California: A shifting market for solar

by Laura Norin and Naina Gupta, with MRW & Associates, LLC in Oakland, California

The California Public Utilities Commission is in the process of changing two key constructs that are central to the economics of solar in California.

The two are net energy metering that allows customers to sell extra electricity generated from rooftop solar panels to the local utility at the full retail rate and time-of-use pricing that values solar energy at a premium based on the time of day of solar output.

The changes will create new challenges for the solar industry in California, both for rooftop solar companies and utility-scale solar developers.

However, they should be seen as market corrections in response to the overwhelming success of solar in the state and not as an indication of the state’s attitude toward solar development. In the long term, opportunities for new solar development in California continue to be strong. Near term prospects are somewhat more limited, especially at the wholesale level. However, opportunities are still available, particularly when solar is paired with energy storage or otherwise structured to maximize value to the grid or to meet specific needs.

Background

Net metering allows customers with rooftop solar panels to manage the timing differences between their solar energy production and their need for power. In California, net-metering customers can sell surplus power back to the utility at the full retail rate, allowing a customer essentially to exchange power purchased from the utility during the night with surplus power the customer produces during the day. The retail price that net-metering customers receive is far above the price that wholesale generators would typically be paid for their power. However, sales from a net-metering customer in excess of the amount of power that the customer purchases from the utility over the course of a year are valued at a price that more closely reflects wholesale power prices.

A time-of-use rate structure prices electricity differently at different times of the day and year. For instance, prices could be lower during the night than in mid-afternoon and higher in summer than in winter. This type of rate structure is supposed to encourage customers to reduce electricity consumption during periods of peak demand when prices are high and shift electricity usage to other times when demand and prices are lower. Ideally, the rates in each time-of-use period are aligned with the cost to produce electricity during that period.

With few exceptions, non-residential customers of the three large investor-owned utilities in California are required to take service under time-of-use rates. These rates are currently optional for residential customers. Residential customers will be moved automatically to time-of-use rates beginning in 2019, unless they opt to remain under the old rate structure.

Net metering and time-of-use rates have contributed to the success of distributed solar in California. Net metering allows customers to size their solar systems to cover a large share of their electricity usage without concern for timing mismatches between solar generation and electricity need. Time-of-use rates have made net metering more valuable because the highest cost period under most rate schedules falls during summer weekday afternoons when air conditioning demand drives high electricity consumption and when solar panels are at peak output.

By installing solar, customers are able to avoid paying the utility for electricity use during high-cost hours and, through net metering, to sell their extra solar electricity to the utility at the high-cost rate. The ability to sell electricity at peak hours and rates has been a key driver of distributed solar economics in California for non-residential customers and for some residential customers.

Time-of-use pricing has also been of benefit to larger-scale projects bidding into utility power solicitations. The utilities apply time-of-delivery factors that place a higher value on power that is generated during times of higher system cost when evaluating bids. The overlap between the high-cost hours and the high solar hours means the utilities assign a higher value to mid-day solar generation than to power generated during the early morning hours or power generated evenly throughout the day.

Expected Changes

The California Public Utilities Commission approved a new framework for the net-metering tariff — commonly known as NEM 2.0 — in January 2016.

NEM 2.0 will require net-metering customers to take service under a time-of-use rate and will increase their costs.

Their costs will increase because of a new interconnection fee of up to $150 to connect rooftop solar to the grid, plus an extension of public purpose charges and certain other utility charges to all electricity purchased from the grid, even electricity that is offset at a different time of day by self-generated power.

The additional charges will have the effect of reducing the value of power sold back to the grid to less than the full retail price of power.

The NEM 2.0 tariff will apply to customers that interconnect a new solar system after July 1, 2017 or after a utility reaches a previously set cap on new solar installations that are eligible for net metering, whichever happens first.

The cap has already been reached for San Diego Gas & Electric and is expected to be reached by the end of 2016 for Pacific Gas & Electric.

In addition to NEM 2.0, the California Public Utilities Commission has four regulatory proceedings underway to re-evaluate the structure of time-of-use periods for the three large investor-owned utilities and to reassess which hours during the summer peak period should have the highest rates.

In particular, the success of solar in California is driving a push to shift the highest rates to the evening when there is little or no solar electricity generation.

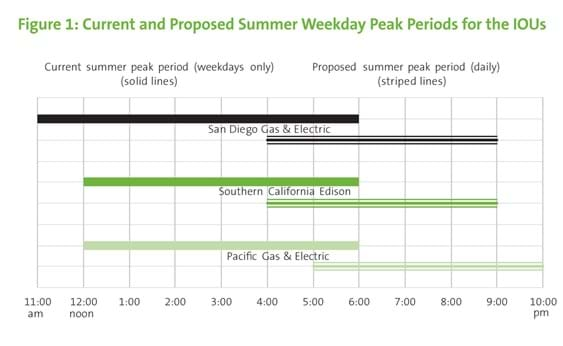

Electricity use remains high during summer afternoons, but the large amount of solar generation during these hours has reduced the need for relatively high-cost generation that used to be needed when customers turned on their air conditioning. There can sometimes be an oversupply of electricity in the afternoon hours, particularly during the spring months when air conditioning use is minimal and solar and hydroelectric generation are plentiful. Wholesale market prices tend to be relatively low during the afternoon hours due to the influence of solar. Energy use remains high in the evening, but the supply of solar power ebbs as sunlight fades, leading to higher wholesale market prices. Consequently, there is a push to move the summer peak-period, which is currently from around noon to 6 p.m., out to 4 to 9 p.m. or later (see Figure 1).

Figure 1 shows what the investor-owned utilities are proposing for their new peak hours.

The utilities’ new peak hour definitions would reduce the value of solar electricity during weekdays because the hours when solar is at peak output would no longer be peak pricing hours. The impact on solar on weekends is less clear because weekends are currently considered entirely off peak, while under the proposed new time-of-use periods, weekends would also include higher cost periods, allowing some share of weekend solar output to fetch higher prices than at present, but with the remaining generation valued at off-peak prices that may be lower than at present.

The net change in value would depend on what share of solar hours are included in the high-cost weekend period over the course of the year and how great the pricing differentials are between the different time-of-use periods. These issues remain subject to debate along with other critical details, including when the new time-of-use periods will be implemented and what protections will be afforded to customers with existing solar installations. However, the overall impact is expected to be somewhat negative.

Each utility’s proposal is being considered in a separate proceeding at the CPUC. Decisions in these proceedings are expected over the next year or so, with SDG&E’s proposal likely to be addressed first, possibly as early as late spring 2017. The commission is widely expected to approve shifts to the peak hours that are similar to the utility proposals, though details may vary.

For residential customers of PG&E and Southern California Edison, the high-cost hours have already been shifted somewhat later in the day in the standard optional time-of-use schedules, and the Figure 1 proposals would not be implemented immediately. The current PG&E “Schedule E-TOU” has high-cost hours from 3 to 8 p.m. or, optionally, from 4 to 9 p.m. The current Southern California Edison “Schedule TOU-D” has high-cost hours from 2 to 8 p.m.

These high-cost periods still include some peak solar hours, so they are less detrimental to solar customers than the proposed non-residential peak periods (Figure 1). Also, most residential customers continue to take service under non-time-of-use rates.

Changes will be more significant for residential customers who are considering installing solar since customers who are subject to NEM 2.0 will be required to take service under time-of-use rates. In addition, over time, the non-residential peak periods are likely to be applied to residential customers as well.

The changes to net metering and time-of-use periods on existing solar customers will have a somewhat muted effect due to grandfathering provisions.

In particular, customers who are already engaged in net metering will remain under the existing net-metering tariff for 20 years from when they first connected their solar systems to the grid. In addition, a proposed decision currently before the CPUC, if adopted, would allow existing solar customers to continue to take service under current time-of-use rate periods for five years from their date of solar interconnection. However, this is a hotly contested provision, and it may be adjusted upward or downward prior to adoption. It is also possible that other relief may be provided to existing solar customers along with, or in place of, a time-of-use grandfathering period, such as a special earlier on-peak period.

New solar customers will take service under the new time-of-use periods and the NEM 2.0 tariff. They will have less incentive to install solar than before. The impact for a given customer will depend on the customer’s usage profile, solar generation profile and utility, as well as the size of the solar system relative to the customer’s electricity use and the particulars of the time-of-use periods and rates that are adopted.

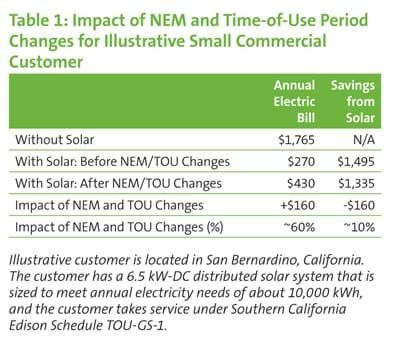

Table 1 shows the combined impacts for an illustrative small commercial customer in San Bernardino, California of the NEM 2.0 changes and the new time-of-use periods that Southern California Edison has proposed. For this illustrative customer, these two changes combined would increase the customer’s annual electricity bill by 60%. Yet, even with this large increase in the customer’s utility bill, the savings the customer would realize from installing solar would be only 10% less after the new rules go into effect than before. This result may not hold for all customers.

Changes to the time-of-use period structures additionally introduce regulatory uncertainty for customers who are considering installing solar.

The proposed decision on time-of-use periods before the CPUC would guarantee net-metering customers a minimum of five years under whatever time-of-use periods they start. While this five-year commitment is helpful, the prospect of further time-of-use period shifts after five years creates added risk for solar systems that require more than a five-year payback period. The prospect of additional future net-metering changes is less of a concern because the CPUC has already guaranteed that NEM 2.0 customers may continue receiving service under that tariff for 20 years.

The new time-of-use periods the utilities are proposing would apply only to retail rates, but the same shift is underway in the time-of-delivery factors that are used to value wholesale solar generation that is sold to the utilities.

In many cases, these time-of-delivery factors have already been updated in recent years to shift the highest value hours to later in the day. For example, PG&E’s time-of-delivery factors assign the highest value to power delivered from 4 to 10 p.m. The correlation between the peak periods used for retail rates (time-of-use periods) and for wholesale procurement (time-of-delivery factors) is still subject to discussion at the CPUC; however, they should move into general alignment over time. The shift to later peak periods will affect both distributed solar and utility-scale solar.

Solar Outlook

The NEM 2.0 and time-of-use period changes are a response to widespread adoption of solar in California. Solar remains a preferred resource in the state, and the California Public Utilities Commission wants to maintain a viable solar market, but it wants a regime that requires lower rate support, given regulators’ desire to avoid unnecessary subsidies between customers and in light of lower underlying costs: between 2007 and 2015, median installed prices for utility-scale solar fell by nearly 60% nationwide, and further cost reductions are anticipated.

California continues to encourage solar adoption. While the CPUC increased costs for net-metering customers, the NEM 2.0 changes are much less drastic than changes to net-metering programs that have been adopted or are under review in other states such as Nevada and Arizona. In addition, the CPUC rejected (for now) a request by the investor-owned utilities for demand charges for residential net-metering customers, and the CPUC is considering allowing net-metering customers to be grandfathered from changes in time-of-use rates period for five years.

A customer may be able to improve the economics of installing solar by combining solar with energy storage.

This would reduce the impact of the NEM 2.0 cost increases since less power would be sold back to the utility under the new net-metering tariff. The customer could also get the highest price for power solar back to the grid by storing the power until the high-cost hours. The CPUC has ruled that a solar system with storage is to be treated the same as a solar system without storage, so these uses are available without restriction.

Electric vehicles could also be used in combination with solar installations to increase the value of both systems. For example, for a system with excess solar power during the middle of the day, using the power to charge an electric vehicle may in some cases be more beneficial than selling the power back to the utility during hours that are outside of the high-cost period.

A less expensive option would be to orient solar systems toward the west (rather than south) to benefit from later-in-the-day sunlight. While this would not provide the same benefit as energy storage, it is a low-cost measure that could provide incremental value for some customers.

With these sorts of strategies and by passing along cost reductions, solar developers should continue to find a market for distributed solar in California, even though the market may not be as robust as in recent years.

Utility-scale solar is not affected by the changes to the net-metering tariff, but it is affected by the shift in time-of-delivery factors. It, too, can be helped by orientation of the solar system to follow the sun or to capture more sunlight from later in the day and can be combined with large-scale storage. The CPUC has directed the investor-owned utilities collectively to procure 1,325 megawatts of storage by 2020 and to implement this procured capacity by 2024. Storage installations that are linked with solar qualify under this storage requirement. In addition to aligning the hours of solar output with peak time-of-delivery periods to increase the value of the power generated, storage could also provide the opportunity to use solar as a flexible resource, further increasing its market value. For example, during the early evening when solar output falls while demand remains high, there is a need for a large amount of fast-ramping power. Storage facilities can quickly dispatch stored solar power to meet these ramping needs, providing a valuable grid service.

A bigger issue for utility-scale solar than the regulatory changes is the near-term glut of renewable power. While California has a very aggressive renewable portfolio standard, requiring 33% of procurement from RPS-eligible power by 2020 and 50% by 2030, the investor-owned utilities are not expected to need new RPS power until the early-to-mid 2020s (Table 2).

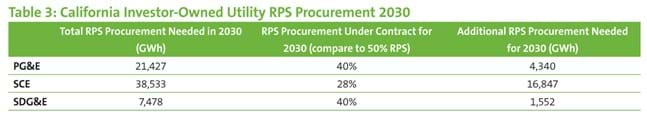

The California utilities will eventually be back in the market for renewable power. Table 3 shows the full renewable procurement needs of the three investor-owned utilities in 2030 compared to the amount of renewable power currently under contract.

Significant gaps remain, particularly for Southern California Edison. In addition, in a settlement agreement that is under CPUC review regarding closure of the Diablo Canyon nuclear power plant, PG&E has agreed to replace the nuclear power with greenhouse gas-free resources, some of which is likely to be solar power, and also to increase its RPS target voluntarily to 55% of retail sales during the period 2031 to 2045. If this agreement is adopted, then PG&E’s RPS requirement will increase by approximately 2,000 GWh per year above the amount shown in Table 3 for each of these years.

In the near term, utility-scale solar developers may do better to focus on municipal utilities and community choice aggregators, called CCAs. (For earlier coverage about CCAs, see “Huge Potential New Demand for Power” in the October 2016 NewsWire and “Another Potential Offtaker: Community Choice Aggregators” in the August 2016 NewsWire.)

CCAs are entities that procure power on behalf of investor-owned utility customers in their jurisdictions, with the local utility continuing to distribute the power. California has seen explosive interest in CCAs in recent years, and the projected growth in CCAs is contributing to utility RPS surpluses as the utilities shed customers to CCAs.

CCAs must meet the same RPS requirements as the utilities must meet, and many have even more aggressive renewable targets. For example, the Marin Clean Energy CCA currently operates with a resource mix of 51% renewable energy, and is committed to a longer-term goal of sourcing 80% of its electricity needs from renewable sources. In addition, many of the existing and planned CCAs have goals for the development of new, local renewable resources, which could include new solar projects.

The changes to time-of-use period (and the closely related time-of-delivery factors) that are being evaluated in California will continue to be reexamined as the power grid continues to evolve.

The introduction of larger amounts of storage and electric vehicles on the grid will shift the power supply and demand curves in ways that are not yet known. In addition, a process is currently underway to better integrate (and perhaps combine) the California grid with the grids of other western states. With this closer integration, a wider portfolio of resources is becoming available for dispatch, which is helping to even out the intermittency of renewable generation more efficiently and cost effectively. This, too, may shift the hourly makeup of supply that is available in California and may push the high-cost hours to other periods or lead to more consistent pricing throughout the day.

While future time-of-use period changes are uncertain, as costs for solar continue to trend downwards, the available subsidies and rate supports should be expected also to diminish.

The near term may be the most challenging as customers adjust to the new time-of-use periods and new NEM 2.0 tariff, and as wholesale procurement is limited due to a glut of RPS power at the investor-owned utilities. Opportunities for wholesale contracting should open up again more widely in the early 2020s, and time-of-use periods (and time-of-delivery factors) may shift further during this period, possibly in a direction that would benefit solar economics. In the meantime, CCAs and municipal utilities may provide avenues for medium or large-scale solar projects, and opportunities remain available in the residential and commercial markets for systems that are competitively priced.