Solar Tax Equity Structures

September 10, 2015 | By Keith Martin in Washington, DC

For an updated version if this article, please click here.

Solar companies use three main structures to raise tax equity to finance projects.

The volume of tax equity and the number of tax equity investors are increasing, ironically as a tax credit for investing in solar approaches expiration. How risks are allocated and the timing of when the tax equity investor must invest in relation to project completion vary by structure.

Current Market

The US government offers tax benefits on solar projects that are worth roughly 56¢ per dollar of capital cost. Most solar developers have a hard time using the tax benefits; thus, a core financing tool for most solar companies is “tax equity” where the benefits are effectively bartered for capital to build the solar project.

There are two benefits: a 30% investment tax credit and the ability to deduct 85% of the cost or fair market value of the project, depending on how the tax equity transaction is structured, over five years on accelerated, or front-loaded, basis.

Solar tax equity deal volume was $4.5 billion in 2014. Tax equity deal volume for wind and solar combined was $10.1 billion. Deal volume is expected to be higher in 2015, and to be higher still in 2016 as solar companies rush to complete projects before a December 2016 deadline to qualify for a 30% investment tax credit on their projects. The rush is expected to strain tax equity shops. A significant number of tax equity deals in late 2014 spilled over to early 2015 due to inability of the market to complete the transactions by year end. Each tax equity shop has a limited number of people who can work on deals; however, the most significant constraint in late 2014 was a shortage of outside engineering consultants who help with diligence. Another spillover is expected in late 2015.

Projects that fail to get into service by December 2016 will still qualify for a 10% investment tax credit and the same accelerated five-year depreciation, but the depreciation will be on 95% – instead of 85% – of the capital cost or market value of the project.

There is a reasonable chance that Congress will convert the 2016 deadline to complete solar projects into a deadline merely to start construction, but it may not happen this year. The Senate tax-writing committee voted in July to extend more than 50 expiring tax benefits by two years. The measure does not include any extension of the solar investment tax credit. The tax extenders bill is expected to be taken up on the Senate floor this fall, at which time solar advocates have been promised a vote on their proposal. The problem has been that the proposal is not considered “germane” to the Senate bill, since the bill is limited currently to extensions of tax benefits that have expired or will expire by the end of this year. The House is expected to oppose extending tax benefits for renewable energy projects; thus, the fate of the current extenders bill is expected to come down to a negotiation late in the year between the two houses.

We see at least 34 tax equity investors currently in the renewable energy market. Another 11 have done some deals, but are currently out of the market. Another 11 companies are on lists of potential tax equity investors or have made the decision to invest but have not yet done their first deals. Only a subset of this number is interested in any particular market segment: for example, wind, utility-scale photovoltaic projects, solar thermal projects, residential rooftop and commercial and industrial rooftop.

Tax equity yields in the last six months have been trending down, although tax equity investors are recovering some of the decline through fees and are often pricing to a second yield 50 basis points higher at year 20. Utility-scale solar PV yields are 7.25% to 8% unleveraged for the least risky deals involving the most experienced sponsors. Residential rooftop solar for brand-name developers is a little below 9%. Some tax equity investors price by quoting an amount per dollar of investment tax credit. The amounts range from $1.10 to $1.32 per dollar of tax credit, with most around $1.27 or $1.28 in the current market.

Adding debt ahead of the tax equity in the capital structure can increase the yield demanded by the tax equity market by at least 500 basis points. Project-level debt is unusual in the current market. Most debt is back-levered debt at the sponsor level that sits behind the tax equity in priority of payment. In deals where debt is ahead of the tax equity investors, the tax equity investors will insist that the lenders agree to forbear from foreclosing on the project after a default long enough to give time for the tax equity investors to reach their target yield. The market consensus on forbearance terms appeared largely to have collapsed as of mid-2014 after a number of new lenders came into the market who were unfamiliar with the existing deal terms.

There are three main tax equity structures for transferring tax benefits, with two significant variations. The three are partnership flips, sale-leasebacks and inverted leases.

Partnership Flip

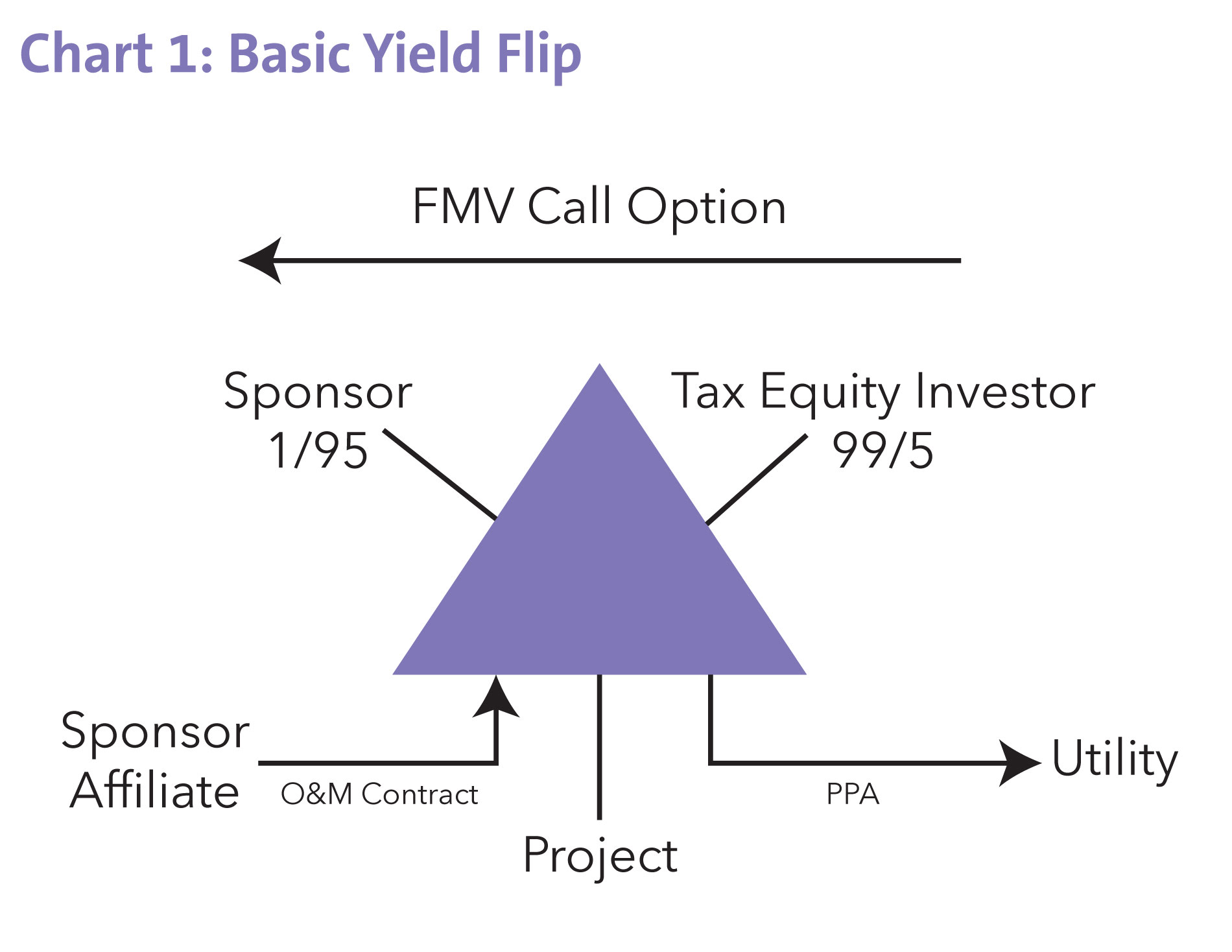

A partnership flip is a simple concept. A sponsor brings in a tax equity investor as a partner to own a renewable energy project together with the sponsor. The partnership allocates taxable income and loss 99% to the tax equity investor until the investor reaches a target yield, after which its share of income and loss drops to 5% and the sponsor has an option to buy the investor’s interest. In some recent deals, the post-flip sharing ratio has been 6% to 7%. Cash may be distributed in a different ratio before the flip.

Many early flip deals had a “cash drought” for the sponsor: cash went first to the sponsor to return its capital, and then cash went 99% to the tax equity investor until the investor got back its capital plus a return. In more recent deals, cash is more likely to be split in a fixed ratio like 40-60, 50-50 or 60-40 from the start, reflecting partly the influence of yield cos as potential buyers of the sponsor positions. Yield cos are focused on cash available for distribution.

The sponsor has a call option to buy the tax equity investor’s interest after the flip, usually for fair market value determined at the time. The call price can also be a fixed price set in advance, as long as the call price is a good-faith estimate at inception of what the value will be upon exercise. Some tax equity investors require the call price to be not less than the amount the investor needs to avoid a book loss on sale of its interest or to be not less than the amount the investor requires to reach a higher post-flip yield at year 20.

Chart 1 is a diagram of a typical flip deal.

The Internal Revenue Service issued guidelines for partnership flip transactions in 2007. The guidelines are in Revenue Procedure 2007-65. They provide a “safe harbor” for transactions that conform to them. Most do. The IRS said recently that the guidelines were written with wind projects in mind and are not a safe harbor for solar transactions. (See the July 2015 Project Finance NewsWire article The Partnership Flip Guidelines and Solar) The central tension in partnership flip transactions is whether the tax equity investor is truly a partner or is a lender or bare purchaser of tax benefits in substance. The latter two labels would prevent the investor from sharing in the tax benefits on the project.

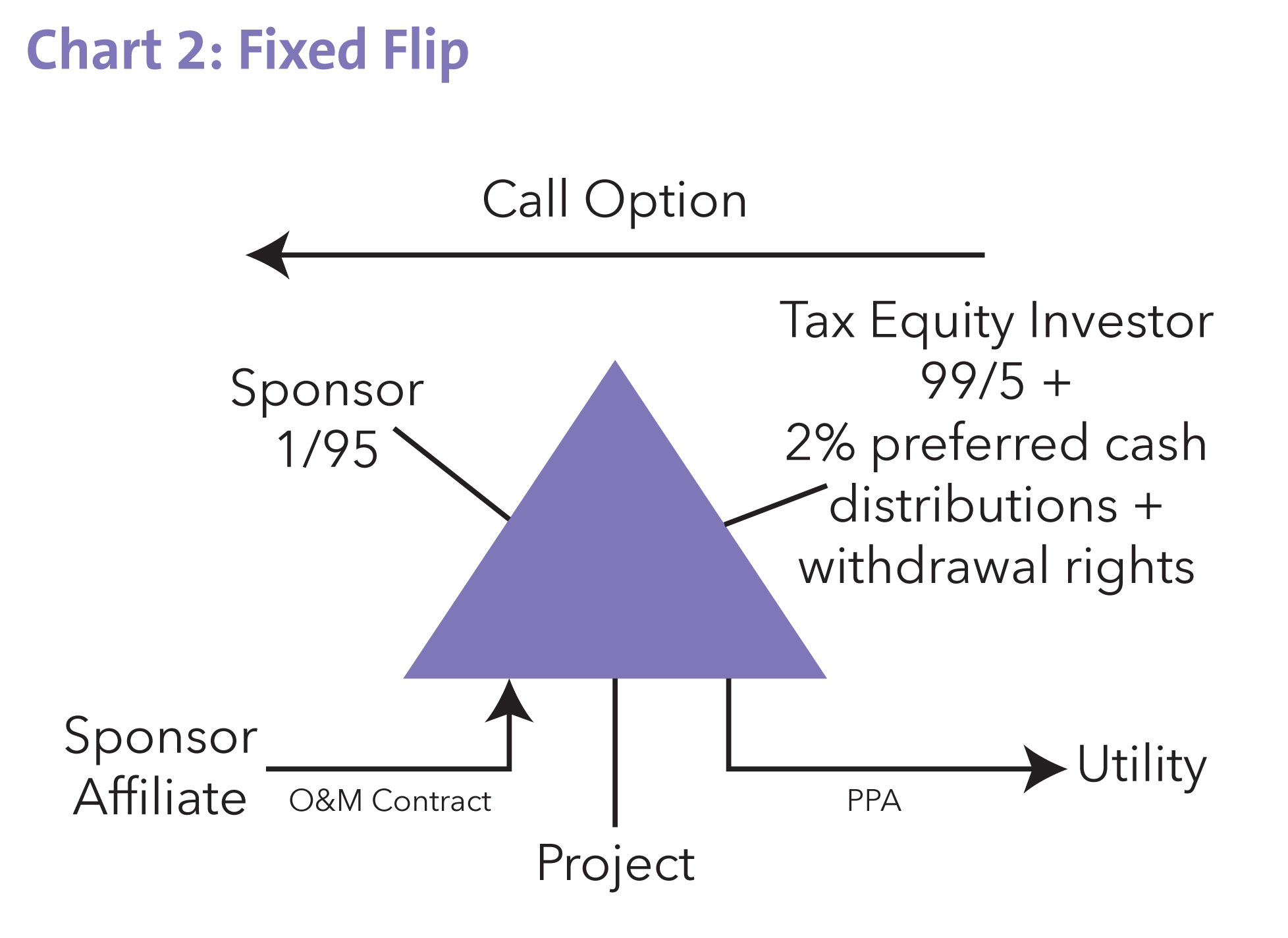

There are two main variations in flip structures. In addition to the yield-based flip, there is also a fixed- or time-based flip structure that is offered by a small subset of tax equity investors and that leaves as much cash as possible for the sponsor without turning the transaction into a bare transfer of tax benefits.

In a fixed-flip transaction, the investor receives annual cash distributions from the partnership, equal to 2% of the tax equity investment, ahead of all other cash distributions. There is then a “waterfall” list of instructions for how remaining cash is shared between the sponsor and tax equity investor, with the sponsor keeping most of the cash, but the investor having a shot at more cash if the project performs well and possibly in other circumstances. The sponsor has a call option immediately after the flip to buy the investor’s interest. The investor has a “put,” structured as a right to withdraw from the partnership, usually a year later if the sponsor does not exercise the call.

Chart 2 is a diagram of a typical fixed-flip deal.

In a partnership flip transaction, the sponsor is responsible for day-to-day management of the project. Tax equity investor consent is required for a list of major decisions.

The tax equity investor may come into the transaction in one of two ways. It may invest by buying an interest in the partnership from the sponsor – a “purchase model” transaction – or by making capital contributions to the partnership – a “contribution model” transaction. The purchase model may let the tax equity investor calculate the tax benefits on a higher “tax basis.”

Almost all partnership flip transactions have “absorption” issues. Each partner has a “capital account” and “outside basis” that are two ways of measuring what the partner put into the deal and what it is allowed to take out in benefits. Most tax equity investors run out of capital account before they are able to absorb 99% of the depreciation. The main way to deal with this problem is for the tax equity investor to agree to make a capital contribution to the partnership when the partnership liquidates in the amount of any deficit in its capital account. This is called a deficit restoration obligation or “DRO.” However, a DRO does not help if the other measure of what the partner has put in and is allowed to take out – its “outside basis” – has also hit zero. Any losses (depreciation) shift to the sponsor once the tax equity investor runs out of capital account. Having debt at the project level makes it possible for the investor to absorb more depreciation by allowing part of the depreciation to be claimed even though the investor has run out of capital account, and the project-level debt causes the investor’s outside basis to increase.

Yield-based flips in the solar market usually price to reach yield in six to eight years. Fixed-flip deals usually flip at five to six years.

How the tax equity investor reaches the yield may be more important for the solar company than the yield. For example, a transaction that flips in a relatively short period and in which the yield is paid largely out of tax benefits may be more attractive than a transaction with a lower flip yield, but a later flip date, where the investor will require more cash to reach yield.

Most tax equity investors require at least a 2% pre-tax yield. Most of the market counts the investment tax credit as part of the cash return for purposes of this calculation.

Sale-Leaseback

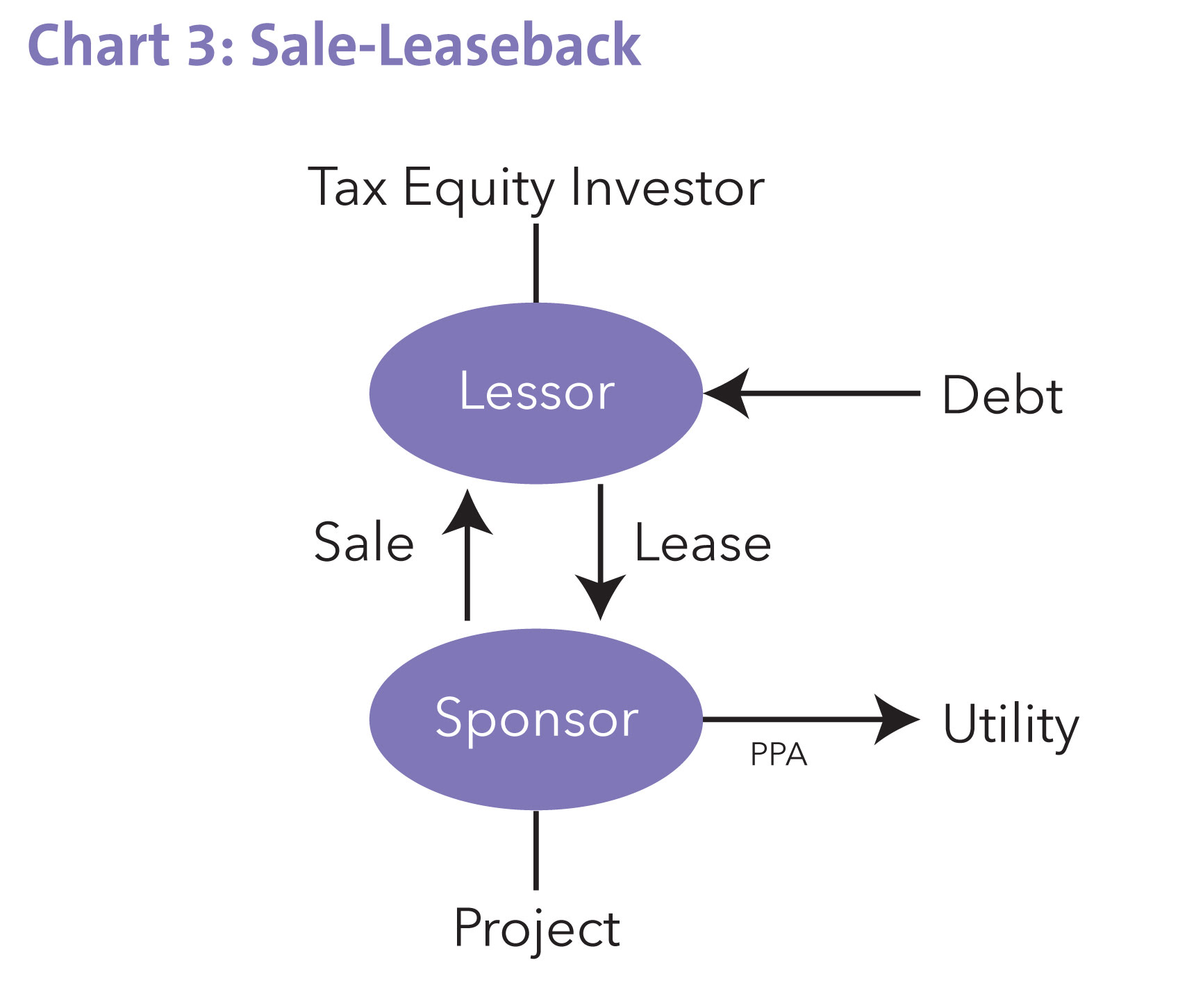

In a sale-leaseback, the solar company sells the project to a tax equity investor and leases it back. Unlike a partnership flip where the investor gets at most 99% of the tax benefits and has to work through complicated partnership accounting rules to determine whether it gets even that much, all the tax benefits are transferred to the tax equity investor. The investor calculates them on the fair market purchase price that it pays for the project. The solar company has a gain on sale to the extent the project is worth more than it cost to build.

The structure is shown in chart 3.

A partnership flip raises 40% to 70% of the project value, depending on the partnership sharing ratios and other factors. A sale-leaseback raises 100% of the fair market value of the project in theory. In practice, the solar company is usually required to prepay something like 15% to 20% of the purchase price as prepaid rent. The rent prepayment is treated as a loan by the lessee to the lessor that is offset over the lease term, but that accrues interest in the meantime. The market calls such a loan a “section 467 loan” after the section in the US tax code that governs the tax treatment.

The IRS has guidelines for leveraged leases where the tax equity investor raises part of the purchase price for the project by borrowing from a bank. They are in Revenue Procedure 200-128. The guidelines limit the term of the leaseback to 80% of the expected life and value of the project. If the lessee wants to keep the project at the end of the lease, then the lessee must repurchase it. Any lessee purchase option cannot be at a price that makes the option reasonably likely to be exercised. There also cannot be anything that will compel the lessee to exercise the option.

Sale-leasebacks remain common in the commercial and industrial rooftop and utility-scale solar markets. They are uncommon in the rooftop market, where the deals are split currently between partnership flips and inverted leases. Rooftop companies dislike sale-leasebacks because they feel the tax equity investors pay too little at inception for the residual value.

Inverted Leases

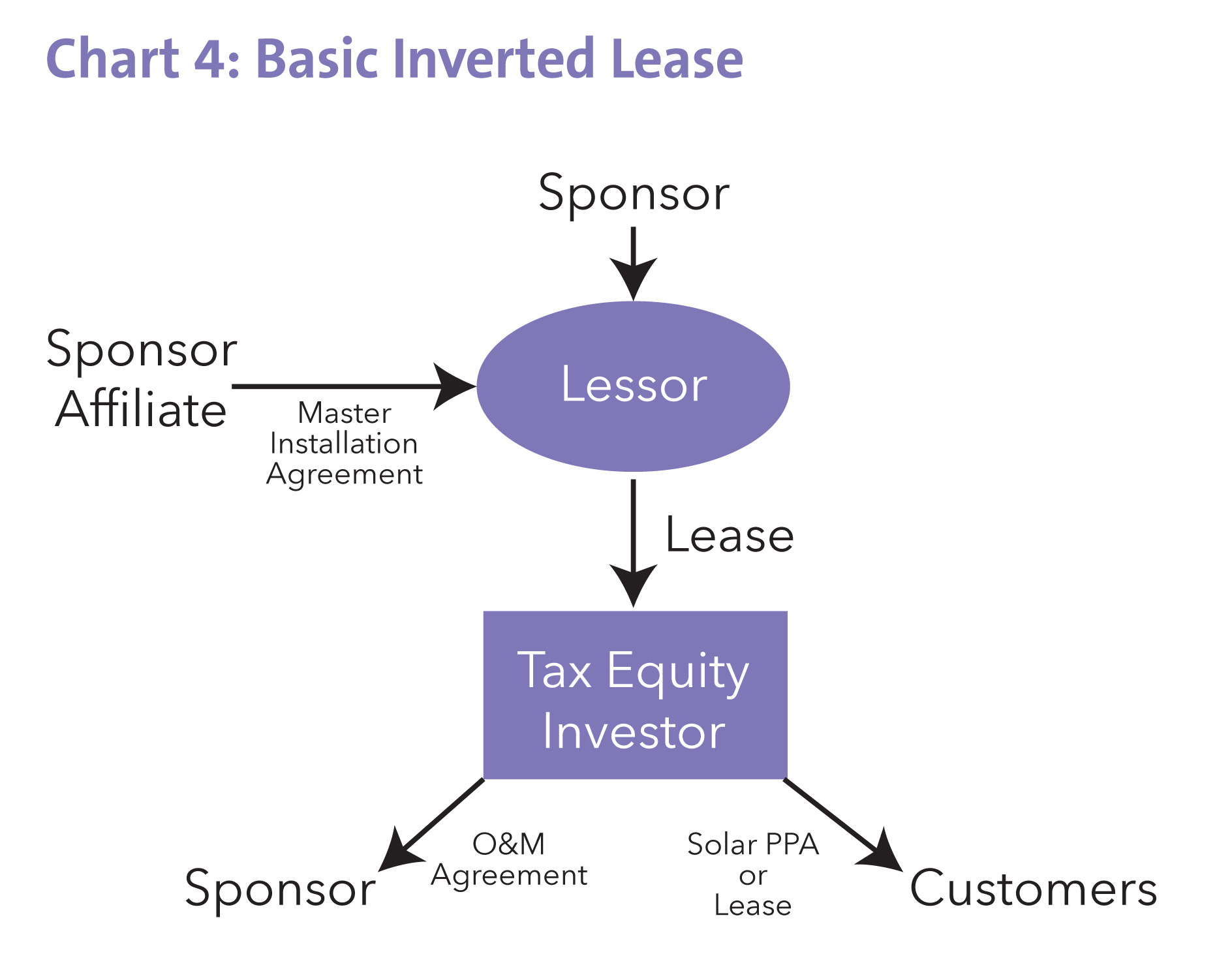

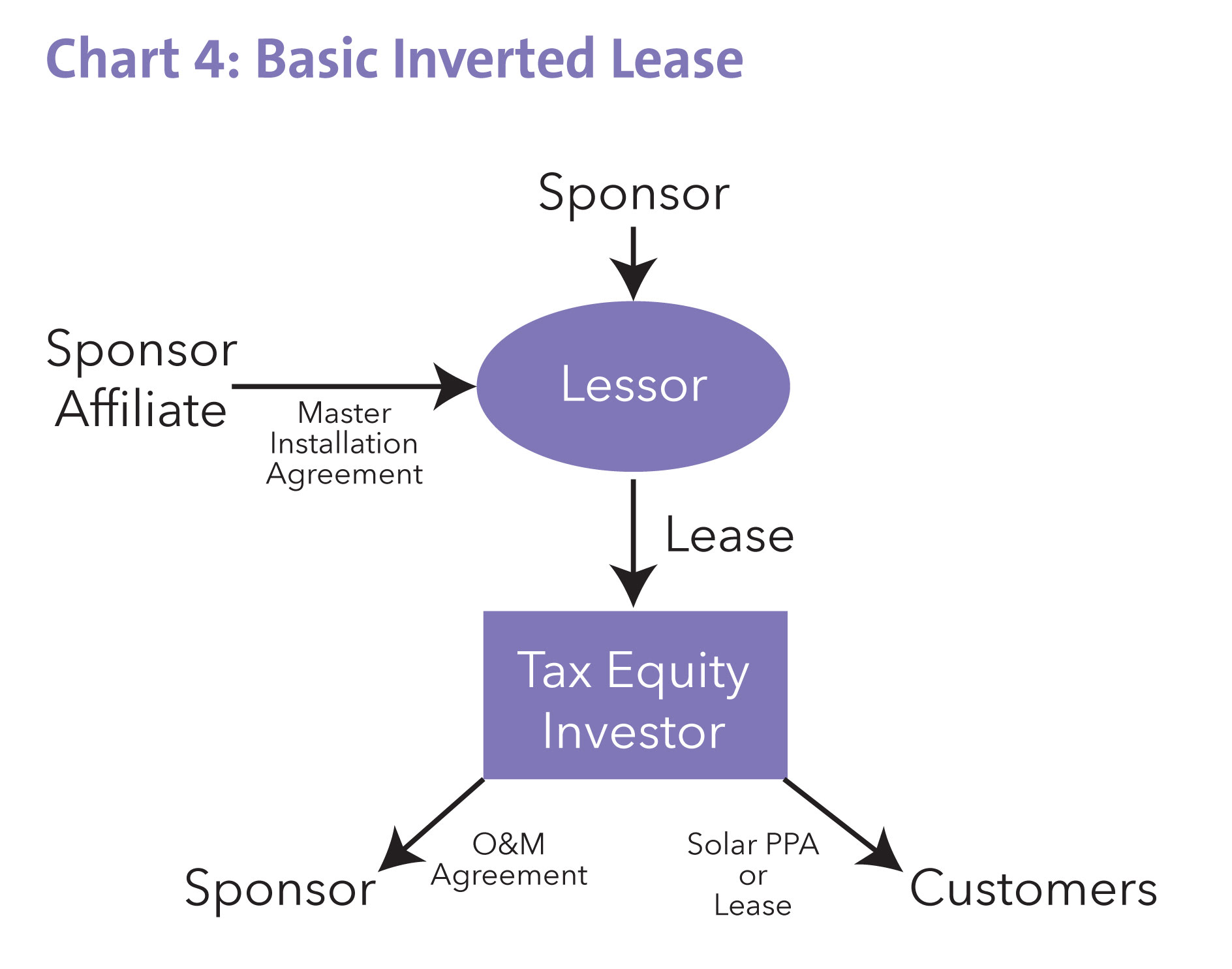

Inverted leases are used mainly in the rooftop market. Think of a yo-yo. The solar company assigns customer agreements and leases rooftop solar systems in tranches to a tax equity investor who collects the customer revenue and pays most of it to the solar company as rent. The solar company passes through the investment tax credit to the tax equity investor. It keeps the depreciation. The solar company takes the asset back at the end of the lease.

A diagram of the structure is in chart 4.

Sponsors like inverted leases because they get the asset back without having to pay for it, and the investment credit is calculated on the fair market value of the solar equipment rather than its cost. Unlike a sale-leaseback, the step up in tax basis does not come at a cost to the solar company of a tax on a commensurate gain.

There are no IRS guidelines for inverted leases, unlike the other two structures. However, the structure is common in historic tax credit deals, and the IRS acknowledged it in guidelines in early 2014 to unfreeze the historic tax credit market after a US appeals court down an aggressive form of the structure in a case called Historic Boardwalk. The acknowledgement is in Revenue Procedure 2014-12. (For a further discussion, see the February 2014 Project Finance NewsWire article Tax Equity Market Weighs New IRS Guidelines.)

The tax equity investor must have upside potential and downside risk to be considered a real lessee. Some tax counsel like to see a “merchant tail,” meaning the lease should run at least 20% longer than the customer agreements. Others focus on the amount of prepaid rent that is paid by the lessee and want to see at least a 20% rent prepayment. In the more conservative deals, the tax equity investor has a hell-or-high-water obligation to pay fixed rents to the solar company. In some deals, part of the rent is contingent on output or lessee cash flow; contingent rent adds tax risk to the structure. Some of the big four accounting firms treat inverted lease transactions as loans rather than real leases.

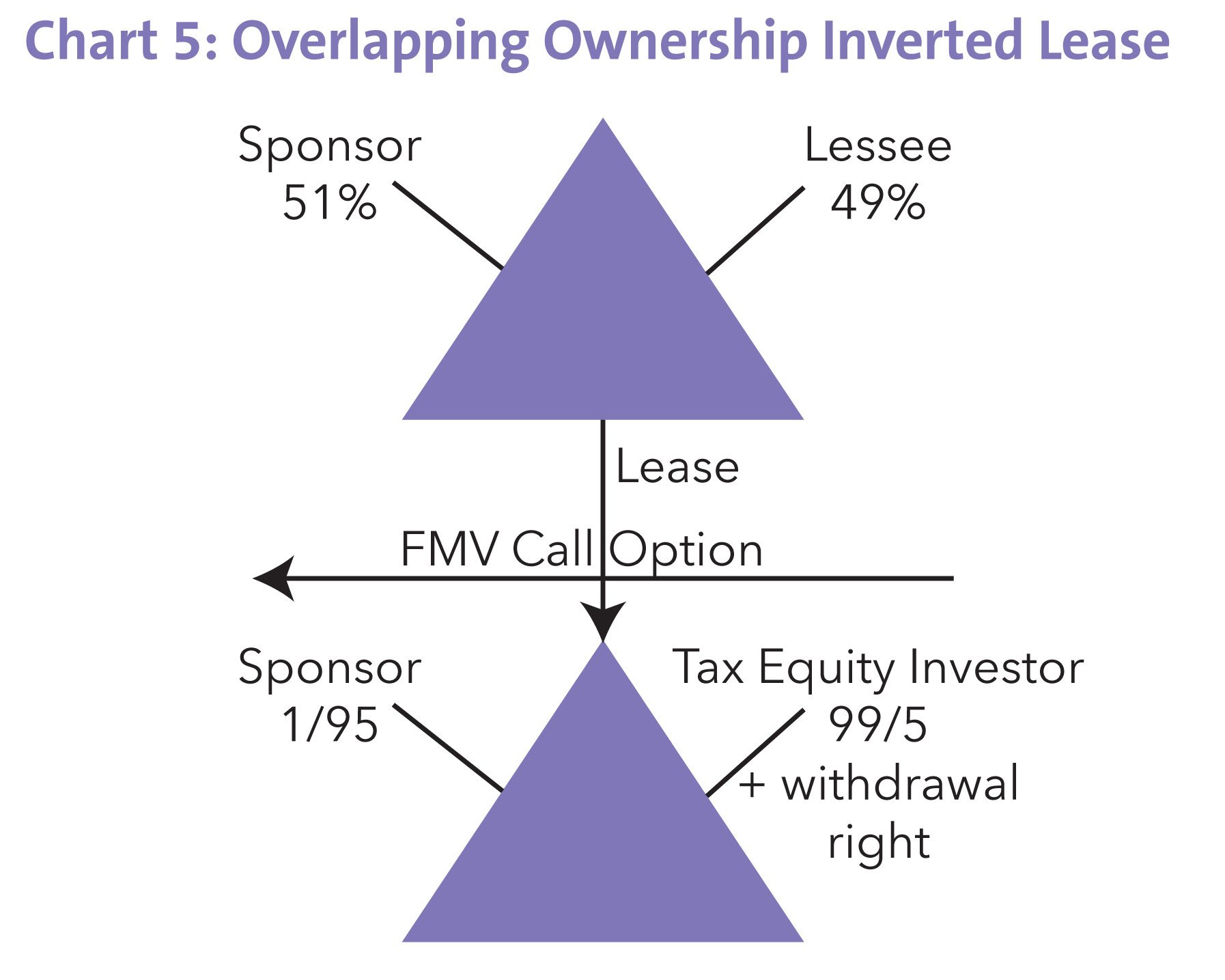

Inverted leases raise 20% to 45% of the project value. The central challenge in inverted leases is how the capital raised by the structure moves from the tax equity investor to the solar company. In the conservative form of the structure, it moves as prepaid rent. In a more aggressive overlapping ownership structure, the lessee makes a capital contribution to the lessor in exchange for a 49% interest in the lessor, thus giving the tax equity investor not only the investment credit but also 49% of the depreciation on the solar assets.

The overlapping ownership structure is shown in chart 5.

Differences

The three structures vary in terms of the amount of capital raised, risk allocation and the timing of when the tax equity investor must invest. The solar company must turn to other sources of capital (debt and equity) to raise the rest of the project cost.

Focusing on risks, in a sale-leaseback, the solar company has a hell-or-high-water obligation to pay rent and must indemnify the tax equity investor for loss of tax benefits and any acceleration of rental income due to a lessee breach of a representation or covenant. In a flip, the investor’s return turns on how well the project performs. The solar company and tax equity investor are like two passengers in a car; whatever they encounter along the road, they encounter together. The investor’s protection in a partnership with the yield-based flip is that it sits on the project at a 99% level until it reaches a target yield. The risk allocation in an inverted lease is closer to a sale-leaseback.

The principal business risks in any transaction are weather, technology and offtaker credit.

“Basis risk,” meaning the risk that too high a tax basis is used to calculate the tax benefits, tends to be borne by the solar company, although this has been true only since 2010 when the US Treasury started challenging the bases on which solar companies applied for cash payments from the US Treasury in place of the investment tax credit. Before then, a sponsor would represent that it gave accurate information to an outside appraiser on whom the tax equity investor relied to advise on the appropriate tax basis, and the investor relied on the appraiser.

In general, tax risks about which the solar company has special insight are borne by the sponsor. An example is facts that go to when a project was placed in service. Tax risks into which both the solar company and tax equity investor have equal insight are borne by the tax equity investor. An example is whether the transaction has been structured properly to transfer tax benefits to the investor. Risks into which neither has special insight are a matter for negotiation. An example is who takes the risk that the law will change and adversely affect the projected tax benefits. In a partnership flip transaction, risks are allocated through a limited number of sponsor representations and through a list of “fixed tax assumptions.” The tax equity investor is treated as having reached its target yield on schedule even if one of the fixed tax assumptions proves untrue.

Turning to timing, the tax equity investor must be a partner in a flip deal before the project is placed in service. In some transactions, the investor makes enough of its investment before a project is put in service to be a partner and contributes the rest after final completion. Most tax counsel are comfortable that the investor is a partner if it invests at least 20% of its expected total investment before the project is in service; some are willing to go as low as 5% in large projects where 5% is a significant number. The deal papers must address what happens if the investor never puts in the remaining investment. The sponsor can have a call to repurchase the investor’s interest at fair market value determined at the time. Care should be taken to avoid turning any arrangement into an option for the investor to unwind the transaction or the investor will not be considered to be a partner until the right to unwind lapses.

Inverted leases must be done before assets go into service. A sale-leaseback can be put in place up to three months after the asset is put in service. This gives the investor more time to determine whether the project is working properly before it has to invest.

Recurring Issues

The investment tax credit vests ratably over five years. The unvested credit will be recaptured, and have to be repaid to the US Treasury, if the assets are disposed of or a partner claiming the credit disposes of his interest or there is more than a one-third reduction in his share of partnership profits during the first five years. This has the effect of locking in the tax equity investor for five years.

The investment credit must be shared by partners in a partnership in the same ratio that they share in profits, or income, in the year an asset is put in service. At least one law firm worries that a shift in losses, due to an inadequate capital account, from the tax equity investor to the solar company during the first five years will cause unvested investment tax credits to be recaptured; this is not the majority view. Most solar projects do not earn a profit for tax purposes until sometime in year 4. The IRS may challenge the ratio in which investment tax credits were shared in year 1 if, by the time there is income, the ratio in which income is allocated has shifted; in that case, the income sharing ratio used in year 1 was illusory. Most tax counsel like to see at least a full year of income allocated at the year 1 ratio.

The asset basis used to calculate depreciation must be reduced by half the investment credit. In an inverted lease, since the lessee claims the credit but does not claim depreciation, it must report 50% of the credit as income ratably over five years. If the lessee is a partnership, then some tax equity investors use the income to increase the “outside basis” in their partnership interests and then claim a loss for the remaining outside basis when they withdraw from the partnership. The IRS does not believe this is appropriate. An IRS notice is expected in the fall. (For earlier coverage, see the May 2015 Project Finance NewsWire article Inverted Leases.)

Solar companies are chafing at cash sweeps in partnership flip transactions. The tax equity investor may insist that any cash that would otherwise be distributed to the solar company should be diverted to the tax equity investor to cover any tax indemnities that have to be paid. Such a sweep will complicate raising back-levered debt against the sponsor share of cash flow. Cash flow to the sponsor could also be interrupted in a fixed-flip partnership if the tax equity investor exercises a right, after the flip, to withdraw from the partnership. The partnership would be required to use cash at that point to pay the investor a withdrawal amount. A solar company planning to add back-levered debt later should also anticipate, when negotiating with the tax equity investor over restrictions on transfers of partnership interests, that the lender will need the ability to foreclose on the sponsor partnership interest.

Solar companies sometimes approach inappropriate tax equity investors. It is very hard for individuals, S corporations and closely-held C corporations to act as tax equity investors. A closely-held C corporation is a regular corporation in which five or fewer individuals own more than half the stock. Such investors are limited by passive loss and at-risk rules that make it hard to use the tax benefits.

Partnerships that earn their revenue from generating electricity cannot disaggregate the elements that go into the calculation of net income or net loss and allocate them separately. For example, such a partnership would not be able to allocate depreciation in one ratio and income, net of depreciation, in another ratio. US tax rules require any partnership engaged in manufacturing to use the inventory method of accounting, meaning it can only allocate net income or net loss each year. Generating electricity is considered manufacturing for this purpose.

There is a move toward utility-scale merchant projects in some parts of the United States. Such projects can be financed only if there is a hedge to put a floor under the electricity price. US tax rules bar a partnership from claiming a net loss – due, for example, to tax depreciation – on a project where the electricity is sold by the partnership to an affiliate. The sponsor may be tempted to enter into a power contract where it buys and resells the electricity as a way of putting a floor under the electricity price. It would be better to enter into a hedge or swap where the sponsor does not take the electricity, at least during the period the partnership could have a net loss.

NewsWire Editor

Keith Martin

Partner, United States

Washington, DC

Email

T: +1 202 974 5674

Stay Connected

Subscribe by Email