Renewables Face Daytime Curtailments in California

by David Howarth and Bill Monsen, with MRW & Associates, LLC in Oakland, California

As California marches toward fulfilling — and probably exceeding — a renewable portfolio standard (RPS) that requires 33% of its electricity to come from renewable energy sources by 2020, grid operators are beginning to face operational challenges that could have implications for existing renewable and non-renewable generators and that will shape opportunities for future projects.

For example, existing renewable generators might be curtailed more than in the past. If the system operator curtails renewables, then the generator might not receive full compensation for curtailed energy.

Existing gas-fired generators might need to increase their flexibility to allow for more starts, faster ramping and lower minimum levels of operation.

New projects — both renewable and conventional — may need to provide greater levels of flexibility or accept greater levels of curtailment.

The California Independent System Operator (CAISO) is concerned that there may be times when there is so much variable wind, solar and other renewable energy being scheduled onto its system that the other generators who will have to adjust to accommodate it will not have the flexibility needed to do so.

When scheduled generation exceeds scheduled demand in the hour-ahead market, the price of energy falls below zero in an attempt to balance supply and demand. In other words, when prices are negative, generators must pay others to take the electricity they produce. After accounting for changes in generation and load between the hour-ahead and real-time markets, if generation still exceeds load and there are no more generators willing to be paid to reduce their output, then the CAISO must order generators to curtail output in order to maintain system frequency.

Why would generation exceed load?

Some generators, such as nuclear, small hydroelectric and most geothermal and combined heat and power plants, need to run and have little ability to shut down because they have limited flexibility. A certain amount of gas-fired power plant capacity must also be operated at minimum levels to provide upward ramping needed later in the day or to provide ancillary services such as regulation and load following. If the combination of must-run generation plus gas-fired generation needed for system operations exceeds demand (particularly in low load hours), then the CAISO must take action.

Growing Curtailments

The CAISO is already beginning to see these types of overgeneration events. (See Sidebar 1.) In February through April 2014, the CAISO had to curtail wind and solar generation four times for a total of six hours to balance supply and demand on its system. On one occasion, the maximum curtailment reached 485 megawatts of wind and 657 megawatts of solar. The impact on individual generators depends on the terms of their power purchase agreements, but typically there is no compensation for curtailment that is ordered by the grid operator.

In the absence of any changes to address the underlying issues, the CAISO forecasts overgeneration and renewable energy curtailment to increase in the future as more renewable energy is added to the system.

Looking ahead to 2024, which was recently modeled by the CAISO, curtailment is expected to remain relatively modest if RPS energy levels remain at 33%. Total curtailment is forecast to be less than two-tenths of 1% of the total RPS supply. However, if RPS energy levels increase to 40% (which has been proposed by California Governor Jerry Brown as an achievable goal), then the CAISO forecast of renewable

A Duck Sighting

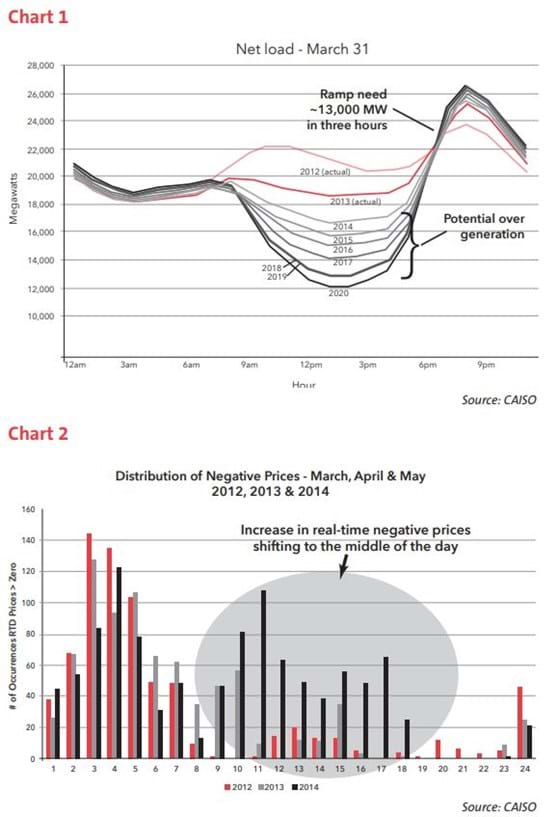

To illustrate the challenge posed by increasing levels of variable renewable generation, the CAISO has produced what has become known as the “duck chart.” The duck chart shows the net load on the system — that is, the electricity demand to be served by generation after subtracting the variable generation over which the CAISO does not have dispatch control — on a spring day with relatively high hydroelectric generation and low demand.

As shown in the chart, the “belly of the duck” grows in each successive year with the addition of solar resources that reduce the net electricity demand during the daytime. Already, the CAISO sees utility-scale solar on its system approaching 5,000 megawatts, plus an additional 2,000 megawatts of solar resources on the customer side of the meter. These solar additions have the effect of shifting the minimum net load from early morning to the middle of the afternoon (that is, from 3 a.m. to around 2 p.m.). The growing belly also contributes to the steep ramp to meet peak net demand after the sun sets. By 2020, the three-hour ramp (from 4 p.m. to 7 p.m.) is expected to reach 13,000 megawatts.

The effect of solar additions can also be observed in the changing distribution of negative real-time energy prices, which provide an indication of the risk of overgeneration. As shown in the chart below, the incidence of negative real-time prices in 2014 increased significantly during the middle of the day compared to prior years. However, there was no significant change in negative real-time prices during other periods.

The overgeneration events that occurred in 2014 are also consistent with the duck-like shape of the net load curve. Only one event occurred at night (at 3:44 a.m.). The other three involved solar curtailments and occurred starting at 8:40 a.m., 11:11 a.m. and 12:40 p.m., respectively. On one of those days, April 12, 2014, energy prices were negative during 43% of the 5-minute real-time dispatch intervals. Based on observations of negative prices and curtailment in 2014, Brad Bouillon, CAISO director of day-ahead operations and real-time operations support, reported to FERC that “the belly of the duck has already arrived.”

California

Curtailment jumps to more than 2.5% of RPS supply. (See Sidebar 2.) This means that a significant portion (15%) of the incremental renewable energy added to move from a 33% RPS to 40% would be curtailed. Under this scenario, which assumes a solar dominated renewable energy portfolio, California would fall short of 40% renewable supply unless even more renewables were added to make up for the curtailed RPS energy, at considerable extra expense and with diminishing returns.

The CAISO has made certain market changes designed to improve the management of overgeneration through economic dispatch as well as to require utilities to procure enough flexible capacity to ensure reliable operation under a range of conditions. On May 1, 2014, the CAISO reduced its bid floor from -$30 per megawatt hour to -$150 per megawatt hour, with provisions to reduce it further to -$300 per megawatt hour after a year.

In other words, if the market-clearing bids are at the floor price, then generators will have to pay $150 per megawatt hour to deliver their electricity to the system.

By reducing the bid floor, the CAISO hopes to provide an additional incentive for renewable generators and less flexible conventional generators to provide market bids rather than simply operate as must-take resources. The CAISO has also implemented a 15-minute market to allow for intra-hour scheduling and to provide another opportunity for renewable generators to submit economic bids and adjust schedules close to real time, thereby reducing the likelihood of overgeneration.

The CAISO is proposing to establish a flexible capacity requirement to ensure that utilities have enough ramping capability. The CAISO is also proposing to procure backstop flexible capacity to meet any system-level deficiencies. The Federal Energy Regulatory Commission approved both proposals on October 16, 2014.

The specter of overgeneration may dampen demand for new renewable generation that would contribute to excess supply during certain hours. This appears to be especially true for solar photovoltaics, which have dominated recent RPS procurements as a low-cost resource and are driving down “net load,” (which is equal to sales plus losses less must-take renewables) during the middle of the day. Baseload renewable generators such as geothermal and biomass should not necessarily expect a boost, however, since they also contribute to the

Forecasting Curtailment in 2024

The CAISO submitted testimony to the California Public Utility Commission in August 2014 based on modeling it performed of the electrical system in 2024.

The forecast assumptions were largely determined in advance by the CPUC with input from the California Energy Commission. There were five scenarios specified by the CPUC: 1) the current policy trajectory with a 33% RPS, 2) the current trajectory without the Diablo Canyon nuclear plant, 3) high loads, 4) a 40% RPS, and 5) expanded slate of preferred resources like energy efficiency and distributed generation.

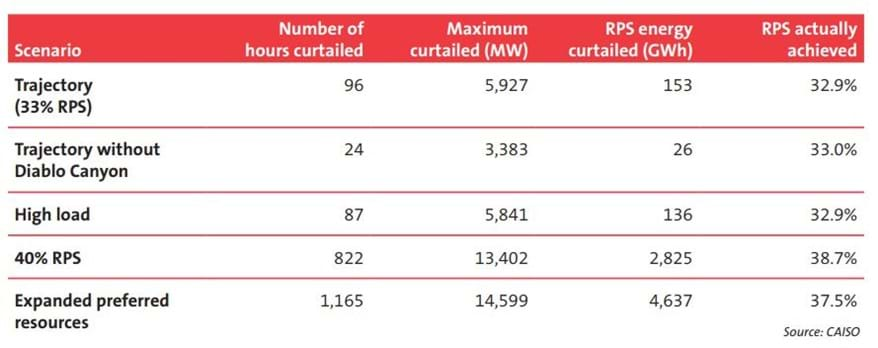

The CAISO’s curtailment forecasts for each of these scenarios are summarized in the table below.

Given a 33% RPS, the CAISO forecasts 96 hours of renewable curtailment, with a maximum curtailment of almost 6,000 megawatts. Total curtailed RPS energy is expected to be 153 GWh. Under a 40% RPS scenario, curtailments are forecast to increase to 822 hours with a maximum curtailment of over 13,000 megawatts. At 2,825 gigawatt hours, the amount of curtailed renewable energy in the 40% RPS scenario is forecast to increase by almost 20 times compared to the 33% RPS scenario.

The highest level of curtailment occurs in the expanded preferred resources scenario, which relies on energy efficiency and customer distributed generation to reduce net electricity demand significantly. In this scenario, renewable energy curtailments would occur during almost 1,200 hours (13% of all the hours in a year), with a maximum curtailment of almost 15,000 megawatts. Curtailments are lower in the scenario without Diablo Canyon since minimum generation levels would be reduced by removal of this baseload nuclear resource. There is relatively little difference in curtailments between the high load and trajectory scenarios because the renewable generation and loads both increase in proportion to each other.

Since the CAISO analysis does not include all of the capacity resources currently being procured to ensure local reliability in Southern California (following the modeling instructions provided by the CPUC), CAISO’s assessment probably overestimates curtailment. This is because the approximately 2,000 megawatts of new capacity not included in the analysis is likely to be more flexible than much of the existing fleet and will reduce the minimum generation needed to be operating at a given time. However, with forecasted curtailments of up to 15,000 megawatts in the 40% RPS scenario, the CAISO will still need additional tools to address overgeneration in the future problem of minimum generation levels. To the extent that such generators can be made dispatchable, they should be more valuable going forward.

Potential Opportunities

There may be an opportunity for existing gas-fired generators to be part of the solution by improving their operating flexibility. However, it remains to be seen whether procurement mechanisms will develop that allow such generators to recover the costs of making flexibility improvements to their existing plants. When utilities procure new capacity resources — and with little or no load growth being forecast in California, it might be a while before they add to the procurement pipeline — we would expect flexibility characteristics to factor into procurement decisions. Projects that are able to ramp quickly and start multiple times per day will be preferred.

Storage facilities should also benefit from the situation since they can increase demand by charging during periods of potential overgeneration — while getting paid to store the excess electricity — and then use that stored energy to meet peak demand and provide ancillary services, thereby reducing the amount of gas-fired generation needed to operate at minimum levels to provide reserves.

Demand response may also be able to meet some of those peak ramping needs and reduce minimum generation levels.

We would also expect to see changes in rate design with an emphasis on getting better price signals to customers to encourage load shifting to times of surplus generation, which might be in the middle of the day. This would be a reversal of historic conservation efforts designed to reduce consumption during historic peak periods such as noon to 6 p.m. in the summer months.

An unknown factor in addressing overgeneration is whether excess generation in California can be exported to other areas. The CAISO says that there have never been fewer than 2,000 megawatts of net imports into California, and therefore, it has assumed zero net exports from California in its modeling. With greater regional coordination, grid operators may be better able to dispatch resources across larger geographic areas, which should reduce the likelihood of overgeneration and curtailment. A first step in this direction was the creation of the energy imbalance market between the CAISO and PacifiCorp that began operating on October 1, 2014; this new market is expected to expand to include Nevada Power in 2015. The CAISO has indicated that it is open to greater regional cooperation, but will move slowly and only in collaboration with other balancing authorities in the West.

The CAISO recently put the overgeneration issue front and center, making it a major theme of its annual stakeholder symposium in October. It hopes that by raising these concerns now, California can avoid the reliability, environmental and economic impacts that would result from pursuing an expanded renewable energy policy without also addressing the concomitant integration issues that threaten to undermine the policy.

Given this attention and the various tools available to regulators and grid operators to address the underlying causes of overgeneration, it is not a given that the CAISO’s forecasted curtailment levels will actually occur during the 10-year time horizon that was modeled.

In fact, preliminary results from the California 2030 low-carbon grid study being performed by the National Renewable Energy Laboratory and sponsored by a group of clean energy companies, foundations and trade associations suggest that, with substantial increases in energy efficiency, demand response and storage and greater cooperation across the West, California’s electrical system in 2030 would be able to accommodate a diverse portfolio of incremental renewable generation equivalent to a 50% RPS with minimal renewable curtailment to address overgeneration.