Energy storage in Latin America and the Caribbean

Latin America is in the midst of a dramatic energy transformation.

Region wide, countries are rapidly transitioning from fuel oil and hydroelectricity as the main power sources to a more diverse energy mix, including natural gas, solar and wind.

In Brazil, Colombia, Panama, Uruguay, Chile and elsewhere, LNG import terminals have been built or are planned. Solar and wind have exploded in countries such as Chile, Honduras, Peru, Brazil and most recently Argentina, where the RENOVAR program has awarded 2,400 megawatts of projects.

Although its current impact is minimal, energy storage — and specifically battery storage — will play key a role in this transformation. In part, the increased importance of battery storage will be inevitable as the costs of batteries decrease. However, the extent of the growth of battery storage — and its effect on market penetration of renewable energy, rural electrification and disaster relief — will depend on both the extent of the decrease in battery storage costs and the development of regulatory regimes that reward the services that storage is capable of providing.

Energy storage projects are either in operation or planned in various Latin American countries.

These projects provide an indication of what energy storage in Latin America may look like in the future, as well as a tool for regulators and developers to understand how energy storage projects can provide valuable services to the grid. They also provide insight into how energy storage is being used across disparate markets in Latin America: in countries with large, inter-connected grids, for off-grid, rural electrification and on island grids.

Below are some of the planned and operational energy storage projects in the region.

Argentina

Argentina has had pumped-storage hydropower since the 1980s. The Los Reyunos power plant in Argentina has an installed capacity of 224 megawatts and has been generating electricity since 1983. Using the same technology but at a larger scale, the Rio Grande hydroelectric complex was built in 1986. It has an installed capacity of 750 megawatts comprised of four turbines of 187.5-MW each.

Pumped-storage hydropower is a mature technology that relies on moving water from one reservoir to another in order to generate electricity. When energy is cheaper during off-peak hours, electricity is used to pump water from one reservoir located at a lower altitude to another reservoir located at a higher altitude. Later, when electricity is in high demand and more expensive during peak hours, the water from the higher reservoir is released to the lower reservoir, causing electricity to be generated when the water passes through a turbine or set of turbines.

Thus, this technology is dependent on the presence of specific conditions. The geography of the location must allow the construction of two interconnected reservoirs located at different altitudes so the water can fall from one to the other at a speed significant enough to generate electricity through the turbines.

Chile

Chile, by regulations, remunerates generators for providing frequency regulation and penalize them if performance is poor.

These regulations were in part a response to intermittency issues caused by the growing number of solar and wind projects.

The quality services technical regulations adopted in 2015 require all generating companies interconnected to the grid to meet certain standards of security and quality services to ensure the grid operates at a near-constant frequency of 50 Hz (slightly lower in contingency scenarios). If a generating facility displays poor performance on frequency regulation, then the Superintendent of Fuels and Electricity can impose penalties ranging from US$75 to US$9,000,000.

Other regulations that complement the quality services technical regulations require frequency regulation to be remunerated as part of ancillary services that any generation company interconnected to the grid can provide.

AES Gener (a subsidiary of The AES Corporation) owns 52 MW of storage capacity in operation in Chile through three separate lithium battery arrays. Each of the battery arrays is tied to one of AES Gener’s thermal plants. The AES Gener storage projects help AES Gener’s thermal plants comply with spinning reserve requirements and increase power generation from the plants because the spinning reserve requirement is met by the batteries.

The 20-MW Angamos array reportedly allows AES Gener to increase the power generation of the Mejillones 544-MW thermal plant by up to 4%. Although the Chilean regulations are not specifically geared toward energy storage, the ability of energy storage to provide frequency regulation through spinning reserve is a natural fit.

Dominican Republic

Like Chile, the Dominican Republic has also adopted regulations that provide a favorable climate for energy storage through the remuneration of frequency regulation services.

The groundwork was laid in 2001 with the passage of a General Electricity Law (No. 125-01), followed a year later by an “application regulation” (adopted through Presidential Decree No. 555-02), that established a requirement for all generators to provide frequency regulation service to the grid and empowered the Superintendent of Electricity to adopt an incentive. The amount of the incentive is calculated from a formula set yearly by the Superintendent of Electricity, with the current base incentive for 2018 being US$9.65 a megawatt hour

In September 2017, the Dominican Republic took a near direct hit from hurricanes Irma and Maria, forcing 40% and 55% of the nation’s power plants off line, respectively. However, the Dominican grid itself remained operational, thanks in part to frequency regulation services provided by two AES-owned 10-MW lithium ion arrays. The role of the batteries in maintaining the Dominican grid is being studied by other Caribbean islands, including Jamaica and Puerto Rico.

Mexico

In Mexico, General Electric has announced five energy storage projects to be developed, with a projected capital cost of around US$5 million each. These energy storage projects will be used to facilitate the incorporation of solar and wind projects into the electric grid.

In 2016, the Mexican Energy Regulatory Commission (Comisión Reguladora de Energía or CRE) passed a resolution adopting criteria for efficiency, quality, reliability, continuity, safety and sustainability of the national electricity system. This “grid code” requires regulators and operators to ensure the reliability of the grid, including through oversight of ancillary services such as frequency regulation.

The CRE launched a “Regulatory Program 2017” for the purpose of communicating to the industry its goal of creating a more transparent and predictable set of regulations for the energy sector in Mexico.

The Regulatory Program 2017 includes a document titled “General Administrative Provisions on Energy Storage” (Disposiciones Administrativas de Carácter General en Materia de Almacenamiento de Energía Eléctrica) that signals that CRE has started preliminary regulatory work on stage one. An initial draft of the administrative provisions is expected to be released later this year.

Jamaica

Increased penetration of renewable energy on the grid has on occasion led to frequency imbalances, load disconnections and blackouts.

To address these problems, the Jamaica Public Service Company held a bidding process for energy storage during 2017. A hybrid storage solution was awarded the bid, consisting of lithium batteries and high-low speed flywheels of approximately 24.5 MW aggregate capacity. The main goal of the project is to provide grid stability and ensure power quality whenever energy from renewable energy sources on the island varies significantly.

The project has attracted a commitment of US$21 million from the Jamaica Public Service Company and is aligned with the regulator’s policy commitment to promote renewable energy. The project is expected to be operational by the third quarter of 2018 and will be a first of its kind in the Caribbean.

Rural electrification

Kingo Energy provides renewable energy services in off-grid, rural areas of Latin America, where the customer pre-pays for the electricity and does not pay any upfront costs for installation of the system.

Kingo retains ownership of the equipment, consisting of rooftop solar systems connected to a battery, and a variety of add-on products; Kingo also provides a service warranty for the life of the customer’s contract.

The customer signs a contract agreeing to use the system for a pre-established period of time each month, and then has the choice to make daily, weekly or monthly pre-payments for electricity.

Kingo earns a profit based on the resale of power. In rural, off-grid areas, families tend to use the most expensive energy substitutes available, which are candles, kerosene, and diesel.

Challenges to deploying storage

High costs are the most significant barrier to energy storage deployment not only in Latin America, but also worldwide.

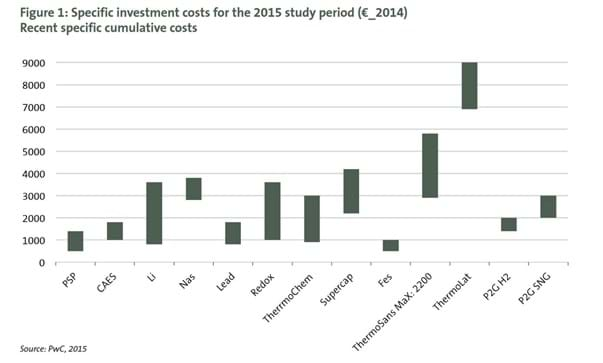

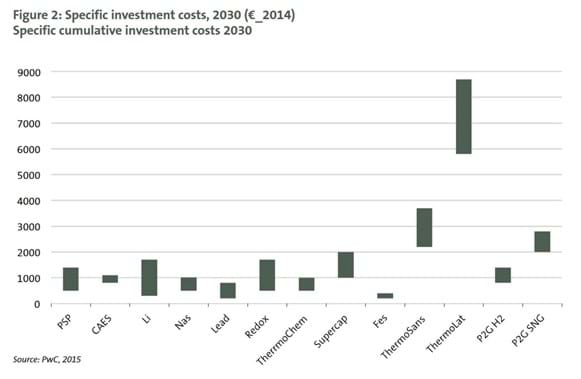

Technological advances are expected to drive down costs in the near future, but reductions will not be uniform across all technologies. Figures 1 and 2 compare installation costs for energy storage capacity per installed discharging capacity in euros per kilowatt for different kinds of energy storage technologies in 2015 and projections for 2030.

Mature technologies, such as pumped hydropower storage, show less significant cost reductions than less mature technologies such as batteries. Costs of lithium-ion batteries in particular have declined sharply in recent years due in large part to the growing market for electric vehicles and consumer electronics. According to McKinsey & Co., the cost of lithium-ion modules has fallen more than 70% since 2010, from around US$1,000 a kWh to below $230 a kWh in 2016. IHS Markit expects costs to drop below $200 a kWh by 2019.

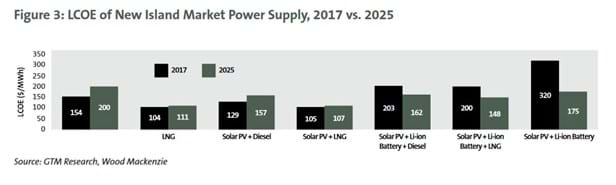

Despite rapidly declining costs, battery storage remains a relatively expensive technology. This is even true at this time for island markets that rely predominantly on oil for electricity generation. According to a recent report from GTM assessing the economics of various alternatives to oil, a solar PV system paired with a battery storage system currently has the highest levelized cost of energy or LCOE, taking into account the cost of the systems as well as construction costs for infrastructure. However, by 2025 things change, as costs are projected to come down enough that solar plus storage will be competitive with diesel (see Figure 3).

The economics for renewable energy coupled with energy storage are strongest in small off-grid towns and island countries in Latin America and the Caribbean due to the high avoided cost of conventional generation.

A team of economists at the Inter-American Development Bank assessed the relative economics of renewable energy paired with energy storage in a small off-grid town (Colombia), an island country (Barbados) and a country with a large, inter-connected grid (Mexico). In all cases, energy storage supported a significant increase in renewables as a percentage of total generation by counteracting the intermittency of renewables through the addition of backup capacity and the ability to store lower-cost renewable energy to discharge at a later time.

In the small off-grid town and the small island country case studies, combining energy storage with renewable energy increased the share of renewable energy in total generation more than renewable energy without energy storage, without increasing the cost of electricity.

This result is explained by the high avoided cost of conventional generation in small off-grid towns and island countries. The value of the savings accrued from using additional renewable energy to generate electricity (instead of conventional generation) was larger than the cost of installing and maintaining the energy storage system.

The economics are more challenging for large countries with organized electricity markets.

Combining renewable energy with energy storage did not result in a reduction in energy prices in the Mexico case study. For that to change, either the cost of conventional peak generation (largely a function of natural gas prices) would need to rise or the costs of battery storage would need to decrease.

Pumped hydropower storage is different from other forms of energy storage in that it is a mature technology — so costs are unlikely to decrease significantly — but projects may only be built in places that are geographically suited. Pumped hydropower storage projects also tend to be large, capital-intensive projects. Thus, while specific projects may be built — the proposed Valhalla project in Chile is an example — pumped hydropower storage is not expected to be used across the region in the same way that is expected for battery storage.

Predicting market trends and technological processes is no easy task and not the purpose of this article, but an analogous example that can be interesting to consider in this case is solar panels and their prices. In 1977, the price for a solar panel was US$76.67 a watt, a prohibitively high price that impeded widespread adoption of the technology. Solar panel prices plummeted to their current price of about 46¢ a watt more quickly than anyone expected. If a similar decrease in price happens to batteries — catalyzed by electric vehicle adoption — energy storage could be the dominant player in the market sooner than analysts predict.

Regulatory frameworks

Regulatory and policy frameworks for energy storage are undeveloped in Latin America and the Caribbean.

However, pockets of favorable regulatory climates do exist, and developers have been focusing their activities on those countries. For example, storage developers are using the performance of batteries in the Dominican Republic to make the case to regulators in other island countries of the necessity of battery storage systems to protect against natural disasters.

As already noted, Chile and the Dominican Republic have adopted regulations that provide a favorable climate for energy storage through the remuneration of frequency regulation services. The projects built to earn revenue from ancillary services provide key lessons and early success stories for the region. The Rocky Mountain Institute has identified 13 fundamental services that energy storage can provide when deployed behind the meter. The 13 are various services for host customers, utilities and transmission providers, ranging from energy arbitrage to backup power, frequency regulation, voltage support, transmission congestion relief and demand charge reduction, among others. Regulatory regimes must be updated to provide value for these services.

Rural electrification programs are less likely to be influenced by the regulatory regime, but will be heavily dependent on government support and non-governmental organizations. However, the economic case is most compelling for rural electrification.

Financing

High costs and underdeveloped regulatory frameworks are dampening the ability of developers to get access to third-party, private-sector financing for energy storage projects in the region.

No project financings of energy storage projects in Latin America have been reported to date. Instead, developers are financing projects on balance sheet, while other projects have been limited to pilots, demonstrations and feasibility analyses supported by concessionary or grant financing from multilateral development banks like the Inter-American Development Bank.

Given the predominance of vertically integrated utilities in Latin America and the Caribbean, one financing model for energy storage that shows promise is build-own-transfer (BOT). Under this arrangement, the utility commissions the project to be built by an independent firm and the project is then transferred to the utility upon completion and put in the utility’s rate base. Acquisition of the facilities rather than signing PPAs and buying the output provides the utility with the opportunity to add new assets to its rate base and earn a return on those assets.

Energy storage for rural electrification and on island grids in Latin America and the Caribbean will take off quickly. Such projects have the greatest shot at being economical due to the displacement of high-cost conventional fuel.

Energy storage in larger countries in the region will also occur, but projects will be deployed first for specific applications where a clear path to compensation exists. For instance, at some point, storage in large countries could be used for time-demand arbitrage for solar plants in the north of Chile if transmission issues still persist. The mix for large countries is likely to be renewables, plus storage, plus LNG.