Inverted leases

Inverted leases are a structure used to raise tax equity for renewable energy projects. The structure is used mainly in the solar rooftop market.

About 10% to 20% of tax equity transactions in that market today involve an inverted lease.

The other two tax equity structures are partnership flips and sale-leasebacks. All wind and other projects that rely on production tax credits use partnership flips. This is required by statute. Sale-leasebacks are somewhat more common in utility-scale projects, but far less common today than in the past. (For a discussion of these other structures, see “Solar Tax Equity Structures” in the September 2015 NewsWire and “Partnership Flips” in the April 2017 NewsWire.)

The US government offers two tax benefits for renewable energy projects: a tax credit and depreciation. They amount to at least 56¢ per dollar of capital cost for the typical solar or wind project. Few developers can use them efficiently. Therefore, finding value for them is the core financing strategy for many US renewable energy companies.

Tax equity covers 20% to 85% of the cost of a project. The developer must fill in the rest of the capital stack with debt or equity.

Comparisons

Each of the tax equity structures raises a different amount of tax equity, allocates risk differently and imposes a deadline on when the tax equity investor must fund its investment.

Inverted leases raise the least amount of capital: roughly 20% to 42% of the capital stack. A partnership flip raises 35% to 50% of the typical solar project. A sale-leaseback raises in theory the full fair market value, but in practice, the developer is usually required to return 15% to 20% of the amount at inception as prepaid rent.

The developer may bear more tax risk with an inverted lease or sale-leaseback than a partnership flip. Developers in lease transactions are more likely to have to indemnify the tax equity investor for loss of tax benefits. Tax indemnities are usually more limited in partnership flips. In a flip, the tax equity investor simply sits on the deal with a large share of the economics until it reaches its target yield.

Sale-leasebacks buy the most time to raise tax equity. The tax equity investor must be in the deal before the project is put in service in both an inverted lease and partnership flip. A sale-leaseback gives the developer up to three months after the project goes into service to close on the tax equity financing.

Drilling down into the details of inverted leases: they are a simple concept. Think of a yo-yo. A solar rooftop company assigns customer agreements and leases rooftop solar systems in tranches to a tax equity investor who collects the customer revenue and pays most of it to the solar company as rent.

The two tax benefits on the solar equipment are bifurcated. The solar company passes through the investment tax credit to the tax equity investor as lessee. It keeps the depreciation and uses it to shelter the rents paid by the tax equity investor. That’s why the structure raises the least amount of capital.

Some tax counsel prefer that the customer agreements be power purchase agreements rather than leases. A PPA leaves operating risk with the tax equity investor or inverted lessee. It is important to be able to show that the lessee is exposed to real business risk rather than merely collecting fixed rents from customers.

Most tax counsel also limit the degree to which customers can have prepaid for electricity for the same reason. Many borrow a limit in section 470 of the US tax code that limits the sum of defeasance arrangements, cash reserves, letters of credit, customer prepayments and rent prepayments under the inverted lease to between 20% and 50% of the lessor’s tax basis in the projects leased to the tax equity investor. Where particular tax counsel draw the line varies.

The sponsor usually retains responsibility for operating or monitoring the assets and dealing with customers under an operations and maintenance agreement with the lessee. Many tax counsel prefer not to see the sponsor bear the operating costs for a fixed fee. It is better to use a cost-plus-fixed fee approach so that operating costs are passed through to the lessee. The O&M agreement should ideally have a short term — for example, five years — with the lessee then having an option to renew at one-year intervals. It should be the type of agreement that a third party would be willing to assume.

Attractions

Solar rooftop companies like inverted leases because they get the equipment back when the lease ends without having to pay for it.

The solar company can monetize the projected rents by borrowing “back-levered” debt. Such debt may be easier to put in place than a similar borrowing in a partnership flip structure.

Both solar companies and tax equity investors like the relatively short term of the financing.

The primary disadvantages are an inverted lease is a more complicated structure than the alternatives and does not raise as much capital, and fewer tax equity investors offer the structure.

The market was originally drawn to the structure in 2009 as a way for investors without tax capacity to continue doing deals during the Treasury cash grant era when the US Treasury was paying 30% of the tax basis in a project as an alternative to claiming tax credits. The recent drop off in use of the structure is due to a variety of factors.

Not all sponsors can use the structure. Government agencies, tax-exempt entities, Indian tribes and real estate investment trusts cannot elect to pass through the investment tax credit to a lessee.

Normally when a solar company claims an investment tax credit, it must reduce its tax basis in the equipment for calculating depreciation by half the investment credit. In an inverted lease, the tax equity investor reports half the investment credit as income ratably over five years. Some tax equity investors took the position, where the lessee is a partnership, that they can deduct the lessee income inclusion later as a capital loss by withdrawing from the partnership. The IRS put a halt to this practice in temporary regulations in July 2016. (For more detail, see “IRS Addresses an Inverted Lease Issue” in the August 2016 NewsWire.)

Inverted leases have terms of seven to 24 years, depending on the counsel acting for the tax equity investor. Some tax counsel like to see a “merchant tail,” meaning the lease should run at least 20% longer than the customer agreements. In deals with long lease terms, the lessee usually has an option to cut the transaction short.

The tax equity investor must have upside potential and downside risk to be considered a true lessee. If there is no substance to its role as lessee, then it will not be able to claim the investment tax credit. Some of the big four accounting firms treat inverted lease transactions as loans rather than real leases.

Some tax counsel believe the tax equity investor is a real lessee based on market exposure if the lease runs longer than the customer agreements. Others focus on the amount of prepaid rent that is paid by the lessee and want to see at least 20% prepaid rent. However, too much prepaid rent can make the deal look like a loan.

In more conservative deals, the tax equity investor has a hell-or-high-water obligation to pay fixed rents to the solar company under the inverted lease. In some deals, part of the rent is contingent on output or lessee cash flow; contingent rent adds tax risk to the structure. The portion of the customer revenue that is retained by the lessee can vary substantially.

Solar companies have an interest in minimizing the share of customer revenue retained by the tax equity investor as lessee. They prefer to monetize future revenue at a back-levered debt rate rather than a higher tax equity yield. Most tax equity investors require at least a 2% pre-tax yield.

There are no IRS guidelines for inverted leases, unlike partnership flips and sale-leasebacks. However, the structure is common in historic tax credit deals, and the IRS acknowledged it in guidelines in early 2014 to unfreeze the historic tax credit market after a US appeals court struck down an aggressive form of the structure in a decision called Historic Boardwalk. The guidelines are in Revenue Procedure 2014-12. (For more discussion, see “Tax Equity Market Weighs New IRS Guidelines” in the February 2014 NewsWire.)

Overlapping Ownership

The central challenge in inverted leases is how the 20% to 42% of the capital stack raised by the structure moves from the tax equity investor to the solar company. In the conservative form of inverted lease, it moves from the lessee to lessor as prepaid rent.

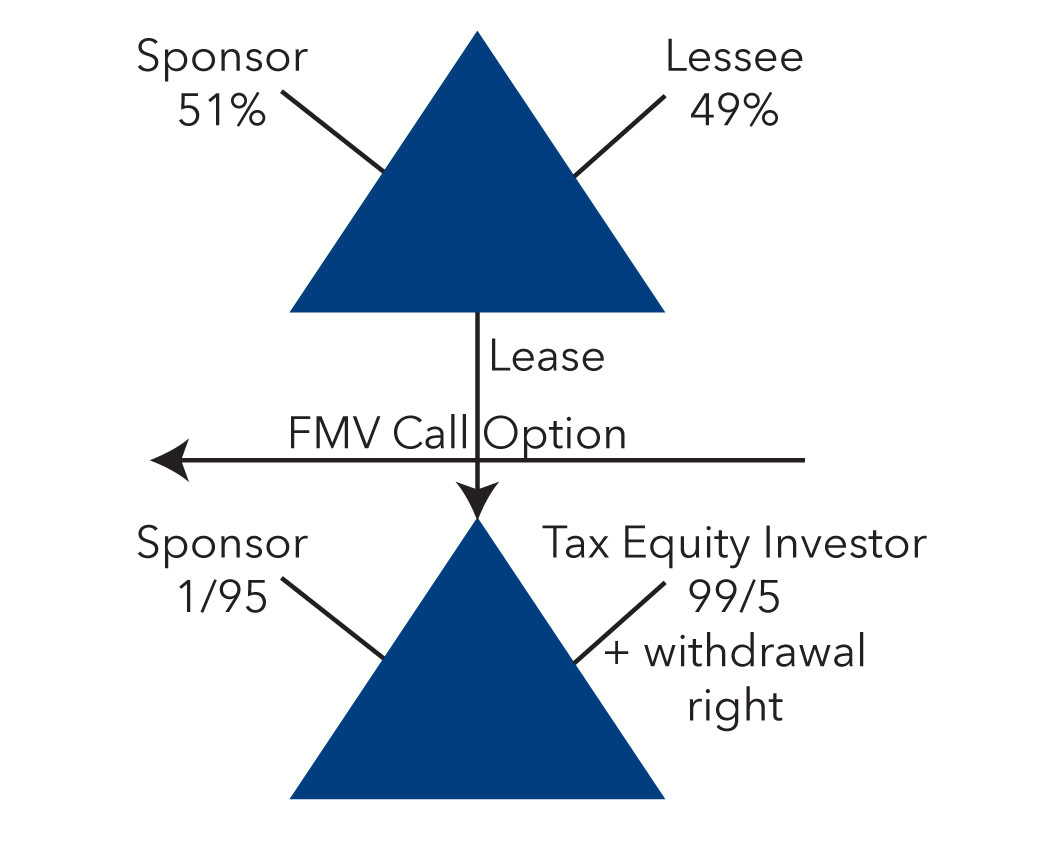

In the overlapping ownership structure, the tax equity investor makes a capital contribution to a lessee partnership, and the lessee makes a capital contribution of the amount to the lessor in exchange for a 49% interest in the lessor. The capital contribution may be distributed by the lessor partnership to the solar company tax free. The investor is able to claim not only the investment credit, but also 49% of the depreciation on the solar assets.

The overlapping ownership structure raises more tax equity because there are more tax benefits for the tax equity investor. Both the lessor and lessee are partnerships. The solar company owns not only 51% of the lessor, but it also owns a 1% interest in the lessee and acts as managing member. The solar company has an option to buy the tax equity investor interest after the recapture period has run on the investment tax credits. The tax equity investor has an option to withdraw from the partnership if the solar company does not exercise the option to buy out the investor.

In other variations on the basic structure, the sponsor may sometimes own 100% of the lessor and take a small interest in the lessee (1% to 5%) as managing member to allow the tax equity investor to avoid consolidating the lessee for book purposes.

In some deals, a sponsor affiliate enters into a master installation agreement with the lessor to install solar systems as customer agreements are signed. More commonly, the sponsor contributes the equipment to the lessor which then leases it to the tax equity investor.

Tax Treatment

Focusing on the tax treatment to each of the parties, the lessor must report the rent it receives as income, but has the depreciation as shelter. The lessee may prepay part of the rent. That part is treated as a “section 467 loan” and is reported by the lessor as income over time.

The lessee must report the revenue from customers as income. It deducts the rent paid to the lessor and claims an investment tax credit on the solar equipment. Any prepaid rent is deducted over the same period the lessor reports it as income. The lessee reports half the investment credit as income over five years.

The tax equity investor is locked in for five years. The “unvested” investment credit must be repaid to the US government if the lease terminates or the investor transfers its leasehold interest within five years after the equipment is put in service. A transfer of the equipment by the lessor does not trigger recapture, unless the transfer is to someone like a government or tax-exempt entity that cannot elect to pass through investment credits or the transferee takes the equipment freed from the inverted lease.

Termination of the inverted lease accelerates the remaining lessee income inclusion in theory, but in practice, the lessee does not have to report more income than half the investment tax credits it is allowed to keep. It would already have done that in a solar inverted lease.

There is no recapture of the investment tax credits if the lessee purchases the equipment from the lessor.

The Internal Revenue Service and Treasury inspector general have probed into the inverted lease structure on audit, but not taken issue with it. Nevertheless, the structured is perceived as carrying more tax risk than other tax equity structures.

Many tax equity investors are limiting the percentage markup they are willing to see in fair market value above cost, although this is most common in utility-scale projects. Tax basis risk is borne in most deals by the sponsor. Tax loss insurance is being used in some solar tax equity transactions to avoid diversions of cash flow to cover tax indemnities, but it is expensive.

In general, tax risks about which the sponsor has special insight are borne by the sponsor. An example is facts that go to when a project was placed in service. Tax risks into which both the sponsor and tax equity investor have equal insight are borne by the tax equity investor. An example is whether the inverted lease structure works.

Risks into which neither party has special insight are usually a matter for negotiation. The biggest such risk is tax change risk. The risk is being put on sponsors, but the market is still feeling its way on how to address it. (For more discussion, see “Tax Change Risk in Tax Equity Deals” in this issue starting on page 23.)

Tax Reform

Progress on tax reform has stalled while Congress waits for the Trump administration to reveal what it wants. The tax “plan” released by Trump in late April had only 30 words on corporate tax reform. No one expects a completed tax bill on the president’s desk before year end at the earliest. Lower tax rates are expected to be phased in starting in 2018 because of cost.

There are six changes potentially in play that could affect the economics of inverted lease transactions. House Republican leaders have lined up behind a plan that would reduce the corporate tax rate to 20%, allow the full cost of new equipment to be deducted immediately, deny interest deductions, exempt export earnings from income taxes, and deny any cost recovery on imported goods and services. Congress could also change the existing phase-out schedule for the solar investment tax credit, although this is not expected.

Trump wants to reduce the corporate tax rate to 15%, and he has talked about imposing a “reciprocal tax” on imports, but without offering any details about how it would work.

Some tax equity investors are already pricing deals using a 20% to 28% corporate tax rate. There is a one-time price reset at the end of 2018 or sooner after a tax overhaul bill clears Congress. A materially adverse proposed change in tax law not reflected in the pricing model is grounds to stop funding additional tranches. The parties debate at what stage in the legislative process it is appropriate to cut off further funding.

Tax equity investors generally have an incentive to accelerate tax equity deals into 2017 when deductions can be taken against a 35% tax rate. However, this is less true of inverted lease transactions where the depreciation remains with the solar company and the lessee must report half the investment credit as income.

The lack of depreciation benefits makes tax reform less of an issue in inverted leases. Without depreciation benefits, the investor’s return is likely to increase from a lower tax rate unless the investment tax credit is overhauled by Congress.

Property taxes are an ever-present issue in transactions involving solar equipment in California. Any change in ownership of solar equipment after initial installation will trigger a property tax reassessment. Putting a tax equity partnership in place is not considered a change in ownership, but later exercise of a sponsor call option or investor put is.