Chile: Solar outlook

By Brian Greene and Monica Borda

Chile had 6.7 megawatts of installed solar capacity at the end of 2013. Three years later, the installed solar capacity in Chile is more than 1,200 megawatts, and there are more than another 1,600 megawatts under construction and more than 12,000 megawatts in development.

We decided to take a closer look at Chile to understand the reasons for this incredible growth and the prospects for the Chilean market going forward.

Catalysts

The reasons for the explosive growth are economic and political. The Atacama desert in the north of Chile provides for one of the best — if not the best — solar resource on earth. Chile also benefits from a stable economy and historically high energy prices due to a lack of domestic fossil fuel production.

In Chile, the term “non-conventional renewable energy” is used to refer to all types of renewable energy excluding hydro projects larger than 20 megawatts. The Chilean Ministry of Energy set a target in May 2014 of generating 20% of Chilean electricity from non-conventional renewable energy by 2025, with 45% of the electric generating capacity to be installed in the country from 2014 to 2025 to come from such non-conventional renewable sources. In September 2015, the 2050 Energy Advisory Committee — a public body established to develop a long-term energy policy — released an even more ambitious renewables forecast — its Energy Roadmap 2050: A Sustainable and Inclusive Strategy — in which the government targeted at least 70% penetration of non-conventional renewable energy in Chile’s energy systems by 2050, with more than 20,000 megawatts of wind and solar generation. Solar energy was projected to meet 19% of this electricity demand. Thus, while Chile did not offer any tax credits or feed-in tariffs, the solar industry was greeted in Chile with enthusiasm and cooperation by the Chilean government.

These conditions led to a flurry of large utility-scale solar projects being constructed and financed in a short period of time, including First Solar’s Luz del Norte project (141 megawatts), SunEdison’s Amanecer (100 megawatts), San Andres (50 megawatts) and Maria Elena (73 megawatts) projects and Total’s Salvador project (70 megawatts).

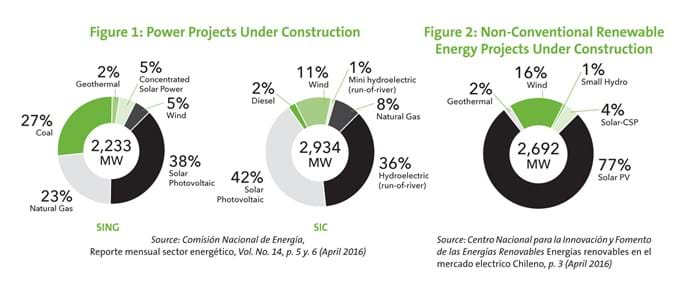

Utility-scale solar now accounts for 5.23% of total installed capacity in Chile. Solar is the fastest developing source, representing 38% of all power projects under construction in the Northern Interconnected System (known as “SING,” short for Sistema Interconectado del Norte Grande), 42% in the Central Interconnected System (known as “SIC,” short for Sistema Interconectado Central), and 77% of all renewables, with a portfolio of almost 2,200 megawatts under construction in both systems.

Figure 1 shows power projects under construction in SING and SIC, and Figure 2 shows renewable energy projects under construction in all parts of Chile.

Headwinds

With success has come competition.

In recent government auctions, the price of winning bids has dropped from an average price of US$79 a megawatt hour in October 2015 to US$44.70 a megawatt hour in August 2016, with the lowest bids in the August 2016 auction being offered at an incredible US$29.10 per megawatt hour. The low prices have reportedly discouraged some developers from pursuing potential projects.

Transmission issues have also created risks for both operating projects and projects in development.

Chile’s solar energy generation has expanded so quickly that transmission has not been able to catch up. A solar PV plant may be operating in one year or one and a half years, including environmental assessment and construction time. New transmission lines often take between three and four years, or longer, to build.

The increase in solar PV projects is also driving the need for upgrades to existing transmission lines to dispatch larger volumes of energy at “peak times” during the day. During 2016, spot prices dropped to zero at certain nodes in northern Chile for a record 113 days, according to a recent Bloomberg report. Transmission has become an issue for both developers and lenders looking at potential new projects.

New Developments

Chile has two main transmission systems, the central grid — SIC — which is the grid for the central region and carries about 70% of the national electricity generation serving more than 90% of Chile’s population, and the northern grid — SING — which accounts for about 20% of Chile’s electricity generation.

These transmission networks are not currently connected to each other. This will soon change.

A July 2016 law (Law 20,936) is supposed to modernize the transmission system and connect SIC and SING. The new law will restructure a significant part of the current electricity market by increasing competition and boosting development of renewable energy.

It does four things. It creates a new centralized entity to control the grid. It addresses the interconnection of SIC and SING, with the objective of strengthening the transmission system and reducing operational costs (in effect, creating a single power grid where renewable energy projects in the north will be able to export surplus energy to Santiago and the rest of central-south Chile when a shortage of hydro generation occurs. Next, it launches a new financing model for grid improvements under which consumers will pay the entire cost to construct new transmission lines. Finally, it gives the Chilean government the ability to designate development hubs for power generation, thereby facilitating expansion of transmission lines to places where there is a great potential for renewable generation in order to incentivize its development.

Two major projects are under construction to provide near-term relief for transmission gridlock.

First, the 600-kilometer (373-mile) Mejillones Cordoba transmission line will connect SIC and SING. The Mejillones Cordoba line, which is being constructed by a joint venture between Engie Energía Chile and Red Eléctrica Internacional, is expected to start operating in the second half of 2017.

Second, the 753-kilometer (468-mile) Cardones Polpaico transmission line, that will run through the Atacama, Coquimbo, Valparaiso and Metropolitana regions, is also under construction and is expected to be operational by the end of 2017. The Cardones Popaico line is being sponsored by the commercial group ISA, and will alleviate congestion in the northern parts of the central grid, the area where grid congestion is most extreme and where spot prices have been driven to zero earlier this year.

Another emerging opportunity for solar developers is the “Small Means of Distributed Generation” program (Pequeños Medios de Generación Distribuidos or PMGD), which is open to projects that are smaller than nine megawatts.

The PMGD program provides developers with two important incentives.

First, the owner of a PMGD project may choose between two revenue models. Electricity can either be offered on the spot market or sold at what is called a “node” or “stabilized” price that is fixed for six-month periods. This price currently is around USD$64 per megawatt hour and is based on a complex calculation of power purchase agreement rates. Its existence will reduce price risk.

Second, PMGD projects that are smaller than three megawatts are not required to have an environmental impact assessment, reducing project costs and shortening the development period. PMGD projects must still comply with other local environmental laws and land permits. Because they are relatively small in size, PMGD projects require less land and may be built closer to Santiago and other urban areas where there is high energy demand. Some developers are looking at pooling PMGD projects and financing them as a portfolio.