015.

More solicitations are expected later in the year.