Financing California hydrogen projects using LCFS credits

California is the cradle for the newborn green hydrogen industry in the United States. Multiple green hydrogen projects have been announced. Private infrastructure companies, equipment manufacturers and utilities have all shown interest, as have solar and wind developers who could supply electricity for making green hydrogen through electrolysis.

Despite the excitement surrounding green hydrogen, the technology remains expensive. Hydrogen producers and retailers can earn valuable credits under the California low-carbon fuel standard — called "LCFS" — to help cover the cost of projects. These credits can form the basis for a project financing. However, structuring transactions to get value for them takes work, especially where a developer wants the lender to assign value to them in the financing.

LCFS credits

There are two main ways to earn LCFS credits with hydrogen. Credits can be earned by supplying hydrogen for use as a transportation fuel and by installing zero-emissions-vehicle refueling infrastructure.

Under the first method, credits are awarded when hydrogen is dispensed to motor vehicles in California. The credits accrue to the owner of the hydrogen fueling station. The upstream producer of the hydrogen can probably sell the hydrogen to the owner of the fueling station at a higher price to reflect the value of the credits to which the station owner will be entitled. The cleaner the source of the hydrogen — for example, a solar-plus-electrolyzer project will produce cleaner hydrogen than hydrogen produced from steam methane reforming — the more valuable it is to a station owner. The station owner should be willing to pay more for cleaner hydrogen.

Under the second method, credits are awarded for installing hydrogen fueling station infrastructure in California that is open to the public. The number of credits awarded is based on the dispensing nameplate capacity of the fueling station minus the quantity of actual fuel dispensed.

The LCFS regulations allow the owner of the fueling station to transfer the right to the credits to the upstream producer of the hydrogen. If this approach is used, the hydrogen producer will end up selling the hydrogen to fueling stations for less cash, but the cash will be supplemented with LCFS credits. The drawback of using this approach is that it shifts the fuel-sale risk to the hydrogen producer because the amount of credits awarded depends on the amount of hydrogen put in motor vehicles.

If the same entity is earning both fuel-sale credits and the infrastructure credits, then any decrease in fuel sales will be compensated by more infrastructure credits since the latter reward spare refueling capacity.

LCFS credits can be lucrative. In 2019, more than 14 million LCFS credits were sold or traded at an average price of $192 per credit, representing a vigorous market with an annual transaction value of more than $2.7 billion.

The market for them is suppliers of petroleum-based fuels. Such companies must turn in credits at the end of each year to the extent the carbon intensity of the fuels they supplied during the year for transportation use in California is above a baseline carbon intensity set by the California Air Resources Board.

Entities with LCFS credits can monetize them by selling them to companies that need credits under bilateral contracts or by selling them in an annual state-run auction.

The LCFS regulations allow petroleum-fuel suppliers that require credits to enter into over-the-counter agreements to transfer credits or to transact using a broker. Most parties choose to document their trades using a master agreement together with one or more confirmations. The master agreement has the general terms and conditions that apply to all trades between the parties like payment netting, close-out setoff, credit support, force majeure, invalidation of credits and dispute resolution. The confirmations contain economic terms like quantity and price for the particular transaction.

In order to finance a project based on LCFS credits, a creditworthy counterparty will have to have agreed to buy the credits over a long period of time. A predictable revenue stream is very important to project finance lenders.

While the price of LCFS credits is currently near the ceiling and has tended to trend up over time, project finance lenders will be reluctant to finance a project without a contract that sets a price floor. The price of credits can drop significantly. Lenders will not take that risk.

The sale of the credits can be analogized to the sale of electricity from a power project. The gold standard is a long-term power purchase agreement with a creditworthy utility. Similarly, a long-term LCFS credit sale agreement with a creditworthy entity would be the easiest way to ensure financing.

However, the market would probably consider other financing structures for LCFS credits just as it has been willing to accommodate quasi-merchant power projects. Some market participants are exploring use of an LCFS hedge product. If the hedge provides a price floor for a predetermined quantity of credits and is with (or backed by) a creditworthy counterparty, then it should be enough to support a financing.

The amount of credits awarded for installing hydrogen fuel infrastructure declines as sales increase. Lenders will not be able to lend against solely this type of LCFS credit. The loan will have to be supported by binding contracts not only for the sale of LCFS credits generated by installation of fueling infrastructure, but also from sales of credits for hydrogen put in motor vehicles so that any decrease in infrastructure credits is offset by an increase in fuel credits. A simple solution to this issue is to contract for the full amount of credits with one buyer and not differentiate the source.

Because the buyer of LCFS credits is often a major oil company, there is not usually an issue with offtaker credit. However, buyers of LCFS credits sometimes use a special-purpose entity as the purchaser. If this is done, the seller of the LCFS credits should ensure that there is a guarantee from a creditworthy parent backing the payment stream.

In addition, sellers should ensure that sales contracts include other typical project finance lender protections. A contract to sell LCFS credits should not prohibit a change of control of the seller that would be implicated if a lender to the project selling LCFS credits has to foreclose on the project. The buyer of LCFS credits (and its guarantor, if there is one) should agree up front to provide a customary consent to assignment and legal opinion. The excuses for buyer performance should be limited.

Long-term sales of LCFS credits will be at a discount to current market prices. A seller may feel that it is leaving significant money on the table. This discount is one of the costs of obtaining the certainty that lenders require about long-term revenue. Most lenders will work with a seller to structure some upside. This could be done by requiring less than all of the projected LCFS credits to be sold under long-term contracts.

A project could hold back some credits to sell in the spot market. Any such spot sales could fetch higher prices than under a long-term contract as long as the market remains strong. Lenders may give some credit to these sales when sizing the financing, but at a more conservative debt service coverage ratio. The lenders could also require cash sweeps from spot-market sales to pay down the debt principal more quickly while allowing the borrower to make larger cash distributions to its parent company.

LCFS basics

A starting point for hydrogen producers and anyone thinking about investing in a hydrogen project is to make sure that the project qualifies for LCFS credits and no money is being left on the table.

The goal of the LCFS program is to reduce the carbon intensity of the transportation fuel used in California. The production and use of petroleum-derived transportation fuels — such as gasoline and diesel fuel — are responsible for almost half of California greenhouse gas emissions.

The LCFS program was first implemented in 2011 under authority in the Global Warming Solutions Act of 2006. Californians call this law Assembly Bill 32 or AB 32. It created a comprehensive, multi-year program to reduce greenhouse gas emissions in the state.

The LCFS program has been extended and amended several times. The California Air Resources Board – called CARB — is the lead agency for implementing and enforcing the low-carbon fuel standard.

Petroleum fuel producers, importers, refiners and wholesalers who sell fuel in California are subject to the LCFS rules. The rules require these "regulated entities" to demonstrate that the carbon intensity, or "CI," of the mix of fuels they sell in California does not exceed an annual benchmark set by the LCFS program.

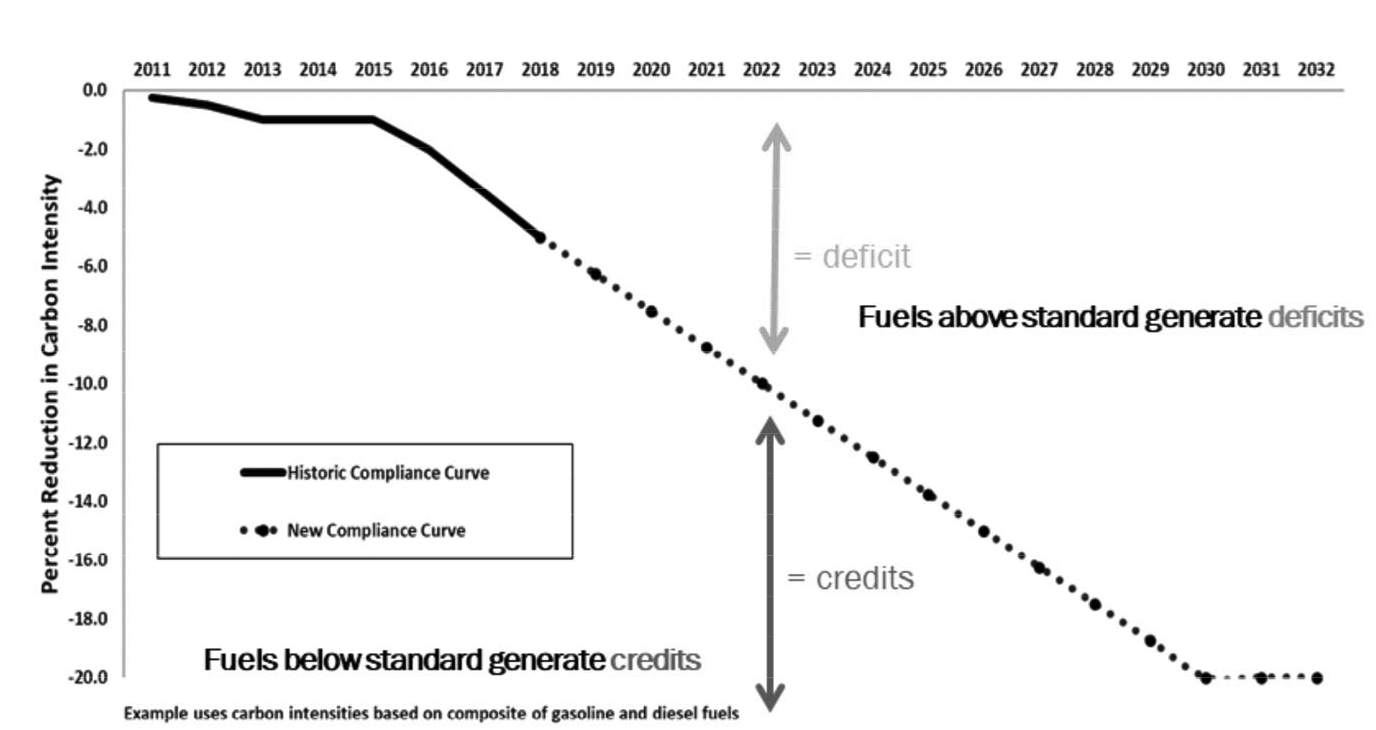

CI is a measure of greenhouse gas emissions over the lifespan of a fuel type, measured in grams of carbon dioxide equivalent per megajoule (gCO2e/MJ). The benchmarks become more stringent each year so that the CI declines over time. The 2030 benchmark represents a 20% reduction in CI as compared to 2010.

A regulated entity can meet its annual carbon intensity benchmark by reducing the carbon intensity of its fuels — for example, by substituting clean fuels for petroleum-based fuels — or by buying LCFS credits in the market. Credits are awarded when a fuel supplier produces fuels that are below the annual CI benchmark. Deficits are generated when a fuel supplier produces fuels that are above the annual CI benchmark.

To ensure that there are enough credits available for purchase, the LCFS rules allow renewable energy and low-carbon-fuel project developers, aggregators and utilities to opt into the program and become regulated entities. Credits are awarded only to regulated entities, and only regulated entities can sell credits. For example, a hydrogen producer who opts into the program would be expected to be awarded credits because the carbon-intensity of hydrogen is below the annual CI benchmark. It can sell those credits to a diesel refiner who is running a deficit because diesel is above the CI benchmark. Credits may be banked and traded within the LCFS market to meet compliance obligations in current or future years.

LCFS credit prices are determined by market dynamics of supply and demand.

Prices are volatile, but have generally trended upward over time. In fact, credits were becoming so valuable that state regulators imposed a price ceiling of $200 in 2016 that adjusts every year for inflation. The ceiling in 2020 is $217.97 per credit. Despite this intervention, regulators commented that the LCFS market is functioning as intended and providing a strong signal for investment in low-carbon fuels. In November, credits were trading at well over $200 per credit.

Demonstrating compliance

A regulated entity must demonstrate that it met its annual compliance obligation by submitting an annual compliance report to CARB that shows that it owned and has retired the number of credits from its credit account required to satisfy its compliance obligation. The annual compliance period is January 1 through December 31 of each year. After compliance reports are filed, CARB retires the number of credits equal to each reporting entity's compliance obligation for that compliance period. If a reporting entity does not have enough credits to cover a deficit in its account, the entity will be liable for the shortfall and could have to pay a serious fine if it does not cover the deficit (plus interest) within five years.

There is a credit clearance market, or "CCM," for regulated parties that do not have enough credits to cover a deficit. If a regulated entity does not retire enough credits to meet its year-end compliance obligation, then it must purchase its pro-rata share of credits in the CCM if one is held. The CCM is also an opportunity for holders of excess credits to sell their credits.

The CCM, if one occurs, will operate in any year from June 1 to August 30. Parties participating in the CCM agree to sell or transfer credits at or below the maximum price for the pertinent year set by CARB until the market closes on August 30. Parties that have voluntarily pledged credits to sell into the market can negotiate the price but cannot reject an offer to buy those pledged credits at the maximum price.

The last CCM was held in 2016. CARB did not need to hold a CCM in subsequent years because all LCFS regulated entities met their compliance obligations for those years.

Qualifying for credits

There are three ways to qualify for credits under the LCFS: fuel pathways, projects and capacity-based crediting.

Under fuel pathways-based crediting, suppliers of low-carbon transportation fuels used in California receive credits by obtaining a certified CI score and reporting the quantity of fuel put into motor vehicles on a quarterly basis.

The CI score depends on the production process used for converting feedstock to a finished fuel, called the "fuel pathway." The CI score can be determined by referring to a "lookup table" that contains the CI scores for different fuel pathways and types of fuels. This is the most straightforward way to obtain a CI score. There are other, more cumbersome, processes available if the fuel pathway in the lookup table does not apply.

Under project-based crediting, projects that reduce emissions at refineries and crude-oil production and transportation facilities can qualify for credits. An example is a carbon-capture-and-sequestration project.

Finally, capacity-based crediting is designed to support the deployment of zero-emissions vehicle infrastructure by awarding credits for ZEV infrastructure based on the capacity of the hydrogen fueling station or EV fast charging site minus the actual amount of fuel dispensed.

Green hydrogen projects will probably rely on the fuel pathways-based crediting and ZEV infrastructure crediting rather than project-based crediting.

The lookup table for fuel pathways-based crediting includes six different pathways pre-approved by CARB. Of the six pathways, two derive hydrogen from natural gas, two derive hydrogen from landfill bio-methane and two pathways derive hydrogen from water using electrolysis. Each pathway has a CI score.

LCFS credits are more valuable the lower the CI score. For example, a calculator provided by CARB estimates that hydrogen produced with clean electricity generates approximately 41% more credits per kilogram of fuel than hydrogen produced with the average California grid electricity.

The only pathway that would produce truly "green" hydrogen is the pathway for compressed, gaseous hydrogen produced in California from electrolysis using electricity generated from a 100% zero-carbon-intensity resource, which means renewable energy resources other than biomass, bio-methane, geothermal and municipal solid waste.

The applicant must demonstrate that energy from the renewable source in question is consumed directly in the hydrogen production process. There are three key ingredients to meeting this requirement. First, the electricity must be supplied from generating equipment under the control of the pathway applicant. Second, the generating equipment must be directly connected through a dedicated line to the facility such that the generating equipment and the load are both physically located on the customer side of the utility meter. The generating source may be grid-tied, but a dedicated connection must exist between the source and load. Finally, the facility's load must be enough to absorb all of the zero-carbon-intensity electricity claimed during a monthly balancing period.

There are other requirements for the other pathways. If electrolytic hydrogen is produced in California using California average grid electricity, an entity can be awarded incremental credits by using smart electrolysis. Smart electrolysis (like smart charging of electric vehicles) means the process draws power from the grid only during certain times of the day when demand is low. A smart electrolysis project applicant must provide CARB with records demonstrating the quantity of electricity dispensed during each hour for the most recent quarter.

The pre-approved pathways for electrolytic hydrogen are only available to hydrogen produced within California. If the hydrogen is not produced in California (but is sold in California), then the project may still qualify for LCFS credits, but will have to apply to CARB for approval on a case-by-case basis.

Hydrogen fueling station owners can earn capacity-based credits based on the capacity of the station minus the amount of fuel dispensed. Capacity-based credits can be earned every day for 15 years. These credits help to solve the chick-and-egg problem experienced by new technologies (such as hydrogen-powered vehicles) by encouraging construction of hydrogen fueling stations before there is enough demand from vehicle owners to justify the infrastructure.