Partnership flips

April 6, 2017 | By Keith Martin in Washington, DC

An updated version of this article can be found in our February 2021 NewsWire.

Partnership flips are used to raise tax equity in the US renewable energy market. They are not the only structure for doing so, but they are the most common, and they are the only way to raise tax equity for wind farms and other projects on which production tax credits will be claimed.

This article describes how the structure works and current issues that are taking up time in partnership flip transactions.

The US government offers two tax benefits: a tax credit and depreciation. They amount to at least 56¢ per dollar of capital cost for the typical wind or solar project. Few developers can use them efficiently. Therefore, finding value for them is the core financing strategy for many US renewable energy companies.

Before tax equity started to adjust pricing this year in anticipation of an overhaul of the US tax code, tax equity accounted for 50% to 60% of the capital stack for a typical wind farm and 40% to 50% for a typical solar project. The percentages are down in 2017 as investors assume lower tax rates for purposes of sizing their investments. Many deal documents provide for a one-time price reset after a tax overhaul bill clears Congress with either an additional investment by the tax equity investor or a capital contribution by the sponsor or cash sweep to return part of the investment that was already made, depending on where the final tax rate settles in relation to the rate used for pricing at original funding.

The developer must fill in the rest of the capital stack with debt or equity.

Simple Concept

Partnership flips are a simple concept. Tax benefits can usually only be claimed by the owner of a project. Partnerships offer flexibility in how economic returns can be shared by the partners. A developer finds an investor who can use the tax benefits. The two of them own the project as partners through a partnership.

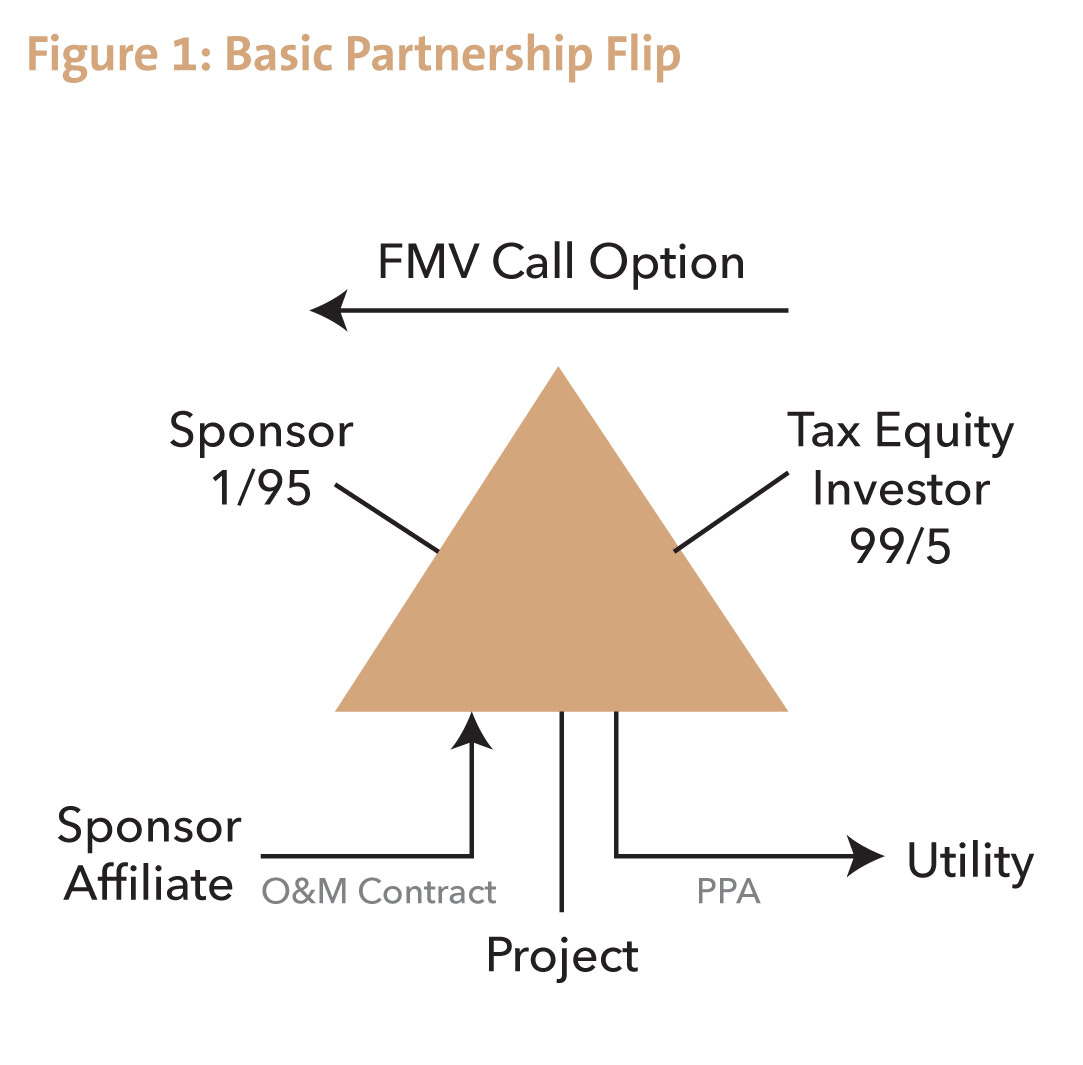

In the typical partnership flip transaction, the partnership allocates 99% of income, loss and tax credits to the tax equity investor until it reaches a target yield. Cash is shared in a different ratio. After the yield is reached, the investor’s share of everything drops to 5% and the developer has an option to buy the investor’s remaining interest.

The typical structure is shown in Figure 1.

Developers like partnership flips because they get back 95% of the project without having to pay anything for it.

In some deals, the investor takes as little as 2.5% of the cash after the flip, but this is uncommon.

The sponsor call option is usually for fair market value, although the IRS allows a fixed price that is a good faith estimate at inception of what the value will be when the option is exercised. Some developers require the investor to pay enough to avoid a book loss on sale. Sometimes the option can be exercised before the flip, but not before five years have run after the project is placed in service. Any option before the flip must pay the investor enough at a minimum to get the investor to its target yield.

The developer retains day-to-day control over the project. A list of major decisions requires consent from the tax equity investor. In some deals, the list is shorter after the flip.

The Internal Revenue Service published guidelines in 2007 for partnership flip transactions. The guidelines are in Revenue Procedure 2007-65. Some revisions were made two years later in Announcement 2009-69. Most transactions remain within the guidelines.

The individual guidelines that are most likely to come into play are that the tax equity investor must retain at least a 4.95% residual interest after the flip, the flip cannot occur more quickly than five years after the project goes into service, any option to buy the investor’s interest must be for fair market value or a fixed price that is a good faith estimate at inception of what the fair market value will be at time of exercise, the investor must make at least 20% of its total investment before the project is put in service, and the investor cannot have a “put” to require the sponsor to purchase its interest.

The guidelines bar guarantees of production tax credits by anyone, including third parties, and the developer, turbine supplier and electricity offtaker cannot guarantee the output for the investor.

Most investors want to see at least a 2% pre-tax or cash-on-cash yield. The market treats tax credits as equivalent to cash for this purpose.

The IRS said in an internal memo released in June 2015 that the flip guidelines do not apply to solar projects or other projects on which investment tax credits are claimed. The memo said to apply general partnership principles to test whether the investor is really a partner. It is CCA 201524024.

The investor must not walk so close to the line as to be considered a lender or a bare purchaser of tax benefits. A lender advances money for a promise to repay the advance plus a return by a fixed maturity date.

Variations

There are several variations in forms of partnership flip transactions.

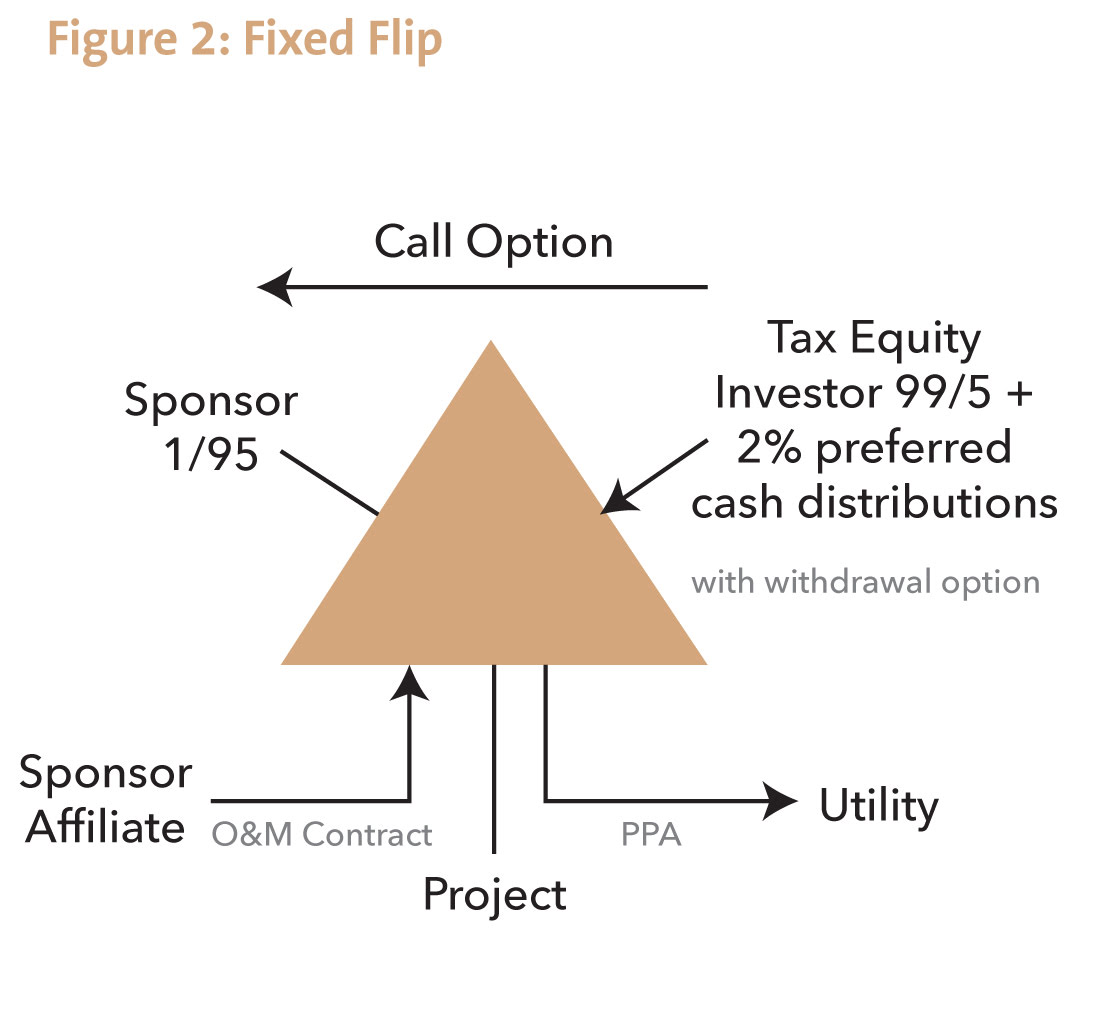

At least one major investor uses a fixed or time-based flip structure. The investor flips to a 5% interest on a fixed date, usually after five years. The developer has a call option. The tax equity investor has a withdrawal right six months to a year later if the call is not exercised.

The investor in a fixed-flip transaction receives preferred cash distributions each year equal to 2% of its original investment and some percentage of remaining cash. Developers like this structure because it lets them retain as much cash as possible. Developers would rather borrow against future cash flow at a lower debt rate than a tax equity yield.

An area of tension in fixed-flip transactions is how quickly the partnership must pay the market value of the investor’s interest after it withdraws from the partnership. Most deal documents give the partnership two years. The withdrawal amount is paid out of partnership cash flow. If the full price is not paid within two years, then the investor can take the project.

Another source of tension is the developer ends up with a negative capital account because it keeps most of the cash. The consequences of this are discussed in more detail below.

Another common variation on the standard flip is a pay-go structure used in wind and geothermal deals with production tax credits. The investor makes 75% of its investment at inception or as a fixed amount over time, and the other 25% is tied to production tax credits the investor is allocated each year. The IRS flip guidelines limit the amount of investment that can be tied to output or tax credits to 25%. Investors were originally not keen on pay-go structures because they preferred to earn a return on the full investment from inception. However, they have gained in popularity as a way to mitigate operating risk and the risk that the tax law will change.

Most uses of the pay-go structure lately have been as a way for sponsors to get additional value for remaining production tax credits after the investor has already reached the flip yield. The pay-go payments are made in the post-flip period from the flip date through the end of the 10-year period for claiming production tax credits.

Absorption Problem

Almost all partnership flip transactions have an “absorption” problem. Each partner has a “capital account” and an “outside basis.” These are two ways of tracking what a partner put into the partnership and is allowed to take out.

Once the investor’s capital account hits zero, then its remaining share of tax losses shifts to the developer.

Once its outside basis hits zero, then any further losses it is allocated end up being suspended. They can be used only against future income the investor is allocated by the partnership. Any cash it is distributed is considered an “excess cash distribution” and must be reported as capital gain.

There are two ways to deal with an inadequate capital account. One is for the investor to agree to a “deficit restoration obligation” or “DRO.” This is a promise to contribute more money to the partnership when the partnership liquidates to cover any negative capital account. On that basis, the IRS will let the investor absorb more losses. However, the investor may still have too little outside basis to absorb them immediately. Suspended losses should not count toward the flip yield until used.

The IRS said in October 2016 that it is studying whether DROs are real. The agency released a list of four factors that it said may be a sign that a DRO is not real. The practical effect of the four factors is to impose a net worth test on the tax equity investor to make sure it can satisfy the DRO. The list of factors is in proposed regulations that will not take effect until republication in final form, but some tax equity investors are moving to comply without waiting. (For more details, see Tax Equity and DROs in the October 2016 NewsWire.)

DROs sometimes reach 40+% of the tax equity investment. Falling electricity prices are forcing them to these levels. Investors who agree to DROs usually want to be allocated income as quickly as possible after the flip to reverse the deficit and to be distributed cash to cover the taxes on the additional income.

Such post-flip measures could turn the original 99% allocations to the tax equity investor into “tax-shifting allocations” if they are reversed within five years. The IRS does not allow tax-shifting allocations.

An investor always places a dollar limit on the DRO to which it has agreed.

Some investors wait to see how a year went and then increase the DRO after the year ends. Partnership allocations for a year can be adjusted retroactively up to the due date for the tax return for the year (not including extensions.) In most deals, once the deficit starts to contract, the cap on the DRO goes down as well.

In fixed-flip deals where the developer ends up with a negative capital account, the investor may require the developer to agree to a DRO. This makes the promise that the developer will be able to keep most of the cash somewhat illusory, since the developer may have to recontribute cash to the partnership. Special measures to reverse the developer deficit are rare.

High DROs may drive the market to look at another way to deal with absorption problems. Adding project-level debt turns part of the depreciation into “nonrecourse deductions” that can be taken by partners even after they run out of capital account. The debt also increases the investor’s outside basis.

However, partners taking nonrecourse deductions must be allocated an equivalent amount of income later as the debt is repaid, thus turning the nonrecourse deductions truly into a mere timing benefit. These later allocations are called “minimum gain chargebacks.” The partnership earns revenue from selling electricity. The partners must report the income. However, the cash goes to the lender to pay debt service, leaving the partners with “phantom” income: income but no cash distributions to cover taxes on the income. The minimum gain chargebacks are of this phantom income. Chargebacks are not additional income, but rather an override on how some of the income the partnership is already allocating to partners must be allocated.

If not already clear, it is important to model what will happen inside the partnership. The business deal may be to allocate income, losses and tax credits 99% to the tax equity investor, but that is usually not what will actually happen. (See Calculating How Much Tax Equity Can Be Raised in the June 2008 NewsWire for help with how to model the deal.)

The amount of tax equity raised through a flip transaction is the present value of the discounted net benefits stream to the tax equity investor. The investor receives three benefits: tax credits, cash, and tax savings from losses. It suffers one detriment: taxes have to be paid on the income it is allocated. It discounts these amounts using its target yield to a present-value number.

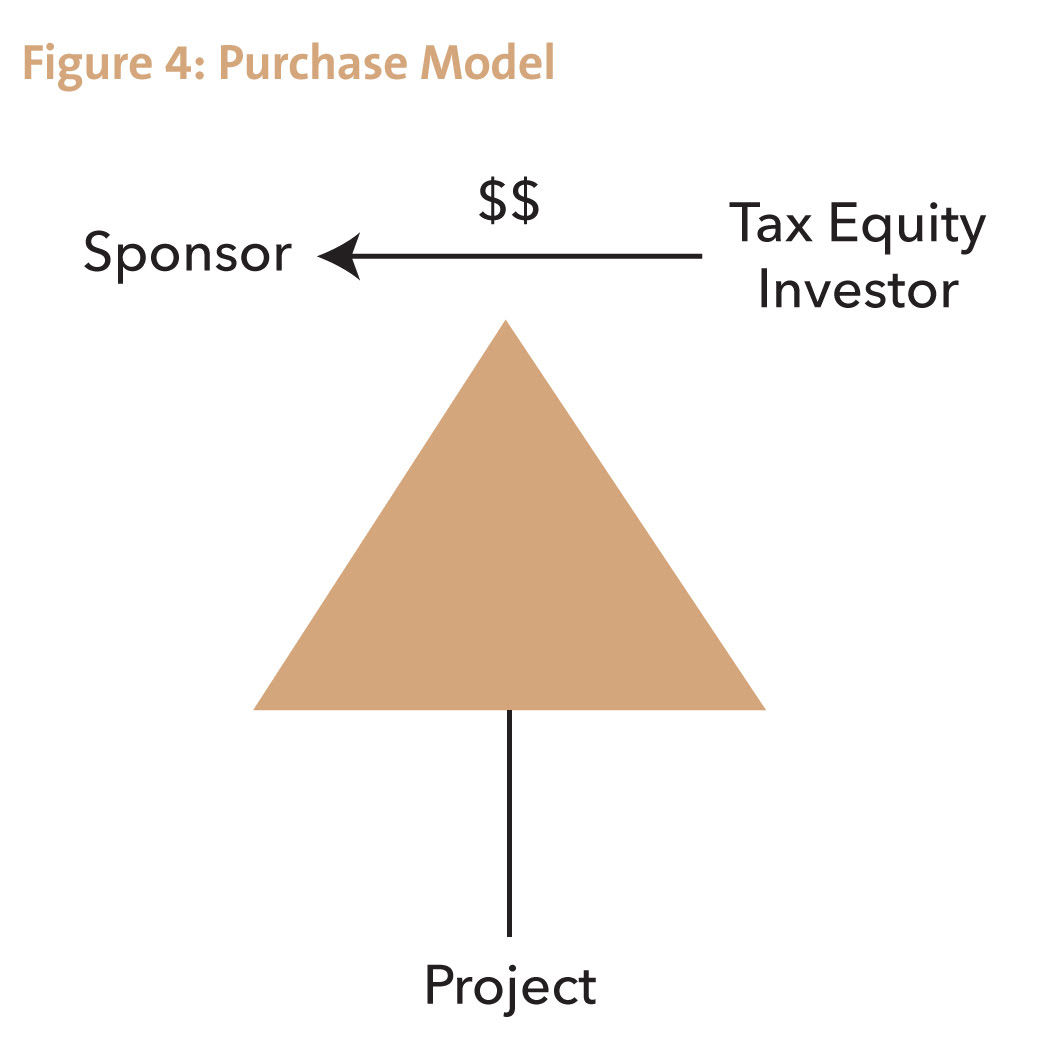

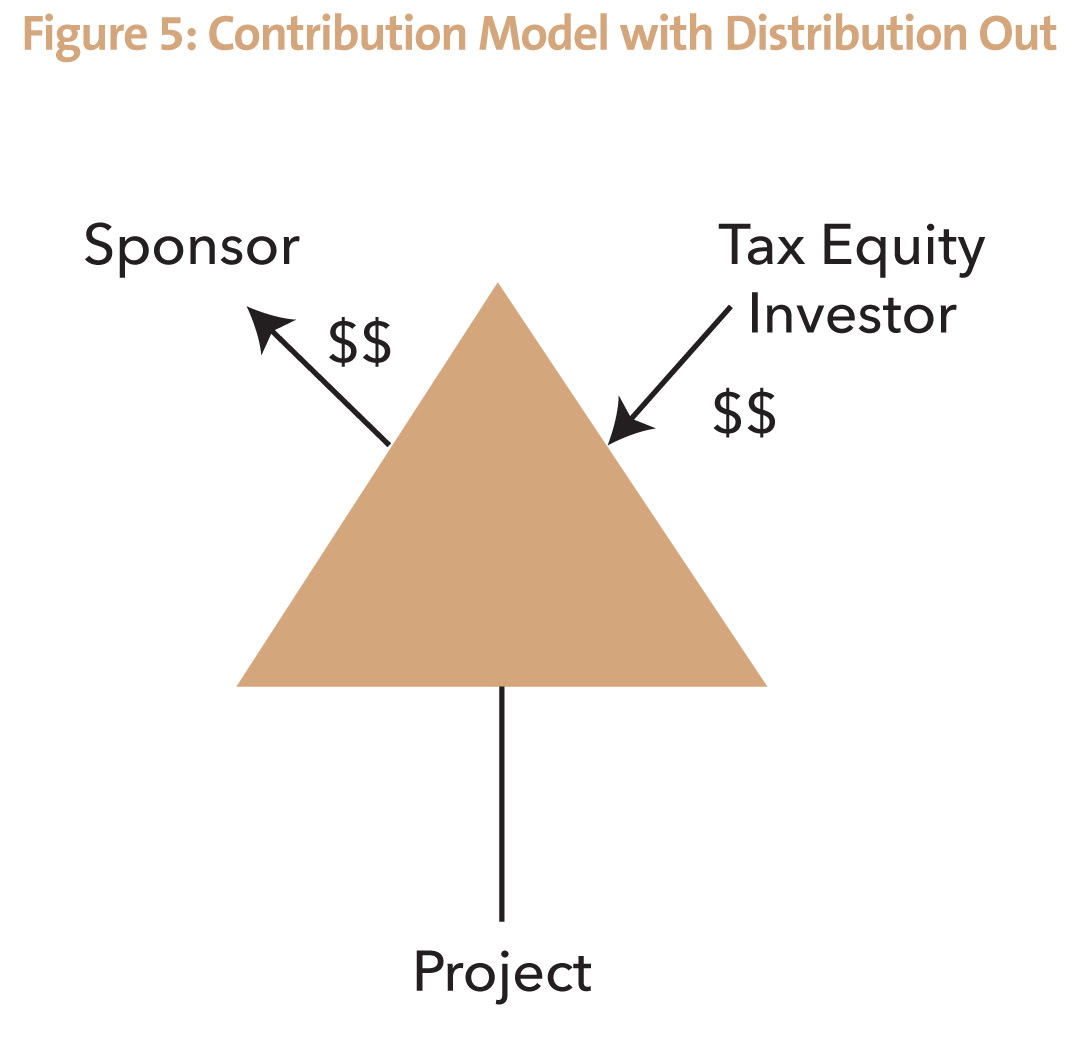

Purchase v. Contribution Model

There are two ways to put a partnership flip transaction in place.

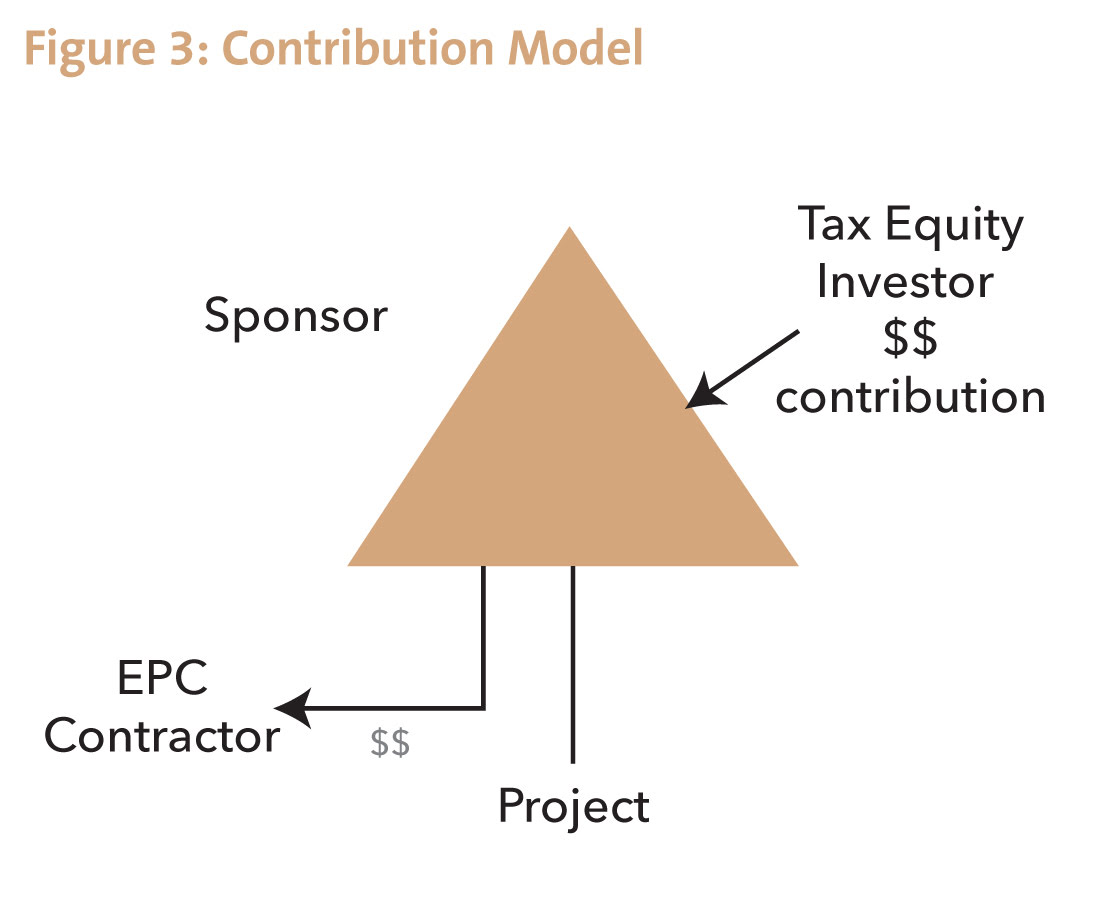

Under the “contribution model,” the tax equity investor acquires an interest in the project company or a holding company in exchange for a capital contribution.

Under the “purchase model,” the tax equity investor pays the developer directly for an interest.

In the contribution model, the contribution by the investor may be distributed to the developer.

The choice of model turns in the first instance on where the money will be used. It makes sense to use the contribution model if the money will be used by the partnership to pay a construction contractor to build the project.

The contribution model is also used by developers who want to avoid having to pay taxes on the tax equity investment. The IRS may view the distribution of the tax equity contribution to the developer as a taxable “disguised sale” of the project to the partnership. Developers try to fit the distribution in a “pre-formation expenditure” safe harbor that lets the developer treat the distribution as reimbursement of its capital spending on the project over the last two years.

A project cannot be worth more than 120% of the tax basis the developer has in the project when the partnership is formed with the tax equity investor to make full use of the safe harbor. If there is a debt on the project when the entity used by the tax equity investor funds, then it will complicate the calculations to determine whether the safe harbor applies. (For a discussion about how the safe harbor works, see Tax Triggered When Partnership Formed? in the October 2016 NewsWire.) Any developer planning to use the safe harbor should make sure the partnership agreement says that the distribution of the tax equity contribution to the developer is reimbursement of pre-formation expenditures within the meaning of section 1.707-4(d) of the US income tax regulations.

The purchase model is used when the tax equity investment will end up going to the developer. The developer is usually treated for income tax purposes under the purchase model as selling a share of the project assets to the investor. It will have to pay income taxes on its gain from the sale of that share of the project.

The purchase model leads to a “step up” in basis used to calculate depreciation and the investment tax credit on the share of the project purchased by the investor. There is no step up under the contribution model, unless the tax equity contribution is distributed to the developer in a disguised sale of the project to the partnership.

Two Biggest Risks

Tax basis remains the biggest risk in the solar market. The US Treasury started challenging solar companies on the bases they claim in 2009. There is IRS audit activity. Two closely-watched cases are working their way through the US courts. The US Court of Federal Claims decided one in favor of the tax equity investors in October 2016. The case involved a wind farm financed in a sale-leaseback transaction. The government is appealing the decision. (For more detail, see Treasury Loses Key Case in the December 2016 NewsWire.) The other case involves the bases claimed in the solar rooftop market and goes to trial on May 1, 2017.

Some tax equity investors are starting to limit the basis step up they will allow through payment of developer fees to 15% to 20% above project cost.

The possibility of corporate tax reform is emerging as the other big issue this year in deals. House Republicans have proposed a bill that would reduce the corporate tax rate to 20%, allow the full cost of new equipment to be deducted immediately, deny interest deductions on debt, and deny any cost recovery for imported equipment and services. Income from exports would go untaxed.

The House plan is stalled while the market waits for the Trump administration to come out with its own proposal or fall into line behind the House plan. Most Washington lobbyists do not expect a tax bill to be on the president’s desk before December 1 at the earliest. In the meantime, many tax equity investors are pricing or sizing their investments using a reduced tax rate, and there is a one-time resizing of the investment at the end of the current Congress or sooner after a tax overhaul bill is enacted. In partnership flip transactions with multiple fundings — for example in the solar rooftop market — the parties debate how far a proposed adverse tax law change needs to have advanced in Congress before the tax equity investor can use it as a reason to stop further funding.

A tax rate reduction would mean less tax equity will be raised on future projects. Developers will have to make up the gap in the capital stack through more debt or with equity. A lower tax rate could also ultimately reduce the supply of tax equity, although how much is unclear. Tax equity yields are a function of demand and supply.

In a yield-cased flip, the lower tax rate could delay or accelerate the flip, depending on when it takes effect. The tax equity investor bears the risk of tax law change in a fixed-flip structure. At least one fixed-flip investor is asking developers for an indemnity to make up any loss in value of tax losses.

Tax equity investors have had little interest in the past in taking the 50% depreciation bonus on offer from the US government because they wanted to spread their scarce tax capacity over more deals. However, with the tax rate now expected to fall, many are moving to take as large deductions this year as possible. The rate reductions are expected to be phased in over time.

Back-Levered Tensions

There are a number of recurring issues in flip deals.

Many developers, particularly in the solar market, use back leverage to borrow against their shares of partnership cash flow. A back-levered loan is a loan to the developer against its share of cash flow from the partnership.

This creates tension between the back-levered lender and the tax equity investor, particularly over any cash sweeps at the partnership level that could divert cash needed to pay debt service on the back-levered debt. Cash sweeps may come up in two contexts. One is where an indemnity has to be paid by the developer. The other is some tax equity investors have a cash sweep to get back on track, in a deal that is falling behind, to reach the target yield on the date originally projected.

Many investors are agreeing to limit the percentage of cash that can be swept to mitigate the risk to the lender. Some agree not to sweep an amount of cash equal to scheduled principal and interest payments on the debt.

Change-in-control issues also come up. The lender wants a right to foreclose on the developer’s partnership interest after a debt default. The tax equity investor wants an experienced renewable energy operator as its partner and may impose net worth and experience requirements on any subsequent transferee of the interest. It would be a good idea for sponsors to get agreement from the tax equity investor on the terms of a consent by the tax equity investor to such a foreclosure and subsequent sale of the sponsor interest when the flip partnership closes, if the back-levered debt will be added later, to avoid costly and time-consuming negotiations later.

The investor in a deal with investment tax credits must be a partner before the project is put in service in order to share in the investment credits. This has led to investors contributing 20% of the expected investment before the project is completed and the other 80% later. Some investors want a right to unwind the transaction if the conditions for the 80% contribution are not met by a deadline. Any unwind right should lapse once the project is in service.

Tax loss insurance is being used in some deals, especially to avoid cash sweeps. The premiums run anywhere from 2% to 5% of the potential payout. The investor should buy the insurance rather than have the sponsor do so.

Other Recurring Issues

Investment tax credits must be shared by partners in the same ratio they share in “profits” in the year a project is put in service. The tax credits will be recaptured if a partnership has more than a one-third reduction in its share of profits during the first five years after the project is put in service.

Some investors reduce their share of losses to 67% after year one until the first year there are profits, when the percentage goes back to 99%. This puts less pressure on the investor capital account. The standard partnership agreement says that once a partner runs out of capital account (plus any DRO), then its remaining share of losses will be diverted automatically to the other partners. Many tax counsel believe such a loss shift will drag production tax credits in years when losses shift to the sponsor; the tax credits are shared in the same ratio that losses end up being allocated in such years. Some counsel worry that unvested investment tax credits may also be recaptured in years that losses shift if the tax equity investor ends up with more than a one-third reduction in its share of losses in such a year. This position is not shared by most tax counsel.

Many investors insist on holding the 99% income share for at least one full year — and sometimes for two years — of meaningful income lest the IRS say the first-year 99% allocation used to send 99% of the investment tax credit to the investor was illusory because it changed by the time there were profits.

Partnerships that generate and sell electricity must use the “inventory method of accounting.” This means they can only allocate net income or net loss. They cannot disaggregate the elements that go into the calculation of net income and loss and allocate them differently. Income and loss from rooftop solar equipment that is leased to customers can be disaggregated and allocated differently.

Taxpayers cannot claim losses on sales to related parties. This means that a partnership cannot claim net losses in years when electricity is sold to a partner. In some partnerships owning merchant power projects, the developer must put a floor under the electricity price to finance the project. Any contract between the partnership and the developer should be a swap rather than a power purchase agreement, at least during the first few years before the partnership turns tax positive.

Some developers approach inappropriate parties as tax equity investors. Passive loss and at-risk rules make it hard for individuals, S corporations and closely-held C corporations to use tax benefits on renewable energy projects. A closely-held C corporation is one where five or fewer individuals own more than half the stock. Stock held by family members is combined. An investor who is subject to the passive loss rules can use tax credits and depreciation to shelter income from other passive investments, but what is considered passive income is limited. Interest received on debt instruments and dividends received on stock are not considered passive income for this purpose.

Bank tax equity investors should be careful to invest in the project company directly or one tier up. An investment higher up could run afoul of the Volcker rule that bars proprietary trading by banks. (For a discussion, see The Volcker Rule in the February 2014 NewsWire.)

National banks cannot hold equity positions in real estate. The Office of the Comptroller of the Currency, which regulates such banks, has issued three interpretative letters analyzing partnership flip transactions. Two of the three letters said that bank participation in particular partnership flip transactions were not equity investments, but rather loans for bank regulatory purposes. The called into question the advice given in the first letter after the OCC concluded that the bank to whom the first letter was addressed had not accurately described the transaction. (For more discussion, see The Volcker Rule in the February 2014 NewsWire.) State chartered banks are regulated by the Federal Reserve Board rather than the OCC.

New partnership audit rules will complicate partnership tax audits starting in 2018. The IRS issued 277 pages of proposed regulations in January 2017 to implement them, but the regulations are temporarily frozen under a Trump directive freezing all regulations until the new Trump team has time to review them. The IRS will be able to collect back taxes directly from the partnership.

Some partnership agreements signed recently direct the managing member to elect to “opt out” of audits at the partnership level, meaning that any audits of 2018 or later tax years would be of the partners directly. Developers dislike this option because they will remain on the hook for tax indemnities, but lose the ability to handle the IRS audits that may lead to an indemnity.

Some recent partnership agreements choose a “push-out” election instead, meaning that any taxes imposed at the partnership level will be pushed out to persons who were partners in the year under audit. It is important in such cases to make clear that the back taxes will be pushed out to partners in a ratio that reflects how they agreed to share the tax risks giving rise to the back tax liability.

Some recent partnership agreements leave any liability for back taxes by default at the partnership level, meaning that the economic burden to pay these taxes will fall on persons who are partners years in the future when the partnership is audited. This may be after the flip.

Once the IRS rules in this area are finalized, there will be a push to amend many partnership agreements to make a more informed decision about the best approach. (For more detail and what options partnerships have available to them, see US Partnerships Get a Makeover in the November 2015 NewsWire.)

NewsWire Editor

Keith Martin

Partner, United States

Washington, DC

Email

T: +1 202 974 5674

Stay Connected

Subscribe by Email