Hydrogen Tax Credit Guidance

New hydrogen tax credit rules released by the US Treasury just before Christmas will make it hard to finance projects that use electrolyzers to produce clean hydrogen until it is possible to do hourly matching of distant intermittent wind and solar electricity with hydrogen output.

The Treasury acknowledged that hourly tracking systems are “not yet broadly available across the country and will take some time to develop.”

The electrolyzer plants most likely to advance in the meantime are ones that have adjacent renewable power supplies.

Even then, the Treasury decision to require electricity generation from intermittent renewable power projects to be matched eventually with hydrogen output hour-by-hour will be challenging to make work to the extent the electrolyzers require around-the-clock operation to be economic.

The Inflation Reduction Act authorized a tax credit of up to $3 a kilogram for producing clean hydrogen.

A hydrogen producer must show its lifecycle greenhouse gas emissions to produce hydrogen are less than 0.45 kilograms of CO2 equivalent per kilogram of hydrogen to qualify for the maximum credit.

The tax credit is in section 45V of the US tax code.

It can be claimed on clean hydrogen produced and sold or used during the 10 years after a plant is originally placed in service. Projects must be under construction by the end of 2032 to qualify. Hydrogen producers have a choice of a one-time investment tax credit for 30% of the project cost instead.

Claiming tax credits will require significant annual paperwork.

The Treasury imposed three other requirements—in addition to a low-emission production process—for hydrogen to qualify as clean. Hydrogen producers will be treated for purposes of tracking emissions as using electricity from power plants from which they buy renewable energy certificates (RECs) or similar "energy attribute certificates" (EACs). Any such power plant cannot be more than 36 months older than the hydrogen plant. It must be in the same region as the hydrogen plant. The electricity used must match the hydrogen output hour-by-hour starting in 2028. Annual matching is permitted until then.

Developers may find it challenging to persuade banks to lend today to finance projects that require tax credits to make the economics work unless the banks are confident the projects will be able to satisfy hourly matching requirements starting in 2028 and remain profitable relying on electricity solely from recently-built renewable power plants.

The Treasury suggested it may be willing to delay the switch to hourly matching if the tracking systems required are not yet ready by 2028. It asked for comments about the appropriate transition period.

The Treasury released 128 pages of proposed regulations and commentary on December 21. Comments are due by February 26. The guidance can be found here.

There are still significant unanswered questions, including how storing hydrogen affects hourly matching and whether tax credits can be claimed where hydrogen is an intermediate chemical step toward production of a different product like methanol or ammonia. Any project whose ultimate output is methanol or ammonia should probably be split into separate facilities so that hydrogen is a clear output before conversion.

Lifecycle Emissions

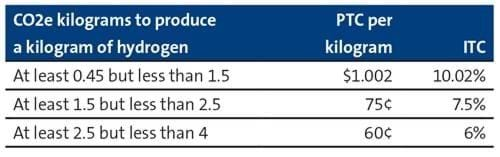

The tax credit amounts vary depending on the greenhouse gases emitted to produce a kilogram of hydrogen. The greenhouse gases are converted into CO2-equivalent emissions.

To claim credits at the full rate of $3 a kilogram, the production process must lead to less than 0.45 kilograms of CO2-equivalent emissions per kilogram of hydrogen.

The following table shows the tax credit amounts where the CO2-equivalent emissions exceed that amount.

The production tax credit amounts are adjusted annually for inflation using 2022 as the base year.

No credits can be claimed on hydrogen produced with more than four kilograms of CO2 emissions per kilogram of hydrogen.

The CO2 emissions are measured on a lifecycle basis, meaning by taking into account all of the emissions from feedstock through the point the hydrogen is produced (rather than also through consumer use). That includes emissions associated not only with cultivation, gathering, extraction, processing and delivery of the feedstock to the hydrogen plant, but also with the electricity used to run the plant and with capturing and sequestering the CO2 generated by the hydrogen plant.

The lifecycle emissions are determined using a GREET model developed by the Argonne National Laboratory.

The model is able to test only eight hydrogen pathways currently: 1. Steam reforming of natural gas with potential carbon capture and storage. 2. Autothermal reforming of natural gas with potential carbon capture and storage. 3. Steam reforming of landfill gas with potential carbon capture and storage. 4. Autothermal reforming of landfill gas with potential carbon capture and storage. 5. Coal gasification with potential carbon capture and storage. 6. Biomass gasification with corn stover and logging residue with no significant market value and with potential carbon capture and storage. 7. Low-temperature electrolysis using electricity. 8. High-temperature water electrolysis using electricity and potential heat from nuclear power plants.

Just because the model recognizes a pathway does not mean that a facility using such a process will automatically qualify.

The emissions are tested using the most recent GREET model available on the first day of the first tax year in which hydrogen tax credits are claimed.

The emissions must be retested annually after the close of each tax year using the then-most recent GREET model, introducing potential uncertainty about annual qualification.

Hydrogen producers for whom there is no current GREET pathway can petition the government for a provisional emissions rate.

Getting such a rate is a two-step process. The hydrogen producer must first petition the US Department of Energy. The DOE window is expected to open on April 1, 2024. DOE will not entertain requests until the FEED (front-end engineering and design) or other study sufficient to make a financial investment decision has been completed. The producer then attaches the DOE analytical assessment of its hydrogen pathway and a copy of its request to DOE for an emissions rate to its first annual tax return on which hydrogen tax credits are claimed.

RECs and other EACs will be taken into account by DOE when determining the provisional emissions rate, although it is unclear how this will work unless the producer has made a full forward purchase.

Emissions can be allocated partly to any "valorized" co-products, meaning other outputs from the hydrogen plant that are put to a productive use.

The government is concerned about overproduction of co-products to siphon emissions away from hydrogen to qualify for higher tax credits. The allocation must follow guidelines in a December 2023 DOE paper that can be found here. For example, steam will not count as a co-product to the extent it exceeds the optimal steam production based on modeling by the National Energy Technology Laboratory.

The hydrogen producer must buy RECs or other EACs from a particular electricity source to treat the electricity as from that source.

EACs are required even where the electricity generator is directly connected to the hydrogen plant or co-located with the hydrogen plant.

EACs must cover each megawatt hour of electricity that the producer claims is from that source. They must be recorded in a qualified registry or accounting system, meaning one that assigns a unique identification number to each EAC, identifies the EAC owner, links each EAC to a single unit of electricity and provides a publicly accessible view of all the generators registered in the tracking system. The Treasury has not decided whether to reduce the EACs for line losses.

The producer may rely on the provisional emissions rate until a suitable GREET pathway becomes available. DOE may reassess the emissions rate if the facility design or operation changes.

The Internal Revenue Service may check on audit for the accuracy of the information the hydrogen producer entered into the GREET model or provided DOE when seeking a provisional emissions rate.

Matching

Three additional boxes must be checked—in addition to a low-emission production process—for hydrogen to count as clean.

The hydrogen producer must match its hydrogen output to the electricity output from the power plant that it claims as the source of the electricity used to produce the hydrogen. Annual matching is allowed through 2027. Hourly matching will be required starting in 2028. Facilities placed in service before 2028 will not be grandfathered into annual matching and will have to make the switch to hourly.

The Treasury said a June 2023 survey of nine existing tracking systems found two that claimed to be tracking on an hourly basis, but "software functionality in these two systems remains limited" and "full functionality will take time."

It said that of the other tracking systems, four gave timelines of less than one to two years, one gave a timeline of three to five years and two declined to make predictions.

The Treasury is still thinking about how to deal with hourly matching where electricity is diverted temporarily into storage.

Incrementality

The second box to check is "incrementality." The generating facility cannot have started "commercial operation" more than 36 months before the hydrogen plant is placed in service.

Part of the electricity from an older generating facility that was "uprated" within the last 36 months will count as new. "Uprated" means improvements have been made to increase the nameplate capacity. For example, if the capacity of a 10-megawatt facility is increased to 12 megawatts, then the generator can treat 16.7% of the annual output or each hour of electricity as satisfying the "incrementality" requirement.

Both dates—the date the generator began commercial operation and the date the clean hydrogen plant was placed in service—could change as described in the next two paragraphs. This could drive the two dates farther apart or bring them closer together.

An existing hydrogen plant that is modified after 2022 to produce clean hydrogen that it was unable to produce earlier is treated for purposes of both the incrementality test and the 10-year tax credit period as placed in service when the modifications are completed. An example is where carbon capture equipment is added to reduce lifecycle emissions to within the range where tax credits can be claimed. However, it is not a modification to change the feedstock or fuel, such as switching from natural gas to renewable natural gas.

The owner might be considered to have built a new generating facility or new hydrogen plant if it makes extensive enough improvements. A facility is considered brand new under an "80/20 test" if the owner makes improvements that cost at least four times the value of the used parts retained from the old facility.

Hydrogen producers near nuclear power plants and hydroelectric facilities, particularly in the Pacific Northwest, are not happy. They cannot fill gaps in intermittent power supply from wind or solar projects by drawing on surplus nuclear or hydro-electricity. Existing facilities are not incremental and cannot serve as a source of electricity for making clean hydrogen.

The Treasury is considering a number of ways that electricity might be supplied from existing facilities and still qualify as incremental.

One is where an older generator is dedicated to a specific hydrogen plant. Another is where the generating facility would otherwise be retired. Treasury is thinking about whether nuclear and hydroelectric plants that must be relicensed to continue operating should be considered at risk of retirement.

More targeted approaches are also under consideration, but seem unduly complicated. These include counting electricity as incremental during periods when the generator would have been curtailed or where the generator is in a location where 100% of the grid electricity comes from "minimal-emitting generators" so that increases in load do not increase emissions. Another targeted approach is to allow hydroelectricity to count as incremental during periods when wholesale electricity prices are zero or negative on a system-wide basis. During such periods, hydroelectric facilities might otherwise reduce output by spilling water.

A simpler approach also under study is to allow 5% of electricity from all existing power plants to count as incremental.

Deliverability

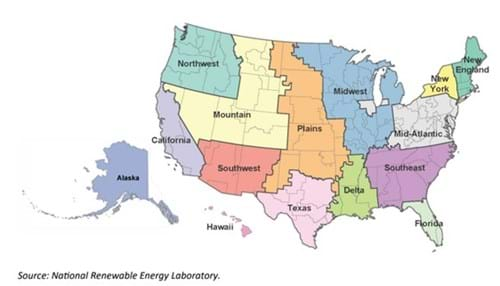

The third box to check is "deliverability." The generator must be in the same region as the hydrogen plant. "Region" means a region on the map below.

Alaska, Hawaii and each US territory are treated as separate regions.

A generator or hydrogen plant will be treated as in the balancing authority to which it is electrically interconnected (rather than its geographic location). Each balancing authority is linked to a single region, with the exception of the MISO balancing authority that is split into two US regions.

The Treasury is still thinking about what to do where the generator is outside the United States. It is also thinking about whether there are other circumstances where deliverability should be considered met even though the generator and hydrogen plant are in different regions.

Paperwork

Demonstrating compliance with all of these tests will require significant paperwork.

Hydrogen producers must attach to their annual tax returns a separate verification report each year for each production line that produces clean hydrogen.

The consultant writing the report must be accredited by the American National Standards Institute National Accreditation Board or under the California Air Resources Board low-carbon fuel standard program.

The consultant must attest, under penalties of perjury, to the lifecycle emissions and the accuracy of the data submitted by the producer to determine them, the hydrogen production, the amount of hydrogen sold or used and to the fact that the consultant has no conflict of interest that would arise, for example, if he or she is paid a fee tied to the amount of tax credits, is a party to the hydrogen sales or is related to the hydrogen producer or a tax credit purchaser.

The verification report must be signed and dated no later than the due date (including extensions) for the tax return for the year the hydrogen was produced.

The required records and raw data supporting the tax credits must be held for at least six years after the due date (including extensions) for filing the tax return on which the credits are claimed.

Stacking

Hydrogen producers have wondered whether they can claim both section 45V credits for making clean hydrogen and section 45Q credits for capturing the carbon emissions.

The Treasury said no. Both tax credits cannot be claimed at the same "facility." The Treasury said capture equipment that is needed to reduce the lifecycle greenhouse gas emissions to a range that qualifies for tax credits is considered part of the hydrogen "facility," thus closing the door to claiming both tax credits by separating ownership. If section 45Q credits were claimed on the captured CO2 emissions at any time in the past, then section 45V credits cannot be claimed on the clean hydrogen.

Rebuilding just the carbon capture equipment does rid the taint, the Treasury said. However, this contradicts other parts of the regulations. First,the hydrogen plant so extensively that it is considered a new facility under the 80/20 test does not rid the taint of having claimed section 45Q credits in the past.

Rebuilding just the carbon capture equipment does rid the taint, the Treasury said. However, this contradicts other parts of the regulations. First, the hydrogen plant and capture equipment are considered a single "facility" if the capture equipment is needed to produce clean hydrogen. It is unclear why rebuilding the entire hydrogen "facility" does not rid the taint while rebuilding only part of the "facility" does so. Second, an example in the proposed regulations says that rebuilding the capture equipment to a point where it is considered new under the 80/20 test does not rid the taint if the capture equipment is not needed to produce clean hydrogen. However, the capture equipment in the example is not part of the hydrogen "facility" so the fact that section 45Q credits were claimed should not matter. Both section 45Q and 45V credits would not be claimed on the same "facility."

Section 45Q credits can be claimed for capturing CO2 emissions from the power plant that is the source of electricity for producing hydrogen without affecting the ability to claim section 45V credits. The hydrogen "facility" does not include generating equipment or any carbon capture equipment tied to the electricity generation.

Sale or Use

The hydrogen must be produced for sale or use as hydrogen.

Storing the hydrogen between production and sale or use does not disqualify the hydrogen. The tax credit is claimed in the year the hydrogen is produced even if the sale or use and verification are not until a later year.

The hydrogen cannot be used to generate electricity that is used to make more hydrogen.

The Treasury is concerned about abuses where hydrogen is produced to generate tax credits and then dumped. Tax credits cannot be claimed by a producer who knows or reasonably expects the customer will vent or flare the hydrogen. The fact that the hydrogen is sold to a customer at a price well below the current market value may be a sign of such a plan.

The hydrogen must be produced in the United States or a US possession like Puerto Rico. However, it does not have to be used in the United States. It can be sold for export.

Other

Production tax credits belong to the owner of the hydrogen facility. Thus, where company A owns a hydrogen production facility and leases it to company B to be used to make hydrogen, A claims the tax credits. Company A would also claim the tax credits under a tolling or contract manufacturing arrangement where B pays A fees to convert gas, water or electricity belonging to B into hydrogen at a plant owned by A.

Hydrogen PTCs may be claimed for 10 years starting on the date the hydrogen production facility is originally placed in service. Thus, a facility placed in service before 2023 will have used up part of the 10-year period by the time it is able to start claiming tax credits. However, a facility that was not producing clean hydrogen before 2023 and that is modified in 2023 or later to produce such hydrogen can treat the 10 years as starting when the improvements are placed in service.

Hydrogen producers will have the option to be paid the cash value of production tax credits—but not the investment tax credit, if that option is selected—under an IRS refund process, but only for the first five tax years of credits commencing with the tax year the producer places the hydrogen plant in service. The five-year period cannot stretch beyond 2032. Tax credits after the refund period ends can be sold to other companies for cash (as can investment tax credits). (For more details on transferring tax credits, see "IRS Transferability Guidance".)

The tax credits will be only a fifth of the full rate unless mechanics and laborers helping to build the project are paid at least “prevailing wages” as determined by the US Department of Labor and qualified apprentices are used for at least 12.5% or 15% of total labor hours, both during construction and when making any repairs or alterations during the full period production tax credits are claimed or, where an investment tax credit is claimed, during the five-year period the ITC is subject to recapture. Apprentices are supposed to be used to train more workers for jobs in the green economy. (For more details, see "Wage and Apprentice Requirements".)

ITCs

Hydrogen producers have the option to claim a one-time investment tax credit for 30% of the cost of the hydrogen facility. However, few producers seem interested in the option. No bonus credits could be claimed on projects in "energy communities" or on account of using enough domestic content.

An investment tax credit cannot be claimed on tax basis built up before 2023 where the plant was already under development or construction before 2023.

The election to claim an ITC is made by filing a Form 3468 with the annual tax return for the year the hydrogen plant is put in service. The election is made at the partnership level for a plant owned by a partnership.

If anyone owning an interest in the hydrogen plant makes such an election, then it binds all direct and indirect interest holders. However, the Treasury has not decided yet whether that should be true of tenancy-in-common structures where two or more parties own undivided interests in the plant.

An annual verification report must be filed for the election year and each year during the ITC recapture period.

Any investment credit claimed remains exposed to potential recapture for five years. Recapture means that part of the credit would have to be repaid to the Treasury. In contrast, section 45V credits are not subject to recapture. Since they are claimed over time, any event that would have triggered ITC recapture leads to a reduced or no section 45V credit in one or more future years.

Three types of events trigger recapture.

Recapture can be triggered by a sale or other disposition of the hydrogen plant or of the taxpayer's interest it (or by a more than one-third reduction in a partner's profits share in cases where a partnership owns the hydrogen plant) during the first five consecutive 12-month periods after the plant is put in service.

It is triggered by failure to comply with the wage and apprentice requirements in any year during the same period.

It is also triggered by an "emissions tier recapture event" where the lifecycle emissions rate increases above the rate for the year the hydrogen plant went into service during any of the first five tax years after the tax year the hydrogen plant went into service. The rate in the original verification report serves as the baseline. It is also an emissions tier recapture event if the hydrogen producer fails to submit a verification report by the deadline (including extensions) for filing its tax return for any tax year during the recapture period.

The recapture amount varies by recapture event.

After a sale or other disposition, the unvested ITC must be repaid to the Treasury. The ITC vests ratably over five years.

A failure to comply with the wage and apprentice requirements in any year during the five-year recapture periods triggers a repayment obligation to the Treasury for 80% times 20% of the ITC claimed.

After an "emissions tier recapture event" in a year, 20% of the ITC claimed must be recalculated for that year and the difference is repaid to the Treasury. For example, if the hydrogen producer claimed an ITC of $100X and misses the deadline to file the verification report for the first tax year after the hydrogen plant went into service, then $20X must be repaid to the Treasury.