Colombia: Opportunities and challenges

Colombia is expected launch a third renewable energy auction in 2020.

Participation in the last two auctions was less robust than hoped due to an inflexible regulatory framework and the amount of security required by bidders.

Colombia awarded contracts for wind and solar projects worth about $2.2 billion in the second auction in October. Roughly 150 companies submitted bids.

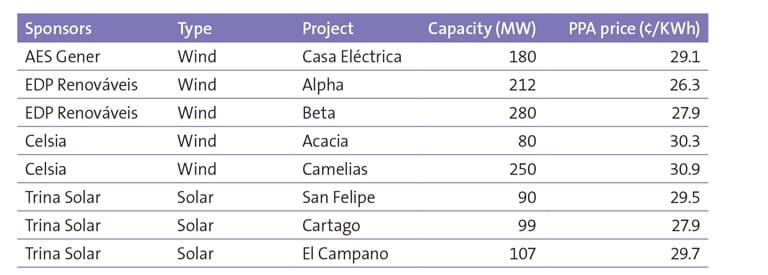

Seven electricity generators secured 15-year power purchase agreements for 1,298.9 megawatts of new wind and solar capacity spread among eight projects (five for wind and three for solar) with a weighted average price of $28.09 a megawatt hour. This weighted average is about $14.68 per megawatt hour below the current prices in bilateral contracts between energy traders and generators. By comparison, Mexico’s third round of renewable energy auctions in 2017 netted an average price of $20.57 a megawatt hour.

Twenty-two companies will buy electricity under the contracts. The offtakers include Celsia, Enel, Empresas Públicas de Medellín, and Ecopetrol, as well as smaller local power distributors like Electrificadora del Caribe and Electrificadora de Santander.

Details of the seven generators are shown in the chart below.

The second-round auction in October followed a failed attempt to hold an initial auction in February 2019. No bids were accepted in the initial auction because the offers received did not meet the criteria set by the Energy and Gas Regulation Commission (Comisión de Regulación de Energía y Gas – CREG) for ensuring market competition.

Historically, the renewable energy market in Colombia has been negligible compared to Colombia’s hydroelectric and thermal generation. Hydroelectric generation has been well-developed due to high rainfall levels and natural resources, and thermal energy has been used to fill in generation gaps during dry periods. However, it is estimated that large-scale onshore wind and geothermal would be able to achieve the same cost per kilowatt hour as current hydroelectric generation, further diversifying the country’s energy mix and increasing overall installed capacity (which is currently around 17,300 megawatts).

In 2022, non-hydroelectric renewable energy sources will represent 11% of Colombia’s energy matrix, according to the government.

Opportunity knocks

Colombia has a series of regulatory, tax, geographic, political and macroeconomic advantages, making it an attractive place to invest in renewable energy projects.

It issued regulations in 2018 for distributed solar generation (up to 100 KW) and other renewable distributed generation (between 100 KW and 1 MW).

Colombia has implemented approximately 34 legal and regulatory reforms since 2006, many of which promote investments in renewable energy. Government regulations allow commercial, residential and small industrial consumers to produce energy to satisfy their own needs and to sell any surplus to the interconnected system.

A key component of the legal and regulatory incentives offered to promote investments in renewable energy are the tax incentives for investors. There are two main tax incentives. VAT taxes are waived for renewable energy goods like solar panels and for domestic or imported renewable energy services. Income-tax deductions may be taken over 15 years for up to 50% of investments made in projects using non-hydroelectric energy sources to generate electricity.

Taxpayers reporting tax on income directly derived from new spending on research, development and investment for the production and use of energy from renewable sources or efficient management of renewable energy are able to deduct up to 50% of the value of such investments. The maximum value to be deducted in a period not exceeding 15 years counted from the fiscal year following that in which the investment is made is fixed at 50% of the total value of the investment made. The maximum value to be deducted for each fiscal year may not exceed 50% of the taxpayer’s net income, before subtracting the income tax deduction.

Accelerated depreciation is also allowed on the share of asset value used to generate renewable energy, not exceeding 20% of the asset value per year. This tax incentive applies to renewable energy generators making new investments in machinery or equipment or paying for civil works acquired or built after the law was enacted in 2014.

Customs duties and tariffs do not have to be paid on machinery, equipment, materials and supplies imported for exclusive use in renewable energy projects.

There are also special incentives for battery energy storage.

Colombia has a daily average solar irradiation of 4.5 kilowatt hours per square meter, exceeding the world average of 3.9 kilowatt hours per square meter. One of the world’s renewable energy champions, Germany, has irradiation of 3.0 kilowatt hours per square meter.

Various studies have found that the wind energy potential is sufficient by itself to meet the country’s current energy needs. The department of La Guajira stands out for its high wind resources (estimated at 21,000 megawatts of capacity). Winds in La Guajira have been classified as class 7 (close to 10 meters per second annual average), making it one of only two regions in Latin America with winds of this speed.

The Colombian government aims to reach about 1,400 megawatts of installed capacity in non-hydroelectric renewable energy by 2023. This is 28 times more installed capacity than the current capacity, mostly coming from new solar and wind projects in the north of the country in the La Guajira and Cesar regions.

In recent years, Colombia’s GDP grew above the average for Latin America and the Caribbean. While in 2017, the country’s economy grew at a 1.8% rate, faster than the 1.3% rate for the region as a whole. During the period 2010 through 2017, the Colombian economy grew at an average annual rate of 3.8%. The country’s GDP growth was 2.6% in 2018. The GDP is estimated to have grown by 3.1% in 2019, making Colombia one of Latin-America’s top 3 fastest growing economies.

In the not-too-distant past, Colombia was seen as a state on the brink of failure. Colombia’s sovereign debt was granted investment grade status by Standard & Poor’s, Moody’s and Fitch in 2011. In 2014, Moody’s raised the country’s rating from Baa3 to Baa2. In March 2017, Fitch Ratings improved Colombia’s rating outlook: it went from negative to stable. The country was invited in 2018 to become a member of the OECD. The only other OECD countries in Latin America are Chile and Mexico. Colombia signed an accession agreement in May 2018 and is on track to join soon.

Colombia is working actively to tackle climate change. It wants to increase its installed generating capacity from renewable energy by 50 times, from less than 50 megawatts in 2018 to 2,500 megawatts in 2022. It wants to reduce the country’s output of CO2 by nine million tons. It wants to increase non-hydroelectric renewable energy from less than 1% to between 8% and 10%.

Three other areas of focus in the coming years are efficient management of demand, intelligent metering and energy storage. The government is encouraging private-sector players to reinvent themselves to take advantage of new business opportunities in decarbonization, digitization, and decentralization.

Second auction

The government made several improvements in the second auction that helped to increase the number of bidders and to maximize diversification.

The power contract term was increased from 12 to 15 years starting on January 1, 2022. The deadline to reach commercial operation was extended. The minimum generating capacity was decreased from 10 megawatts to five megawatts.

The new PPA provides developers with flexibility to outsource energy from third parties in the event construction of a developer’s project is delayed. Power suppliers were allowed to submit offers in different power blocks. (For an earlier discussion about bankability of the PPA, see “Bankability of Colombian Projects” in the October 2019 NewsWire.)

The newly awarded clean energy suppliers will mobilize an estimated $1.3 billion in investment, boost Colombia’s generating capacity by 2,250 megawatts, and attract another $2 billion of estimated private-sector investment.

The second auction was supported by the US Agency for International Development through workshops, hosting events for potential bidders, an auction IT platform, and a bilingual document library with rules for bidder participation and the contracts to be awarded to winning bidders, among other resources.

Future auctions

The government is expected to hold a third renewable energy auction in 2020, but it recognizes that various challenges remain.

A major hurdle to increasing renewable energy production is the lack of infrastructure in non-interconnected areas. Bidders in future auctions should assume their projects will have to include grid infrastructure as well as storage.

Notwithstanding criticism from foreign investors in response to the initial auction, the PPAs awarded in the second auction still set the energy prices in Colombian pesos, and payments will be made in pesos at a price that will be adjusted on a monthly basis. This remains a major challenge for foreign investors due to Colombian peso volatility and currency risk. Investors have to use financial instruments, such as currency swaps, to hedge against this type of currency risk.

Various developers complain that there has been a lack of planning around community engagement in areas where projects are to be located, and that conditions placed on bidders with respect to coordination with communities were overly burdensome and complicated.

In the past, mining and oil projects in the region have been brought to a halt by local protests based on environmental, social and indigenous land rights concerns related to the local community and nearby natural resources affected by construction and operation. Such confrontations are costly and many potential bidders are deterred by the potential reputation risk from such protests.