When Will the Next Power Crisis Start in California? | Norton Rose Fulbright

By Robert Weisenmiller, Steve McClary and Heather Vierbicher

California has not yet fixed the problems that led to the electricity crisis in 2000 and 2001, though there has been some progress in restoring a workable electricity market structure. Electricity shortages could hit again as early as this summer. They will start as a “squall” rather than the “perfect storm” that buffeted the state before.

Most observers of the California power market accept that a contributing factor to the crisis in 2000 and 2001 was an under-investment in new energy infrastructure. We have written in these pages in the past that three fundamental prerequisites for investment in energy infrastructure are creditworthy buyers and sellers, predictable market rules, and a stable regulatory environment.

California has made progress toward re-establishing those investment prerequisites. Creditworthy buyers are once again in the market. Pacific Gas & Electric emerged from bankruptcy on April 14, 2004 with an investment-grade credit rating. Southern California Edison was restored to investment-grade status in December 2003. Sempra Energy maintained its investment grade rating throughout the crisis. Although many sellers and project developers remain in or on the edge of bankruptcy, some of the power suppliers to California’s investor-owned utilities — including many “qualifying facility,” or “QF,” projects — have also seen their credit ratings upgraded.

Despite this progress, considerable work on the policy front remains to be done. Consensus on the types of reforms needed has not been easy to reach. A surfeit of regulatory proceedings has sprouted in the past three years to consider and implement the needed reforms, taxing the resources of the California Public Utilities Commission and industry stakeholders alike.

Moreover, a confluence of adverse weather conditions and delays in infrastructure upgrades could jeopardize California’s tenuous supply-demand balance. As Chairman Pat Wood of the Federal Energy Regulatory Commission said of California in early May, “There are very troublesome conditions out there,” and the power market “looks a lot like the days of yore.”

In short, California has some distance still to go to revamp the rules and regulatory policies underpinning its electricity market in order to re-establish a favorable investment climate. Lawmakers, regulators, the utilities and other stakeholders involved in the process may not have time on their side.

Supply and Demand Imbalance

The current conventional wisdom, endorsed by the California Energy Commission, the California ISO — known as “CAISO” — and state utilities is that under average weather conditions, California should have adequate supplies of electricity for the next five years. However, these same agencies and others also warn that with the wrong convergence of variables, weather being but one, trouble could occur much sooner. In February, Edison International CEO John Bryson warned that now is the “calm before the storm” when regulators need to “establish ‘clarity’ about how electricity will and should be provided, what obligations utilities will have and the role of competitive markets.”

Both the California Energy Commission and CAISO predict that under normal conditions the state should escape supply emergencies in 2004. However, California may not have the luxury of “normal” conditions. The CAISO has already declared two “stage 1 emergencies” this year due to unseasonably hot spring weather in southern California and a combination of scheduled and forced outages. The CAISO was also forced to curtail load due to a potential transmission overload. Even without widespread outages, forecasters all acknowledge the potential that interruptible customers will be curtailed this summer.

Aside from adverse weather, two factors are causing significant concern for California going into the summer. First is the increasing probability that hydroelectric production in the West will be below average. Second is the possibility that existing transmission bottlenecks could be aggravated by planned and unplanned transmission outages. A report from Fitch Ratings in late April noted:

The importance of variability in hydropower generation in the West cannot be overstated. Indeed, the 1999–2001 drought in the Pacific Northwest was a key factor driving shortages and price spikes and affecting natural gas and electricity in [the] WECC in 2000–2001. Hydroelectric power generation, a low-cost source of energy, represents approximately 34% of installed capacity and is expected to provide 31% of total delivered energy in 2004, assuming normal underlying water conditions.”

Unfortunately, “normal underlying water conditions” are not panning out for 2004. The West is entering the fifth year of below-normal flows in the Columbia Basin. The Bonneville Power Administration’s Paul Norman says the five-year drought is turning out to be the worst since the dust-bowl days of the mid-1930s. The Colorado River situation is just as grim, suffering from the driest five-year period on record. California hydro conditions, while not as severe as elsewhere in the West, are expected to remain below average in 2004.

Transmission bottlenecks contributed to at least one of the recent CAISO emergencies, and the situation is not expected to improve this summer. Upgrade work on the Pacific DC Intertie that connects the Pacific Northwest to southern California will reduce the transfer capabilities from 3,100 megawatts to 2,000 megawatts through August. In September, the DC Intertie will be completely removed from service until the end of 2004. Meanwhile, a long-awaited upgrade to Path 15, the major transmission link between the northern and southern parts of the state, is not scheduled to come online until the end of the year. Path 46, connecting California to the capacity-glutted desert southwest, lacks the capacity to import that excess power without significant upgrades. Approvals for upgrades to the Mission-San Miguel line are stalled before the California Public Utilities Commission in its cumbersome permitting process, delaying access to new generation in northern Mexico.

Drought unfortunately can further increase the possibilities of service interruptions: droughts lead to wildfires, which can in turn remove key transmission assets from service. For example, the southern California fires that occurred in October 2003 tripped the southwest power link, cutting off delivery of more than 900 megawatts to the San Diego region.

Longer term, projecting the balance of supply and demand requires a different perspective than anticipating needs for the coming summer.

Long-term supply-demand forecasts use, out of necessity, average values for outage rates, hydroelectric production and load growth. Of these elements, load growth has generally been the source of greatest long-term uncertainty. This continues to be the case in California given widely swinging policies concerning demand-side management and the reality that major segments of the state’s economy are subject to boom-bust cycles. Five-year forecasts of peak demand by the California Energy Commission can vary by plus or minus 1,200 megawatts depending upon economic conditions, and by over 1,700 megawatts with swings in the level and focus of demand-side-management investment.

On the supply side, an issue coming under greater scrutiny in forecasting long-term resource balances is plant retirement. The CAISO notes that “more than 3,870 megawatts of thermal generation is potentially at risk of retiring over the next several years. These generating units are more than 40 years old, have high heat rates, and ran less than 40% of the time last year.” While this 3,870-megawatt uncertainty makes the forecaster’s life more difficult, much of that capacity has already undergone costly pollution retrofits, indicating some commitment to continued operation of those plants. A few units are being mothballed rather than permanently removed from service, at least as long as their owners see a potential for future profits.

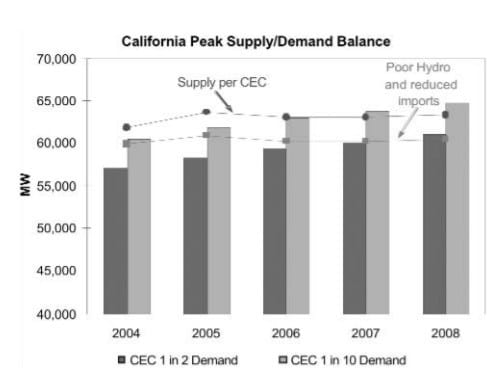

Introducing two additional variables — hydroelectric output and reduced imports — makes the story more interesting. The accompanying chart shows the most recent demand projections from the California Energy Commission along with the agency’s supply forecast (released in January 2004). Under normal conditions — typical weather and base case supply forecast — supply is sufficient to meet demand. Concerns over supply adequacy in California appear justified if supply availability is decreased to account for drought conditions (normal peak hydro production reduced 15%) and imports are reduced (by 1,000 megawatts). The combination of a regional heat wave leading to high demand throughout the West, along with reduced imports due to transmission problems and limited hydro production during a drought year could cause supply problems as early as this summer.

Furthermore, in the long term both PG&E and Southern California Edison have proposed major maintenance projects (steam generator replacements) for the Diablo Canyon and San Onofre nuclear plants, which could remove significant resources from the grid in the 2008-2010 timeframe. On the other hand, the California Energy Commission forecasts assume the retirement of Edison’s Mohave coal plant; while likely, this is still being actively debated.

The bottom line is California is unlikely to enjoy an unbroken stretch of normal weather conditions over the next few years. But the “perfect storm” conditions of 2000-2001 are also unlikely to repeat. What does seem likely is a “squall”: high regional temperatures coupled with poor hydro production or transmission failures. California has learned some lessons from the 2000-2001 crisis, such as better use of interruptible load and demand-response programs, use of backup generators during emergencies, and the huge conservation potential of California citizens and industries. However, to avoid relying on these emergency resources, infrastructure bottlenecks in both generation and transmission must be addressed.

A New Procurement Framework

The state legislature and the California Public Utilities Commission have made some positive moves to improve the California regulatory climate to support investment in new energy infrastructure.

In January 2004, regulators adopted a new procurement framework that embraces key provisions of legislation passed in 2002. The new procurement rules should correct some of the glaring flaws in the market design that contributed to the electricity crisis before. Together the legislation and the regulatory framework represent significant steps toward improved regulatory stability in California.

PG&E’s and Edison’s financial problems arising from the electricity crisis stemmed from their inability to recover through frozen retail rates the runaway costs of procuring spot power from broken wholesale markets. Before the crisis, the utilities could have locked in reasonable prices for power through long-term contracts. But regulators encouraged (even required) an over-reliance on the volatile spot market. Although utilities were guaranteed full cost recovery for spot purchases, regulators could choose to penalize utility shareholders if, in hindsight, any long-term contracts were found to be “bad” deals. Regulators now acknowledge the important role of long-term procurement commitments. But the utilities are more convinced than ever of the need for up-front regulatory assurances for their procurement decisions. From the perspective of the utilities, high credit ratings and access to capital markets on reasonable terms and conditions depend upon the credibility of regulatory assurance that the utilities will be able to recover their costs.

The state legislature passed Assembly Bill 57 in 2002 giving utilities the freedom to enter into long-term power purchase agreements without fear of retroactive review. The legislation required California regulators to establish an upfront review and approval process for procurement plans. Utilities will be allowed full recovery of costs associated with these plans. In January 2004, the CPUC adopted a procurement framework based on AB 57 and another bill, Senate Bill 1976. The new procurement process establishes a regulatory framework that:

(1) requires each utility to prepare and file a procurement plan that meets specified requirements; (2) provides the criteria by which the Commission should review and either adopt, modify, or reject each utility’s plan; (3) eliminates the need for after-the-fact reasonableness reviews of utility actions in compliance with an approved plan; (4) ensures timely recovery of prospective procurement costs incurred pursuant to an approved plan; and (5) requires that an approved plan enable the utility to fulfill its obligation to serve its customers at just and reasonable rates, with such just and reason able rates to include an appropriate balancing of price stability and price level.

The utilities are now developing long-term procurement plans that will be reviewed by regulators later this year.

Devil in the Details

Translating the new procurement framework into a workable process for securing future electricity supplies could prove the old axiom that “the devil is in the details.”

The California Public Utilities Commission has conducted at least eight workshops over the past three months trying to resolve the definitions and accounting questions associated with resource adequacy, just one issue to be addressed under the new procurement framework. The utilities have asked the Commission to resolve these issues expeditiously. With resource adequacy rules in place, Edison says it could complete its procurement plan by September 2004, and the commission could issue a decision on that plan by May 2005. On the other hand, PG&E has asked the commission to complete a review of both resource adequacy issues and its procurement plan by the end of 2004. Under either time frame, the utilities would conduct solicitations for new power supplies no sooner than 2005.

Meanwhile, other equally contentious issues are on similar tracks. For example, aggressive renewable resource requirements are required by law, but procurement rules, subsidies and schedules are under review in parallel sets of workshops. Community aggregation also is under discussion and, if widely adopted, could pose significant issues for the utilities’ load expectations.

Procurement issues have proliferated to the point that they are being addressed in eight or more separate proceedings (see sidebar). The number of proceedings alone suggests a low likelihood of achieving a timely resolution of all these proceedings in a coherent fashion. To complicate matters, the current commissioners are chronically split and typically have resolved contentious issues on 3-2 votes. The terms of allied Commissioners Lynch and Wood will end early next year, creating vacancies for two new commissioners. Anticipating this change in the CPUC’s makeup, difficult decisions could be held until a new commission is in place. Appointments of the new commissioners by the governor could be delayed. Even without delays in the appointment process, the new commissioners will require some time to get up to speed on the numerous and complex issues they will face.

At the same time, Southern California Edison has been lobbying in Sacramento for passage of AB 2006, which has the backing of the speaker in the state assembly. The bill would revise the AB 57 framework and redraw the boundaries of various California Public Utilities Commission proceedings in mid-case. Decisionmakers are being forced to balance the need to get the procurement process right with the need to get it done in a timely fashion.

Predictable Market Rules

The third prerequisite for a favorable investment climate is predictable market rules. Further clarification of the structure of the wholesale and retail markets must take place before the utilities make additional procurement commitments, whether through power purchase agreements or utility-built and -owned power plants. Like other states, California is debating the tradeoffs of utilities owning plants or contracting for power plans. Edison’s plans for the Mountainview project and SDG&E’s proposed acquisition of the Palomar plant are symptomatic of the current debate.)

The question of “debt equivalence” is another important factor that will play into utility decisions on power purchase agreements. The “debt equivalence” of long-term power procurement contracts is the imputation of debt-like characteristics to a portion of the revenue requirements of these contracts by rating agencies in their assessment of a utility’s risk profile. For example, Standard & Poor’s will add to a utility’s reported debt a risk-adjusted portion of the revenue associated with power purchase contracts over the life of the contracts. This adjustment to the reported debt is considered in assessing financial ratios for a company (such as the ratio of funds from operations to debt) and could lead to a lower rating. Like most commissions, the CPUC does not consider debt equivalence when it sets a utility’s authorized capital structure. The CPUC has committed to re-examine this factor as part of the pending 2005 cost-of-capital proceedings of PG&E and Southern California Edison.

There is universal agreement that wholesale market rules need reform, but limited progress on addressing these problems has been made. The CAISO still seeks approval for some variation of its MD02 proposal but is having limited success at the Federal Energy Regulatory Commission, which remains a convenient target for California politicians. For example, State Attorney General Bill Lockyer recently issued a white paper on wholesale market reform, attacking FERC for a failure to order refunds in the aftermath of the electricity crisis. The California Public Utilities Commission continues to challenge FERC’s jurisdiction in wholesale markets by setting resource adequacy requirements for non-utility energy service providers, by adopting power plant operating standards for wholesale generators, and by seeking authority over siting of LNG terminals.

Long-term resource commitments are also threatened by uncertainty over the future structure of California’s retail market. Utilities are reluctant to make long-term commitments without knowing what the customer base will be. But in California the retail market structure hangs in limbo awaiting decisions on two approaches to retail choice: direct access and community choice aggregation.

California suspended direct access (California’s term for retail choice) in 2001 following the electricity crisis. Today, about 15% of the investor-owned utilities’ combined load (primarily large commercial and industrial customers) is served under grandfathered contracts. State lawmakers are currently debating two pieces of legislation that would reopen the direct access market by creating a “core/non-core” market structure: large customers could either remain utility customers or could contract with energy service providers. The terms and conditions for such a core/non-core retail market structure have been the subject of vigorous debate in recent months. Legislators do not agree, for example, on the definition of a large customer, debating whether the cut off should be 200 kilowatts or 500 kilowatts of load.

In September 2002, the state legislature granted cities and counties the authority to establish community choice aggregation programs to procure power for their citizens. The City and County of San Francisco has already passed an ordinance to establish such a program, and a number of other cities have expressed interest in pursuing community choice aggregation as a means to lower electricity costs, pursue renewable energy and support economic development. The implementation rules and procedures for community choice aggregation programs are being considered in an ongoing California Public Utilities Commission proceeding.

The financial impact of the power crisis, particularly the legacy of high-cost contracts the state signed in 2001 to buy wholesale power, has resulted in high retail electricity rates. High electricity bills have in turn sparked interest in the core/non-core and community choice aggregation proposals. They have also spurred renewed interest in municipalization of power supply. Considering the undefined nature of their customer bases, California’s utilities remain averse to entering into commitments that might ultimately lead to a replay of the debate over “stranded” costs.

Conclusion

California continues to make progress, albeit slowly, toward cleaning up the aftermath from the electricity crisis. Lawmakers, regulators and other industry stakeholders are keenly aware of the need for revamped policies and market rules. But consensus on critical issues remains elusive, and crafting detailed implementation rules is time-consuming. California may have precious little time before adverse weather, below-average hydro production, transmission bottlenecks or spikes in demand combine to upset the state’s supply-demand balance and, perhaps, force a faster pace toward restoring a rational regulatory environment.

Too Many Proceedings?

There are nine significant proceedings underway before the California Public Utilities Commission to address issues stemming from the California energy crisis in 2000 and 2001. The sheer number makes for slow progress. Brief descriptions of the most significant ongoing proceedings are below.

R.04-04-003 – Referred to as the “umbrella proceeding,” this proceeding is intended to ensure policy consistency and overall coordination for the review of the utilities’ long-term procurement plans in conjunction with eight other proceedings.

R.03-10-003 – “Community choice aggregation.” This proceeding will establish the implementation rules allowing cities and counties to purchase and sell electricity on behalf of residents and businesses in their jurisdictions.

R.02-06-001 – Demand response. This proceeding will implement policies and practices for advanced metering, demand response and dynamic pricing. An objective of the proceeding is to expand demand response capabilities of large customers and assess the practical demand response potential of small customers.

R.04-03-017 – Distributed generation. The scope of this proceeding is not yet completely defined, but a key priority will be to develop cost-benefit analysis methodologies to assist investor-owned utilities in the evaluation and interconnection of distributed generation projects.

R.01-08-028 – Energy efficiency. This proceeding examines energy efficiency policies and programs, encourages utilities and non-utilities to propose energy efficiency programs and delineate specific program evaluation criteria, and determines who should administer commission- ordered energy efficiency programs.

R.04-01-026 – Transmission assessment process. The CPUC is using this proceeding to attempt to streamline the transmission planning process and eliminate duplicative need assessments. Parties are also debating an economic methodology that would allow the CPUC to defer to the CAISO’s assessment of need for new transmission projects.

I.00-11-001 – Transmission planning. This proceeding preceded R.04-01-026 and has served as a forum to consider a wide range of transmission-related issues as well as specific transmission projects.

R.04-04-025 – Avoided cost and QF pricing. The CPUC opened this proceeding to develop a common methodology to calculate avoided costs in a variety of regulatory applications. The short-run avoided cost methodology for prices paid to QFs will be an important and contentious component of this proceeding.

R.04-04-026 – Renewable portfolio standards. This proceeding will establish baseline levels of renewable generation for each utility and set the annual procurement target each utility must meet in 2004. The CPUC will also adopt standardized contract terms and conditions for renewable electricity sales, finalize the “market price referent” methodology, and continue to develop a “least-cost and best-fit” evaluation process.